- Algonquin Power & Utilities (AQN, Financial) surpasses earnings expectations with a strong performance in its Regulated Services Group.

- Analysts provide a mixed outlook with target prices suggesting a slight downside potential.

- GuruFocus estimates indicate a potential upside based on GF Value.

Algonquin Power & Utilities (AQN) has reported impressive financial results for the first quarter, showcasing a Non-GAAP EPS of $0.14, which is $0.04 above market expectations. The company's robust performance is largely attributed to its Regulated Services Group, which recorded a remarkable 43% increase in net earnings year-over-year, underscoring significant growth potential.

Wall Street Analysts' Insights

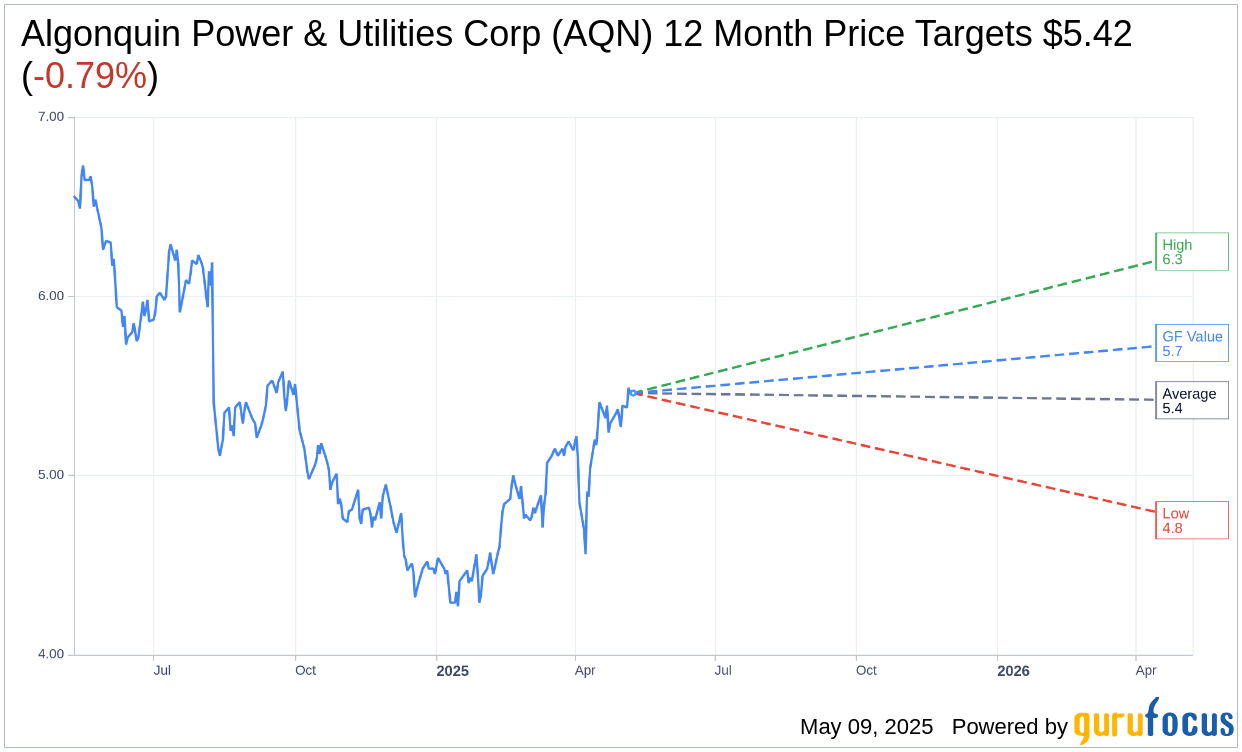

Analyst forecasts present a varied picture for Algonquin Power & Utilities Corp (AQN, Financial). According to projections from nine analysts, the average target price for the stock is set at $5.42, with estimates ranging between a high of $6.25 and a low of $4.75. This average suggests a slight downside of 0.79% from the current trading price of $5.46. Investors seeking more comprehensive data can explore the Algonquin Power & Utilities Corp (AQN) Forecast page.

Brokerage Recommendations

The average brokerage recommendation for Algonquin Power & Utilities Corp (AQN, Financial), based on consensus from ten brokerage firms, stands at 2.8, which corresponds to a "Hold" status. This rating is derived from a scale of 1 to 5, where 1 indicates a Strong Buy and 5 signifies a Sell.

Analyzing GF Value

Utilizing GuruFocus's GF Value metric provides a positive outlook for Algonquin Power & Utilities Corp (AQN, Financial). Over the next year, the GF Value is projected at $5.74, implying a potential upside of 5.13% from the current price of $5.46. GF Value represents GuruFocus' estimation of the fair trading value of the stock, calculated using historical trading multiples and future business performance estimates. For a deeper dive, refer to the Algonquin Power & Utilities Corp (AQN) Summary page.