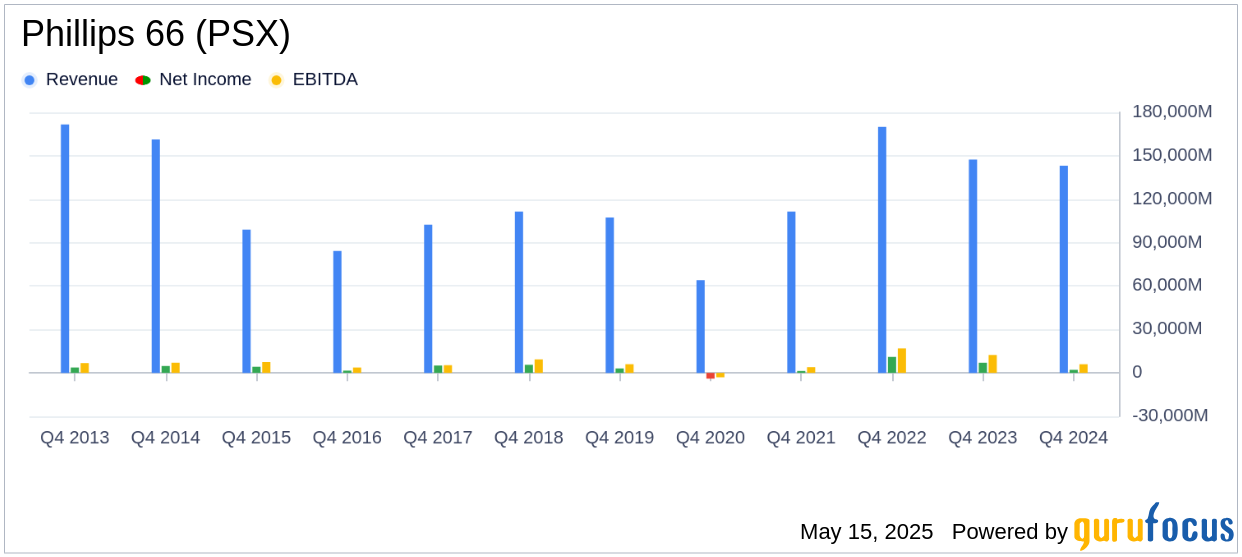

Long-established in the Oil & Gas industry, Phillips 66 (PSX, Financial) has enjoyed a stellar reputation. However, it has recently witnessed a daily loss of 1.17%, juxtaposed with a three-month change of -2.89%. Fresh insights from the GF Score hint at potential headwinds. Notably, its diminished rankings in financial strength, growth, and valuation suggest that the company might not live up to its historical performance. Join us as we dive deep into these pivotal metrics to unravel the evolving narrative of Phillips 66.

