- Disney is launching a new sports streaming app, "ESPN," distinct from ESPN+, priced at $25-$30.

- Analysts predict a 17.27% upside for Disney's stock, with an average target price of $124.23.

- Disney's stock is rated as "Outperform" by brokerage firms, with a GF Value suggesting a 6.11% upside.

Disney (DIS, Financial) is set to make waves in the sports streaming arena with the upcoming launch of "ESPN," a comprehensive sports app that promises abundant sports content for avid fans. Set to be distinct from the current ESPN+ service, the new offering will provide access to a full spectrum of ESPN's programs, along with additional channels such as ESPN2 and the SEC Network, with a subscription fee ranging from $25 to $30 per month.

Wall Street Analysts Forecast

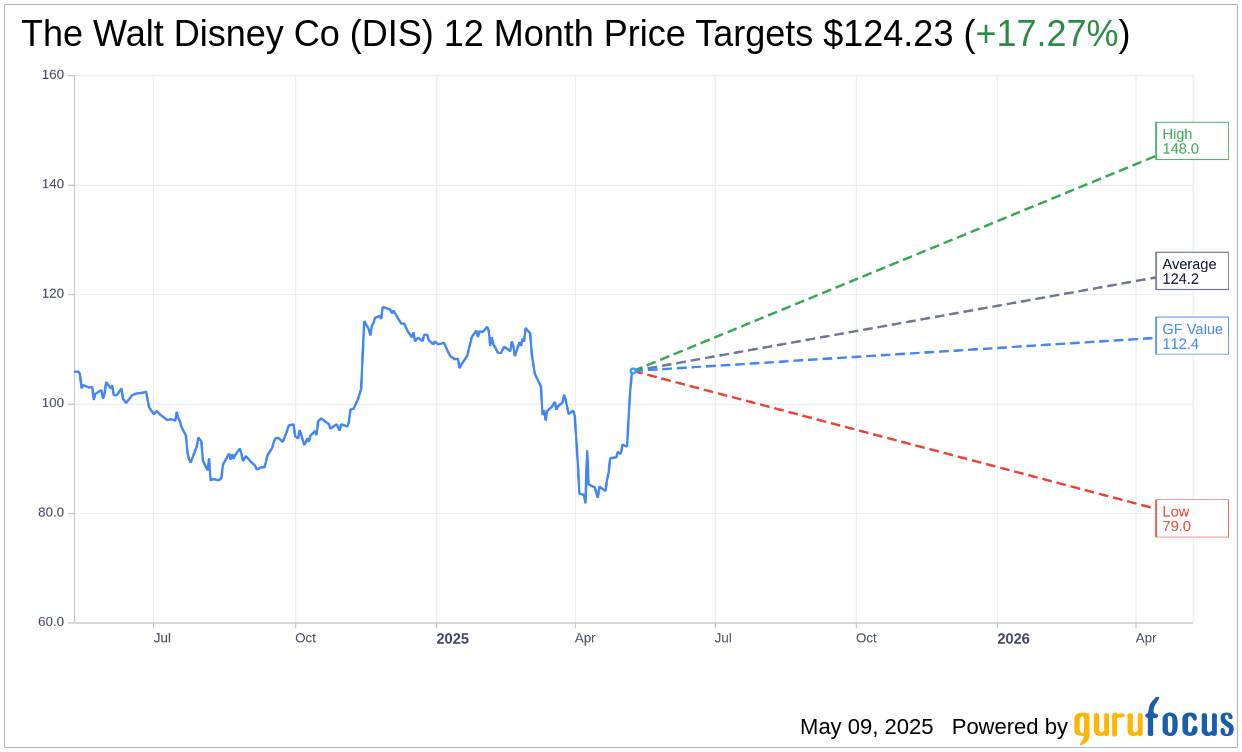

Wall Street analysts are optimistic about The Walt Disney Co (DIS, Financial) stock, with 27 experts targeting an average price of $124.23—a potential increase of 17.27% from its current value of $105.94. Projections range from a low of $79.00 to a high of $148.00. Investors can find more comprehensive estimates on the The Walt Disney Co (DIS) Forecast page.

Analyst consensus from 32 brokerage firms reflects a positive outlook for Disney, giving it an average "Outperform" recommendation of 2.0 on a scale of 1 to 5 (where 1 indicates a Strong Buy and 5 a Sell).

In addition, GuruFocus estimates indicate a GF Value of $112.41 for Disney within a year, suggesting an upside of 6.11% from the current price of $105.94. This GF Value reflects the fair trading value of the stock, calculated based on historical stock multiples, past business growth, and future business performance projections. More detailed insights are available on the The Walt Disney Co (DIS, Financial) Summary page.