On May 20, 2025, ProPhase Labs Inc (PRPH, Financial) released its 8-K filing detailing its financial results for the first quarter ended March 31, 2025. ProPhase Labs Inc is a diversified company offering diagnostic testing, genomics testing, and contract manufacturing services. It operates through two main segments: Diagnostic services, which provides COVID-19 diagnostic information services, and Consumer Products, which focuses on OTC consumer healthcare products and dietary supplements.

Performance Overview and Strategic Developments

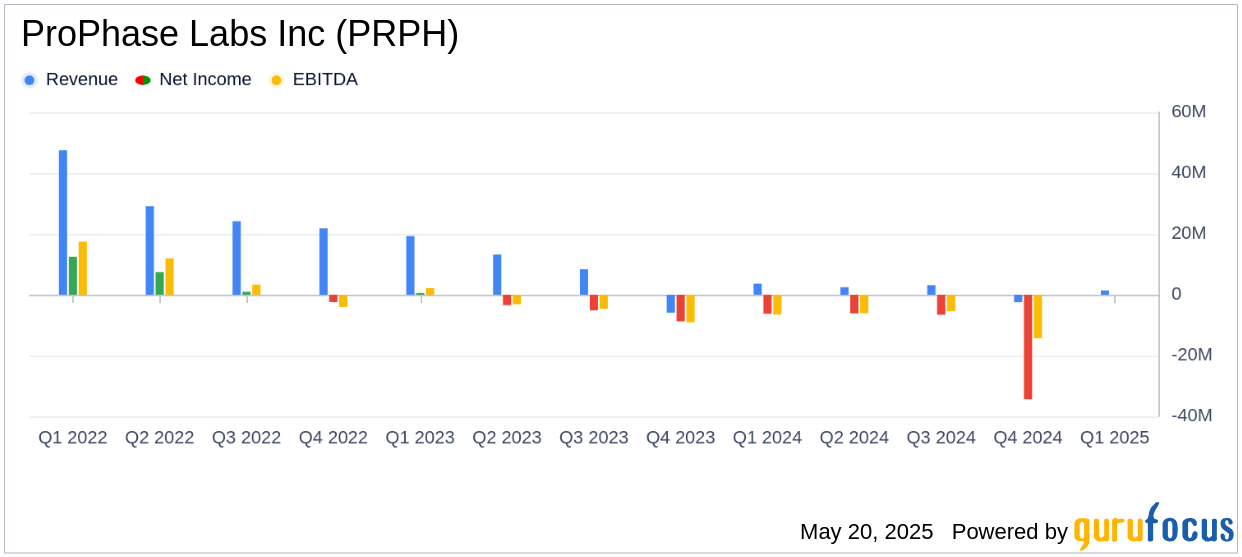

ProPhase Labs Inc reported a net revenue of $1.4 million for Q1 2025, falling short of the analyst estimate of $2.45 million. This represents a significant decrease from the $2.4 million reported in the same period last year. The decline was primarily due to a $1.0 million decrease in consumer products revenue, with no revenue generated from diagnostic services in both comparable periods.

The company has undertaken significant restructuring efforts, including the divestiture of its Pharmaloz manufacturing operations and the shutdown of its genomics laboratory, resulting in substantial cost savings. These strategic moves are aimed at transforming ProPhase Labs into a leaner entity with lower overhead and reduced risk to shareholders.

Financial Achievements and Industry Implications

Despite the revenue shortfall, ProPhase Labs achieved a gross margin profit of $0.5 million, a notable improvement from the gross margin loss of $0.1 million in Q1 2024. The overall gross margin increased to 36.8% from a negative 2.5% in the previous year, driven by improved margins in the consumer products segment.

These financial achievements are crucial for a company in the Medical Diagnostics & Research industry, as they reflect the ability to manage costs effectively while navigating a challenging market environment. The company's focus on strategic asset development and disciplined execution is expected to unlock long-term shareholder value.

Key Financial Metrics and Analysis

ProPhase Labs reported a net loss from continuing operations of $4.7 million, or $(0.13) per share, which is an improvement from the $5.5 million loss, or $(0.32) per share, in Q1 2024. The company's cash and cash equivalents decreased to $88,000 as of March 31, 2025, from $678,000 at the end of 2024, primarily due to cash used in operating activities and repayment of notes payable.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Net Revenue | $1.4 million | $2.4 million |

| Gross Margin | 36.8% | (2.5)% |

| Net Loss from Continuing Operations | $(4.7) million | $(5.5) million |

| Cash and Cash Equivalents | $88,000 | $678,000 |

CEO Commentary and Future Outlook

“ProPhase is now sharply focused on unlocking value through strategic asset development and disciplined execution,” said Ted Karkus, CEO of ProPhase Labs. “We’ve taken bold steps to streamline operations, reduce overhead and align our resources with opportunities that we believe have real value. With BE-Smart nearing commercialization and a robust pipeline of potential liquidity events, we believe we are well-positioned to create meaningful, long-term shareholder value. We’re optimistic about what’s ahead—the next few months could be a turning point as we move closer to several major milestones.”

ProPhase Labs is actively pursuing strategic alternatives for its subsidiary Nebula Genomics and anticipates significant liquidity events in the near future. The company's efforts to recover approximately $50 million in insurance payments through Crown Medical Collections could provide a substantial non-dilutive financial influx in the second half of 2025.

Overall, ProPhase Labs Inc's Q1 2025 results reflect a company in transition, focusing on strategic restructuring and cost management to enhance shareholder value. The company's ability to navigate these challenges and capitalize on upcoming opportunities will be critical to its future success.

Explore the complete 8-K earnings release (here) from ProPhase Labs Inc for further details.