ICF International (ICFI, Financial) remains optimistic about its future prospects, maintaining its revenue guidance amid a challenging federal landscape. CEO John Wasson emphasized that while the company expects its 2025 total revenues, GAAP EPS, and Non-GAAP EPS to potentially experience a decline of up to 10% from last year's figures, a diversified business model allows for agility. The anticipated decline primarily stems from reduced business with federal government clients during the early period of a new administration.

To counterbalance this, ICFI foresees strong growth, predicting a minimum 15% revenue increase from commercial energy, state and local, and international government sectors. Such growth is expected to mitigate the fall in federal client revenues due to potential funding cuts and a slower introduction of new proposals. The forecasts do not account for a significant government shutdown or long-lasting pauses in contract modifications or new agreements.

ICFI's Q1 margin results reflect effective cost management, aiming to sustain adjusted EBITDA margins comparable to 2024 levels. The current year's first quarter included a special tax benefit contributing an additional 13 cents to EPS, not factored into the 2025 EPS framework. The company projects operating cash flow of approximately $150 million for the year. Reflecting confidence in its growth trajectory, ICFI repurchased 313,000 shares in Q1, demonstrating a commitment to shareholder value.

Wall Street Analysts Forecast

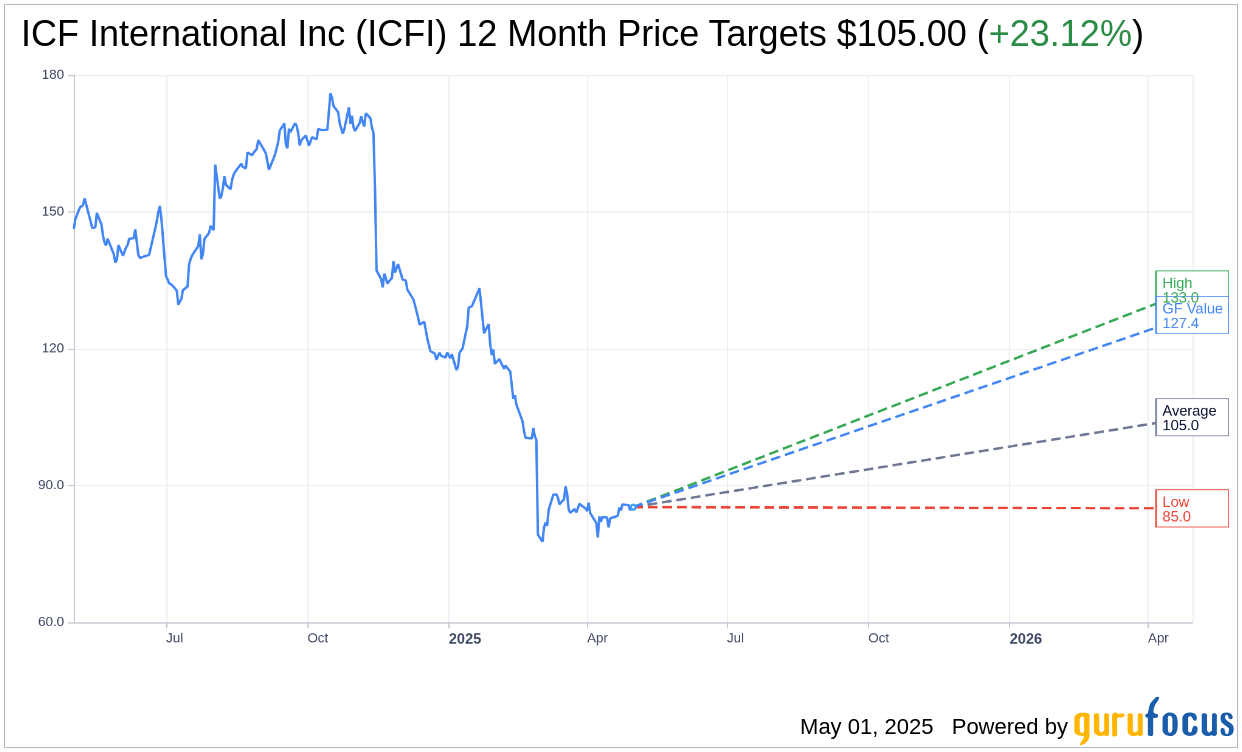

Based on the one-year price targets offered by 4 analysts, the average target price for ICF International Inc (ICFI, Financial) is $105.00 with a high estimate of $133.00 and a low estimate of $85.00. The average target implies an upside of 23.12% from the current price of $85.28. More detailed estimate data can be found on the ICF International Inc (ICFI) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, ICF International Inc's (ICFI, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ICF International Inc (ICFI, Financial) in one year is $127.38, suggesting a upside of 49.37% from the current price of $85.28. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ICF International Inc (ICFI) Summary page.

ICFI Key Business Developments

Release Date: February 27, 2025

- Revenue (Q4 2024): $496.3 million, a 3.8% increase year over year.

- Commercial Revenue (Q4 2024): $133.2 million, a 22% increase.

- Federal Government Revenue (Q4 2024): Declined 2.4% due to lower pass-through costs.

- Adjusted EBITDA Margin (2024): 11.2%, a 30 basis point expansion.

- Non-GAAP EPS (2024): $7.45, a 15% increase.

- Net Income (Q4 2024): $24.6 million, a 10.8% increase.

- Diluted EPS (Q4 2024): $1.30, a 12.1% increase.

- Full Year Revenue (2024): $2.02 billion, a 2.9% increase.

- Operating Cash Flow (2024): $171.5 million, exceeding guidance.

- Debt (Year-end 2024): $411.7 million, reduced from $430.4 million in 2023.

- Share Repurchases (Nov 2024 - Feb 2025): 395,000 shares for $48 million.

- Backlog (Year-end 2024): $3.8 billion, with $1.9 billion funded.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ICF International Inc (ICFI, Financial) reported a 15% increase in non-GAAP EPS to $7.45, driven by a 30 basis point expansion in adjusted EBITDA margin to 11.2%.

- The company experienced a 26% revenue increase in its commercial energy sector, attributed to new wins and contract expansions.

- ICF International Inc (ICFI) completed the acquisition of Applied Energy Group, enhancing its energy technology and advisory services capabilities.

- The company repurchased 395,000 shares, demonstrating confidence in its long-term outlook.

- ICF International Inc (ICFI) secured significant international contracts with the European Commission and the UK government, valued at over $210 million.

Negative Points

- ICF International Inc (ICFI) faces potential revenue reductions of up to 10% in 2025 due to changes in federal government spending priorities.

- Approximately $90 million of estimated 2025 revenues have been affected by stop work orders and contract terminations, primarily impacting USAID contracts.

- The federal government business saw a 2.4% decline in revenue in the fourth quarter, driven by lower pass-through costs.

- The company anticipates a transitional year in 2025 for its federal government business, with potential further revenue impacts.

- ICF International Inc (ICFI) faces uncertainty in the federal market, which could affect its IT modernization and digital transformation services.