Key Highlights:

- Super Micro Computer projects substantial revenue growth in the upcoming quarter as AI platform transitions progress.

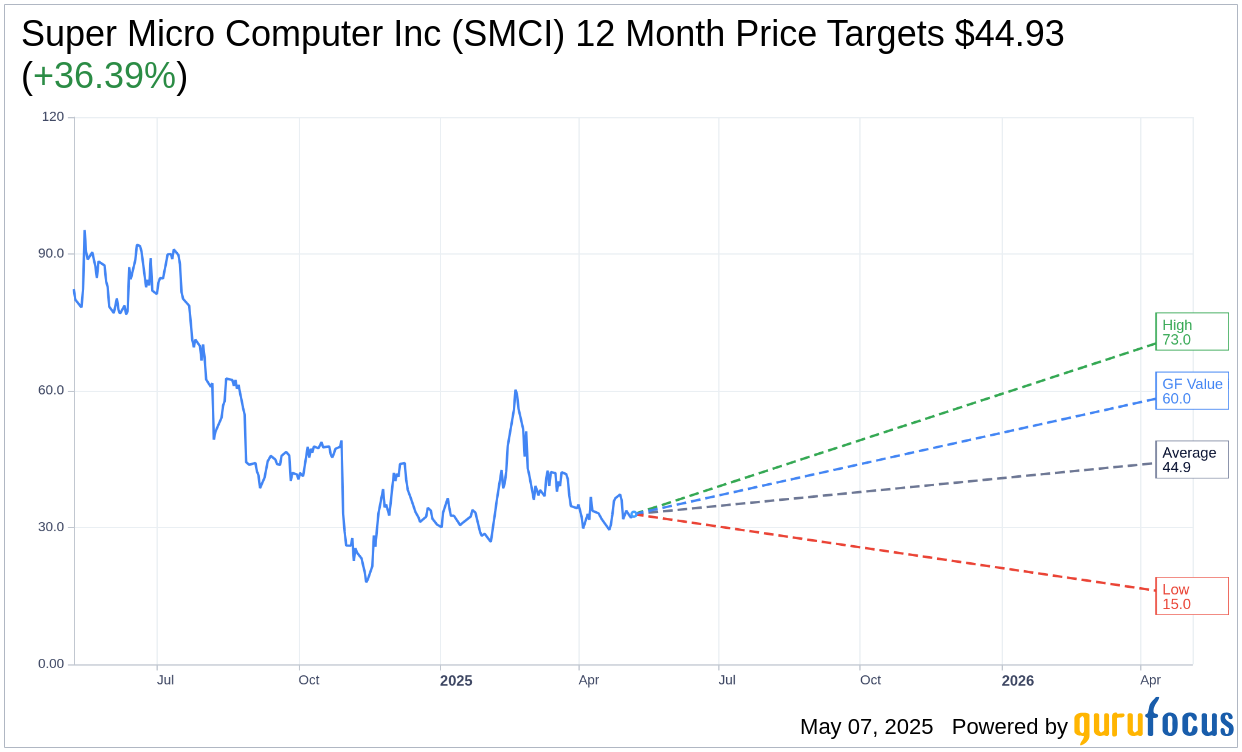

- Analysts foresee an average price increase of over 36% for SMCI stock.

- GuruFocus estimates suggest a significant upside with a GF Value indicating potential growth of 82.24%.

Super Micro Computer (SMCI, Financial) recently announced its third-quarter 2025 revenue figures, reaching $4.6 billion. These results were influenced by delays in transitioning its AI platforms. CEO Charles Liang expressed optimism about upcoming launches and new facilities designed to support the company's growth trajectory. Looking ahead, the company projects its fourth-quarter revenue to fall between $5.6 billion and $6.4 billion, with earnings per share (EPS) estimated at $0.40 to $0.50.

Wall Street Analysts Forecast

According to insights from 12 analysts, the average one-year price target for Super Micro Computer Inc (SMCI, Financial) is set at $44.93. This average includes a high estimate of $73.00 and a low estimate of $15.00. This suggests a promising upside potential of 36.39% from the current stock price of $32.94. For more detailed analyst predictions, please visit the Super Micro Computer Inc (SMCI) Forecast page.

The consensus among 15 brokerage firms places Super Micro Computer Inc (SMCI, Financial) at an average recommendation of 2.8, categorizing it under "Hold." The recommendation scale ranges from 1, representing a Strong Buy, to 5, indicating Sell.

GuruFocus Valuation Insights

Leveraging GuruFocus's proprietary metrics, the one-year estimated GF Value for Super Micro Computer Inc (SMCI, Financial) is $60.03. This points to a substantial upside of 82.24% from the current stock price of $32.94. The GF Value is a reflection of what GuruFocus believes is the fair market value based on historical trading multiples, previous business growth patterns, and projected future performance. To dive deeper into these valuations, you can explore the Super Micro Computer Inc (SMCI) Summary page.