Understanding the GF Score

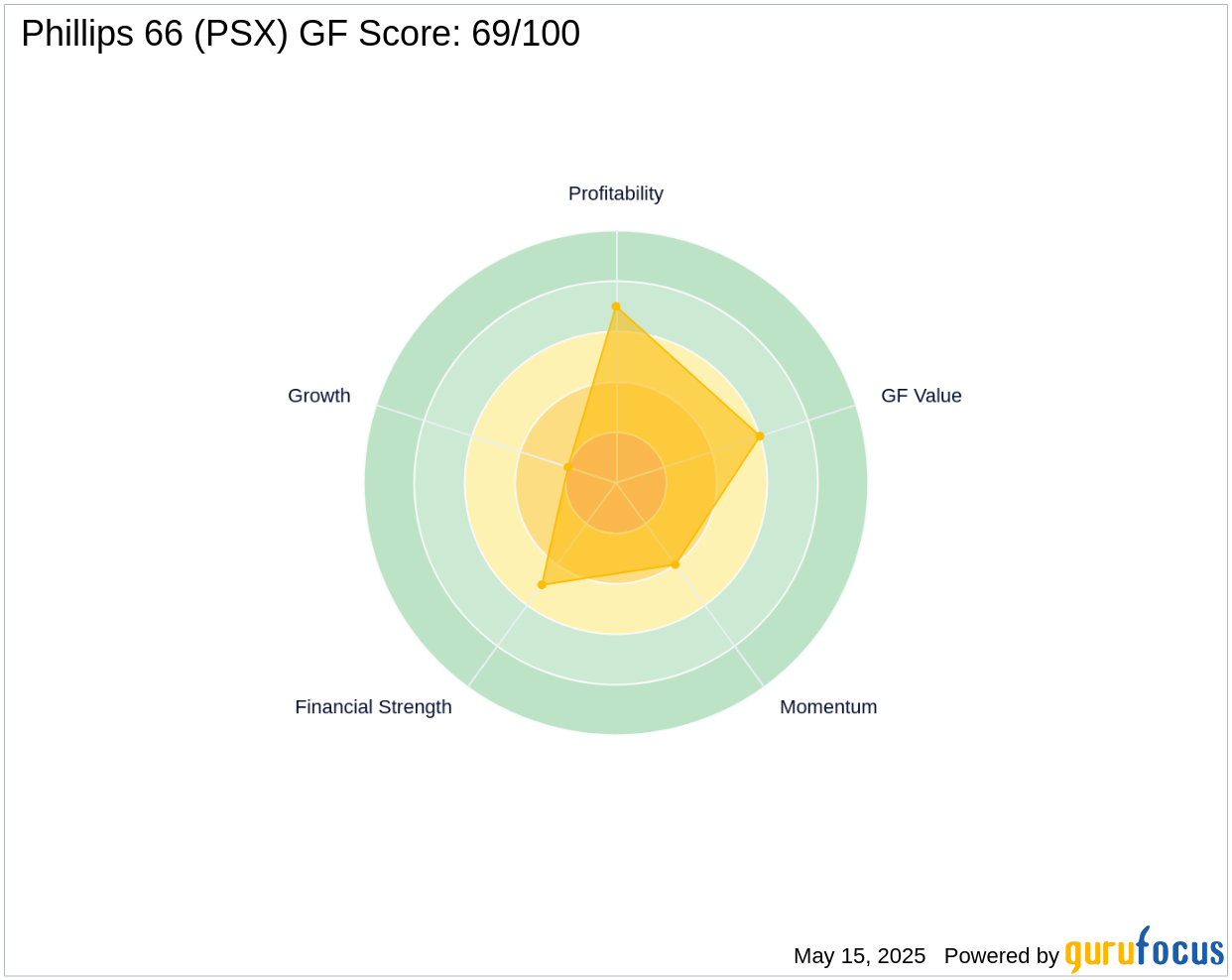

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

- Financial strength rank: 5/10

- Profitability rank: 7/10

- Growth rank: 2/10

- GF Value rank: 6/10

- Momentum rank: 4/10

Based on the above method, GuruFocus assigned Phillips 66 the GF Score of 69 out of 100, which signals poor future outperformance potential.

