New Fortress Energy (NFE, Financial) reported a significant decline in its first-quarter revenue, coming in at $470.5 million. This figure represents a decrease when contrasted with last year’s Q1 revenue of $690.3 million. The reduction highlights a challenging period for the company, prompting a closer look at its financial strategies and market positioning. Investors may need to assess the potential implications for NFE’s future performance and strategies to rebound from this decline.

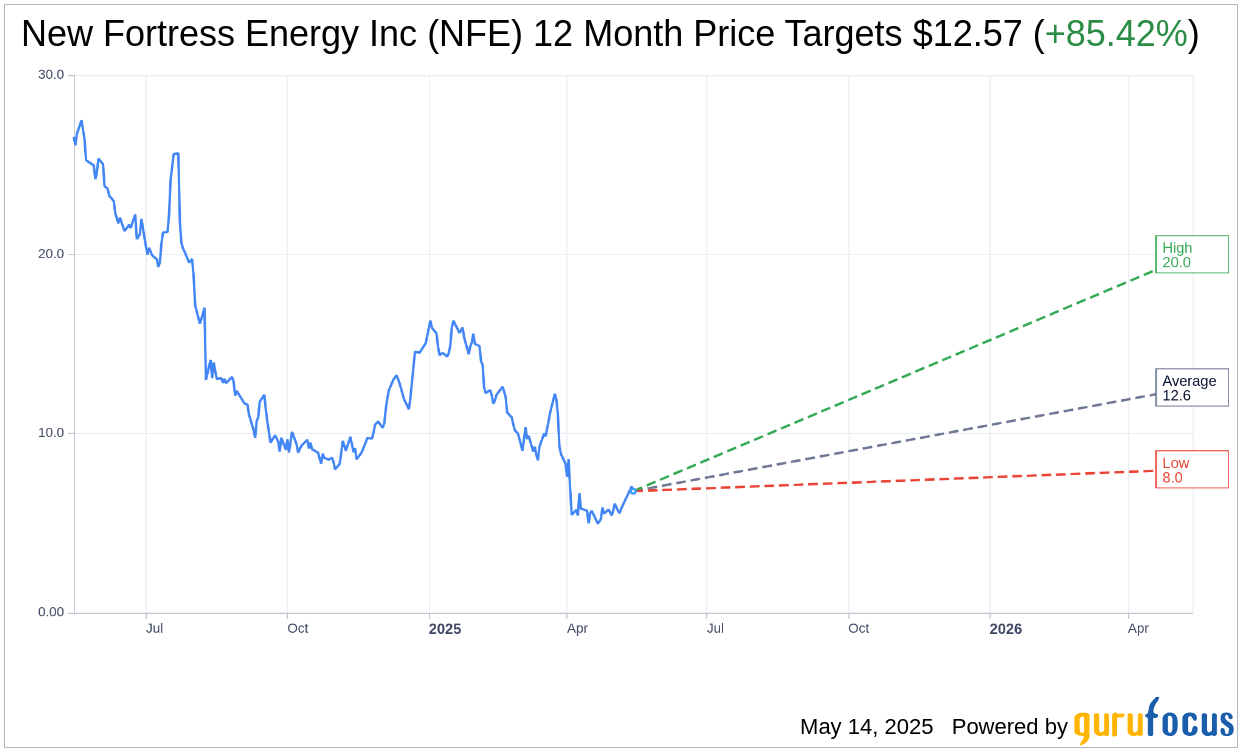

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for New Fortress Energy Inc (NFE, Financial) is $12.57 with a high estimate of $20.00 and a low estimate of $8.00. The average target implies an upside of 85.42% from the current price of $6.78. More detailed estimate data can be found on the New Fortress Energy Inc (NFE) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, New Fortress Energy Inc's (NFE, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for New Fortress Energy Inc (NFE, Financial) in one year is $31.19, suggesting a upside of 360.03% from the current price of $6.78. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the New Fortress Energy Inc (NFE) Summary page.

NFE Key Business Developments

Release Date: March 03, 2025

- EBITDA: $313 million for Q4 2024, a 50% increase over previous guidance; $950 million for the full year 2024.

- Revenue: Total segment operating margin of $240 million for Q4 and just under $1.1 billion for fiscal year 2024.

- Net Loss: $242 million for Q4 2024 or $1.11 per share; $270 million for the full year 2024 or $1.25 per share.

- Cash Flow: Funds from operations of $68 million for Q4 and $263 million for the fiscal year 2024.

- Debt Refinancing: Completed a $2.7 billion bond issuance, extended $900 million revolver to October 2027, and raised $400 million in new equity.

- Term Loan B: Closed a $425 million Term Loan B upsized.

- Asset Sales: Expecting $2 billion net proceeds from asset sales in 2025 to pay down corporate debt.

- Puerto Rico Operations: Extended an 80 TBtu contract for one year; potential market growth from 50 TBtu to between 250 and 350 TBtu.

- Brazil Operations: Operating two LNG terminals with a supply capacity of approximately 200 TBtu per year each; secured over 2.2 gigawatts with long-term power purchase agreements.

- FLNG 1 Asset: Achieved approximately 120% of nameplate capacity in January; shipped 12 cargoes totaling approximately 24 TBtu.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- New Fortress Energy Inc (NFE, Financial) reported a strong quarter with $313 million in EBITDA, marking a 50% increase over previous guidance.

- The company confirmed its guidance of $1 billion in EBITDA for 2025, indicating a positive outlook.

- NFE's FLNG asset coming online significantly contributed to earnings and is expected to continue doing so.

- The company has strengthened its balance sheet through various capital market activities, including raising $400 million in new equity and issuing a $2.7 billion bond.

- NFE is well-positioned in key markets like Brazil and Puerto Rico, with significant growth opportunities in gas-to-power conversions and new power plant developments.

Negative Points

- The business is capital-intensive, which poses challenges despite the competitive advantages once infrastructure is established.

- NFE faces decisions on whether to hedge or sell excess gas supply, which could impact profitability depending on market conditions.

- The company experienced a net loss of $242 million for Q4 2024, largely due to charges related to debt extinguishment.

- There are uncertainties regarding the renewal and extension of contracts in Puerto Rico, which could affect future revenue streams.

- NFE had to reverse $83 million in previously recognized revenue due to changes in its incentive contract with PREPA, impacting reported earnings.