Castle Biosciences (CSTL, Financial) reported its first-quarter revenue, reaching $87.99 million, surpassing analysts' expectations of $80.38 million. The company attributes this strong performance to a substantial increase in test report volume and consistent revenue growth.

Derek Maetzold, the company’s president and CEO, highlighted the impressive start to the year, crediting the results to the significant clinical value their tests offer to healthcare professionals, alongside robust teamwork across their therapeutic domains.

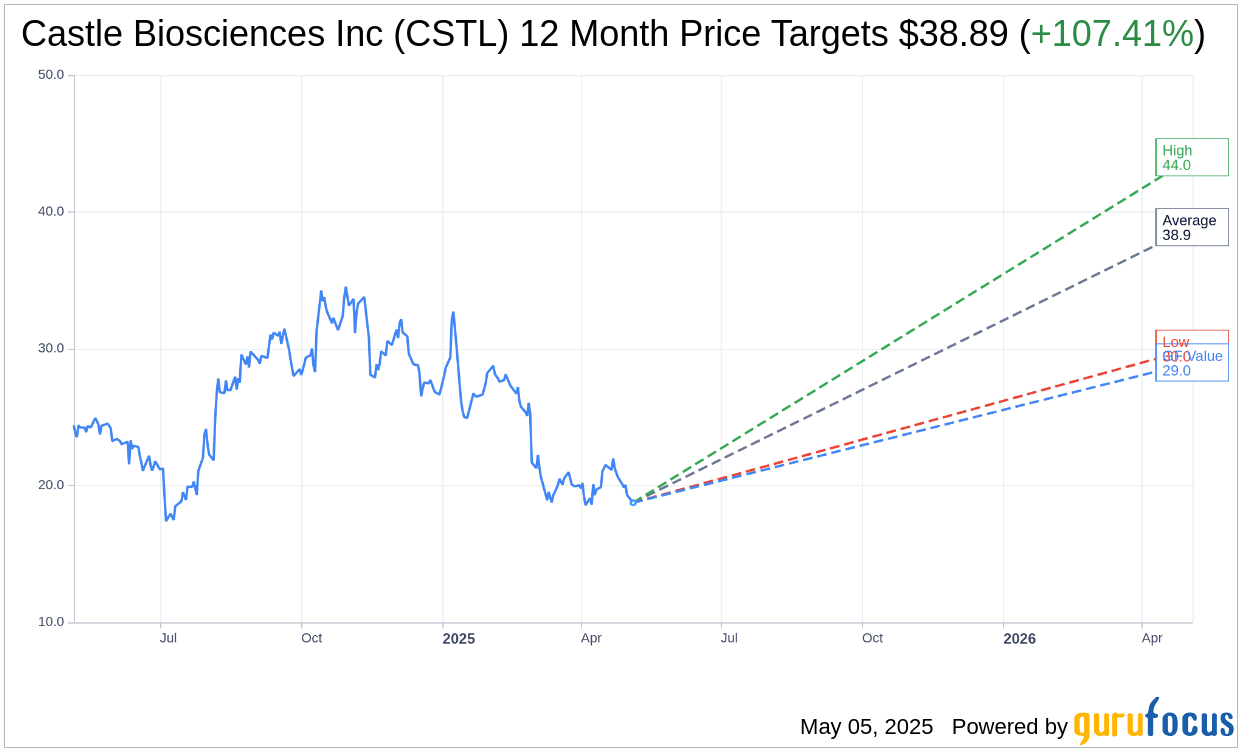

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Castle Biosciences Inc (CSTL, Financial) is $38.89 with a high estimate of $44.00 and a low estimate of $30.00. The average target implies an upside of 107.41% from the current price of $18.75. More detailed estimate data can be found on the Castle Biosciences Inc (CSTL) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Castle Biosciences Inc's (CSTL, Financial) average brokerage recommendation is currently 1.4, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Castle Biosciences Inc (CSTL, Financial) in one year is $29.00, suggesting a upside of 54.67% from the current price of $18.75. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Castle Biosciences Inc (CSTL) Summary page.

CSTL Key Business Developments

Release Date: February 27, 2025

- Fourth Quarter Revenue: $86.3 million, a 31% increase over Q4 2023.

- Full Year Revenue 2024: $332.1 million, a 51% increase over 2023.

- Total Test Report Volume Growth 2024: 36% increase compared to 2023.

- Cash, Cash Equivalents, and Marketable Securities: $293.1 million as of December 31, 2024.

- Gross Margin Q4 2024: 76.2% compared to 77.8% in Q4 2023.

- Full Year Gross Margin 2024: 78.5% compared to 75.4% in 2023.

- Net Income Q4 2024: $9.6 million compared to a net loss of $2.6 million in Q4 2023.

- Full Year Net Income 2024: $18.2 million compared to a net loss of $57.5 million in 2023.

- Diluted Earnings Per Share Q4 2024: $0.32 compared to a diluted loss per share of $0.10 in Q4 2023.

- Full Year Diluted Earnings Per Share 2024: $0.62 compared to a diluted loss per share of $2.14 in 2023.

- Adjusted EBITDA Q4 2024: $21.3 million compared to $9.4 million in Q4 2023.

- Full Year Adjusted EBITDA 2024: $75 million compared to a negative $4.4 million in 2023.

- Net Cash Provided by Operating Activities 2024: $64.9 million.

- DecisionDx-Melanoma Test Reports 2024: 36,008, an 8% increase over 2023.

- DecisionDx-SCC Test Reports 2024: 16,348, a 43% increase over 2023.

- TissueCypher Test Reports 2024: 20,956, a 130% increase over 2023.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Castle Biosciences Inc (CSTL, Financial) reported a 51% year-over-year revenue growth, reaching $332.1 million for the full year 2024.

- The company achieved a 36% increase in total test report volume in 2024 compared to 2023.

- Castle Biosciences Inc (CSTL) ended 2024 with $293.1 million in cash, cash equivalents, and marketable investment securities, a $50 million increase over the previous year.

- The TissueCypher test saw a 130% growth in test report volume in 2024, with positive reception from the gastroenterology community.

- Castle Biosciences Inc (CSTL) achieved a net income of $18.2 million for 2024, compared to a net loss of $57.5 million in 2023.

Negative Points

- The DecisionDx-SCC test faces potential noncoverage by Medicare starting April 24, 2025, which could impact revenue.

- Gross margin decreased slightly in the fourth quarter of 2024 to 76.2% from 77.8% in the same period of 2023.

- The company anticipates a decrease in IDgenetix test report volumes and net revenues in 2025 due to market changes.

- Castle Biosciences Inc (CSTL) expects typical seasonality to affect the first quarter of 2025, potentially leading to flat or slightly down volumes compared to the fourth quarter of 2024.

- The company faces challenges in expanding the use of DecisionDx-Melanoma in academic centers due to the absence of guideline inclusion.