Company Overview

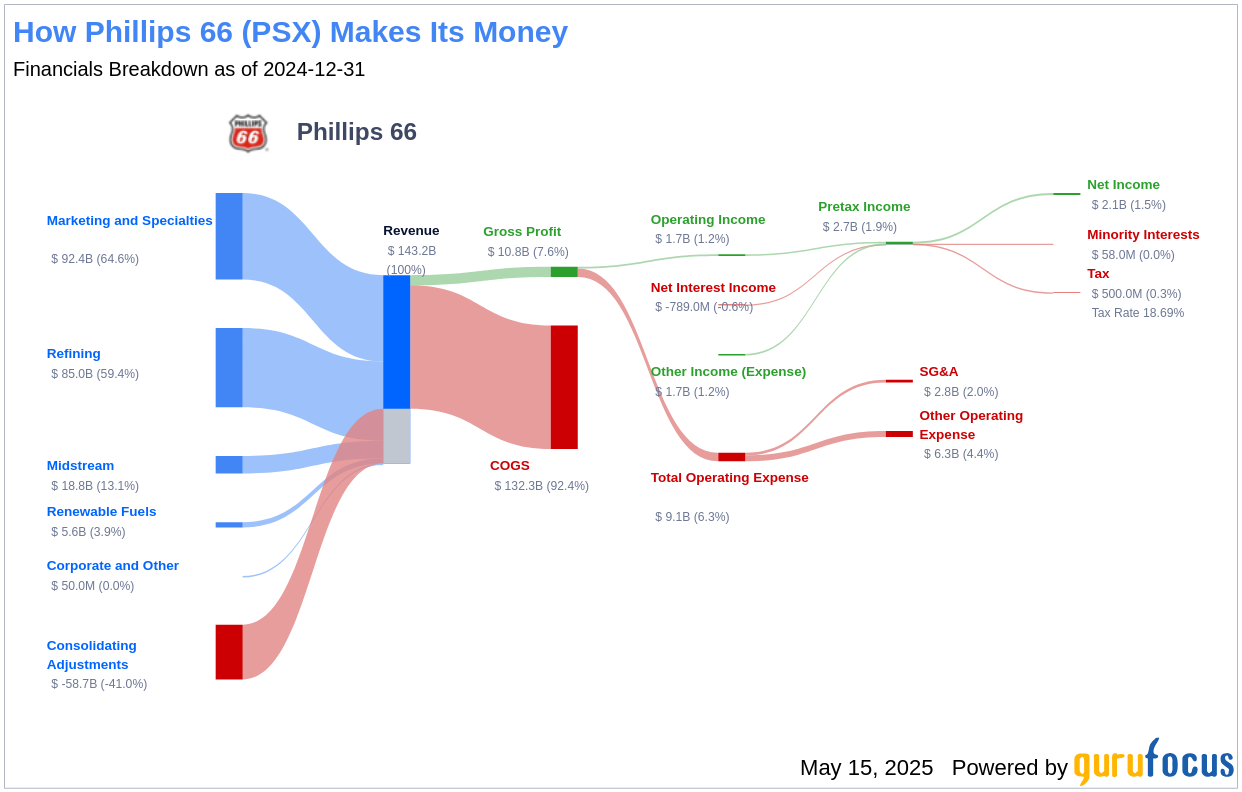

Phillips 66 is an independent refiner that owns or holds interest in 11 refineries with a total crude throughput capacity of 1.8 million barrels per day, or mmb/d, at the end of 2024. The midstream segment comprises extensive transportation and NGL processing assets. It includes 70,000 miles of crude oil, refined petroleum product, NGL and natural gas pipeline systems, and a comprehensive set of refined petroleum product, NGL and crude oil terminals, gathering and processing plants and fractionation facilities and various other storage and loading facilities. Its CPChem chemical joint venture operates facilities primarily in the United States and the Middle East and produces olefins and polyolefins.

Financial Strength Breakdown

Phillips 66's financial strength indicators present some concerning insights about the company's balance sheet health. Phillips 66 has an interest coverage ratio of 0.64, which positions it worse than 95.98% of 721 companies in the Oil & Gas industry. This ratio highlights potential challenges the company might face when handling its interest expenses on outstanding debt. It's worth noting that the esteemed investor Benjamin Graham typically favored companies with an interest coverage ratio of at least five.

Additionally, the company's low cash-to-debt ratio at 0.08 indicates a struggle in handling existing debt levels.

Growth Prospects

A lack of significant growth is another area where Phillips 66 seems to falter, as evidenced by the company's low Growth rank. Lastly, Phillips 66 predictability rank is just one star out of five, adding to investor uncertainty regarding revenue and earnings consistency.

Conclusion

In conclusion, the financial strength, profitability, and growth metrics of Phillips 66, as highlighted by the GF Score, suggest potential underperformance. The company's challenges in managing debt, coupled with its low growth prospects, paint a picture of a firm that may struggle to meet investor expectations. For those seeking companies with stronger potential, GuruFocus Premium members can explore more options using the GF Score Screen.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.