Jefferies has adjusted its price target for Teleflex (TFX, Financial), reducing it from $160 to $145 while maintaining a Hold rating on the stock. This revision follows the company's first-quarter performance, during which Teleflex lowered its adjusted earnings per share (EPS) forecast for the fiscal year 2025 due to a $1.05 tariff impact. Jefferies has effectively incorporated this into the fiscal year 2026 projections as well, leading to a downward adjustment of their forward estimates. The firm considers this scenario to be close to a worst-case situation but suggests that potential changes in tariffs or other mitigating circumstances could alleviate some of the pressure on EPS in the future.

Wall Street Analysts Forecast

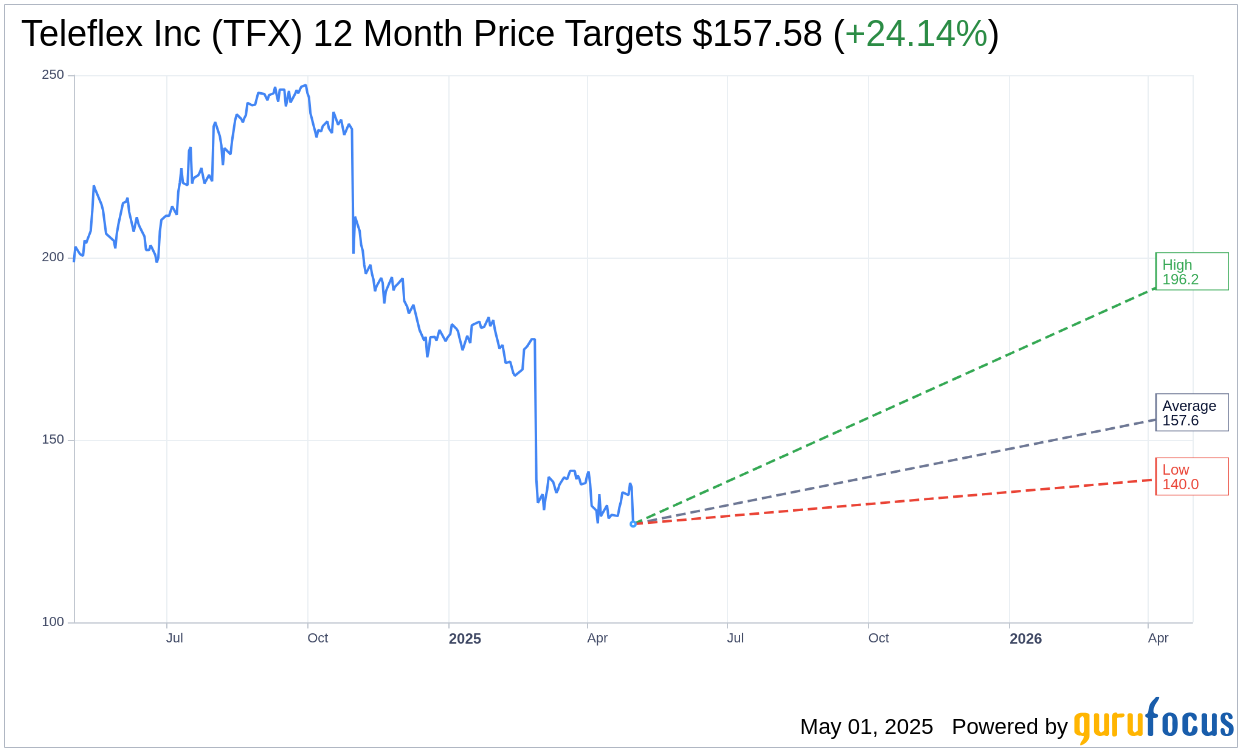

Based on the one-year price targets offered by 9 analysts, the average target price for Teleflex Inc (TFX, Financial) is $157.58 with a high estimate of $196.23 and a low estimate of $140.00. The average target implies an upside of 24.14% from the current price of $126.94. More detailed estimate data can be found on the Teleflex Inc (TFX) Forecast page.

Based on the consensus recommendation from 14 brokerage firms, Teleflex Inc's (TFX, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Teleflex Inc (TFX, Financial) in one year is $256.06, suggesting a upside of 101.73% from the current price of $126.935. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Teleflex Inc (TFX) Summary page.

TFX Key Business Developments

Release Date: February 27, 2025

- Revenue: $795.4 million for Q4 2024, up 2.8% year over year on a GAAP basis and 3.2% on an adjusted constant currency basis.

- Interventional Business Growth: 18.7% adjusted constant currency growth in Q4 2024.

- Surgical Business Growth: 12.3% adjusted constant currency growth in Q4 2024.

- Adjusted Earnings Per Share (EPS): $3.89 for Q4 2024, a 15.1% increase year over year.

- Adjusted Gross Margin: 60.1% for Q4 2024, flat compared to the prior year.

- Adjusted Operating Margin: 27.6% for Q4 2024, up 130 basis points year over year.

- Full Year 2024 Adjusted Constant Currency Revenue Growth: 3.1% year over year.

- Full Year 2024 Adjusted EPS: $14.01.

- Cash Flow from Operations: $638.3 million for 2024, a 24.7% increase year over year.

- Net Leverage: Approximately 1.5 times at the end of Q4 2024.

- Goodwill Impairment Charge: $240 million for Q4 2024 related to the interventional urology North America reporting unit.

- 2025 Financial Guidance - Adjusted Constant Currency Growth: 1% to 2%.

- 2025 Adjusted EPS Guidance: $13.95 to $14.35.

- 2025 Adjusted Gross Margin Guidance: 60.25% to 61%.

- 2025 Adjusted Operating Margin Guidance: 26.6% to 27%.

- Accelerated Share Repurchase: $300 million, effective February 28, 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Teleflex Inc (TFX, Financial) reported a 2.8% year-over-year increase in revenues for the fourth quarter of 2024, with strong performances in interventional and surgical businesses.

- Adjusted earnings per share grew by 15.1% to $3.89 in the fourth quarter.

- The company announced a $300 million accelerated share repurchase program, expected to be completed in the second quarter of 2025.

- Teleflex Inc (TFX) has entered into a definitive agreement to acquire the vascular intervention business of Biotronik SE, which is expected to enhance its market presence and drive sustainable revenue growth.

- Cash flow from operations increased by 24.7% year-over-year to $638.3 million in 2024, benefiting from improved operating performance and working capital management.

Negative Points

- Fourth quarter revenues were $10.2 million below the low end of expectations, partly due to lower hospitalizations impacting the CDC and vascular business units.

- Teleflex Inc (TFX) recognized a non-cash goodwill impairment charge of $240 million for the interventional urology North America reporting unit.

- The company expects continued pressure on its interventional urology business in 2025 due to softness in UroLift.

- 2025 financial guidance indicates only 1% to 2% adjusted constant currency growth, reflecting challenges in the trading environment.

- The acquisition of Biotronik's vascular intervention business is expected to be dilutive to Teleflex's adjusted operating margins initially.