- Take-Two Interactive Software sees a modest share increase amid GTA 6 delay announcement.

- Bank of America maintains "Buy" rating on TTWO, citing mitigation of delay risks and upcoming Xbox insights.

- Analysts suggest a potential upside in TTWO stock with a target price reflecting promising growth.

Take-Two Interactive Software (NASDAQ: TTWO) experienced a slight uptick in its share price, rising by 0.4% following the announcement from Rockstar Games concerning a delay in the release of Grand Theft Auto 6 to May 26, 2026. This delay seemingly has not deterred investor confidence, as Bank of America reaffirmed its "Buy" rating on TTWO. The firm points to reduced risks associated with the delay and anticipates potential pricing insights following Xbox’s proposed price adjustments in 2025 as key factors influencing their stance.

Wall Street Analysts Forecast

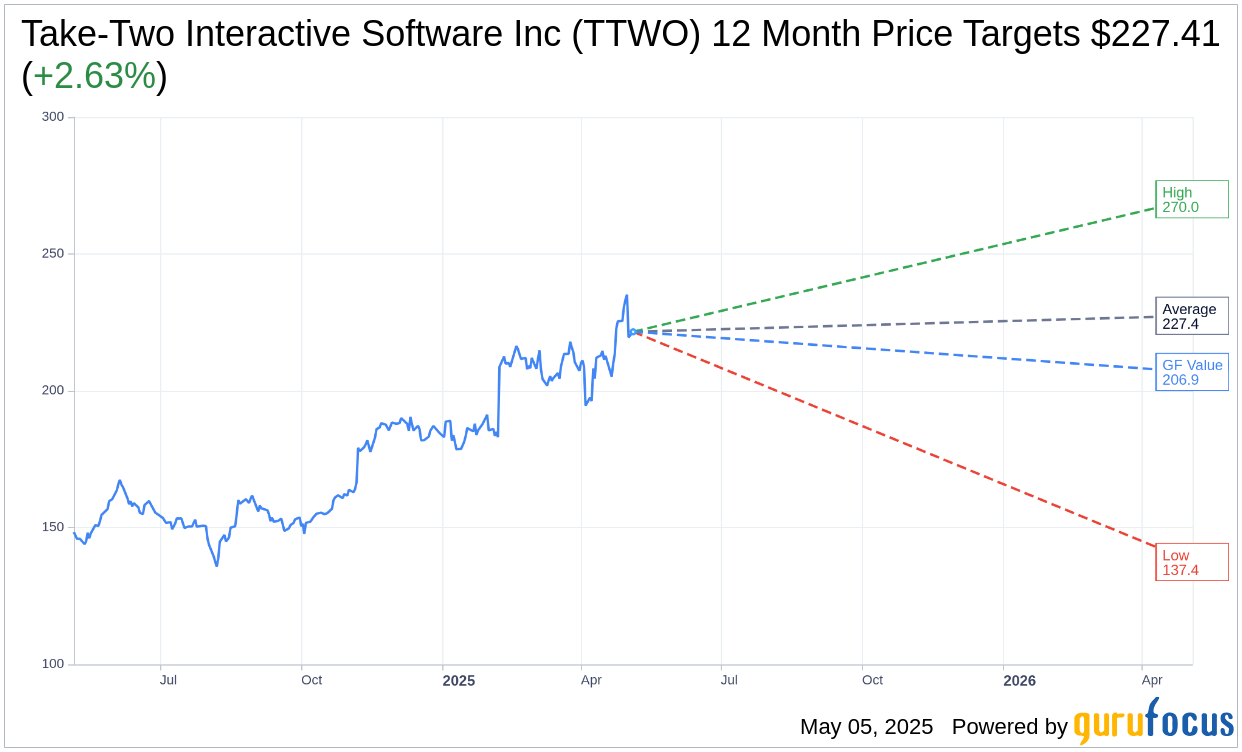

Take-Two Interactive Software Inc. (TTWO, Financial) continues to attract significant attention from analysts. Based on the one-year price targets provided by 29 analysts, the average target price stands at $227.41, with expectations ranging from a high estimate of $270.00 to a low of $137.43. This average target suggests a potential upside of 2.63% from the current trading price of $221.58. Investors seeking further details can explore more on the Take-Two Interactive Software Inc. (TTWO) Forecast page.

The consensus from 30 brokerage firms indicates an "Outperform" status for Take-Two Interactive Software Inc. (TTWO, Financial), with an average brokerage recommendation of 1.8 out of a scale of 1 to 5. Here, a rating of 1 represents a "Strong Buy," while a rating of 5 signifies a "Sell."

Estimating the GF Value

According to GuruFocus evaluations, Take-Two Interactive Software Inc. (TTWO, Financial) has an estimated GF Value of $206.88 over the next year. This suggests a potential downside of 6.63% compared to the current stock price of $221.58. The GF Value offers an insightful estimate of the fair value at which this stock should be traded, as derived from historical trading multiples, previous business growth, and future business performance projections. Investors interested in in-depth analysis can visit the Take-Two Interactive Software Inc. (TTWO) Summary page.