- Nvidia (NVDA, Financial) remains at the forefront of AI innovation with new tech showcases at Computex.

- Investment firm Citi upholds a Buy rating for NVDA, projecting robust growth despite market challenges.

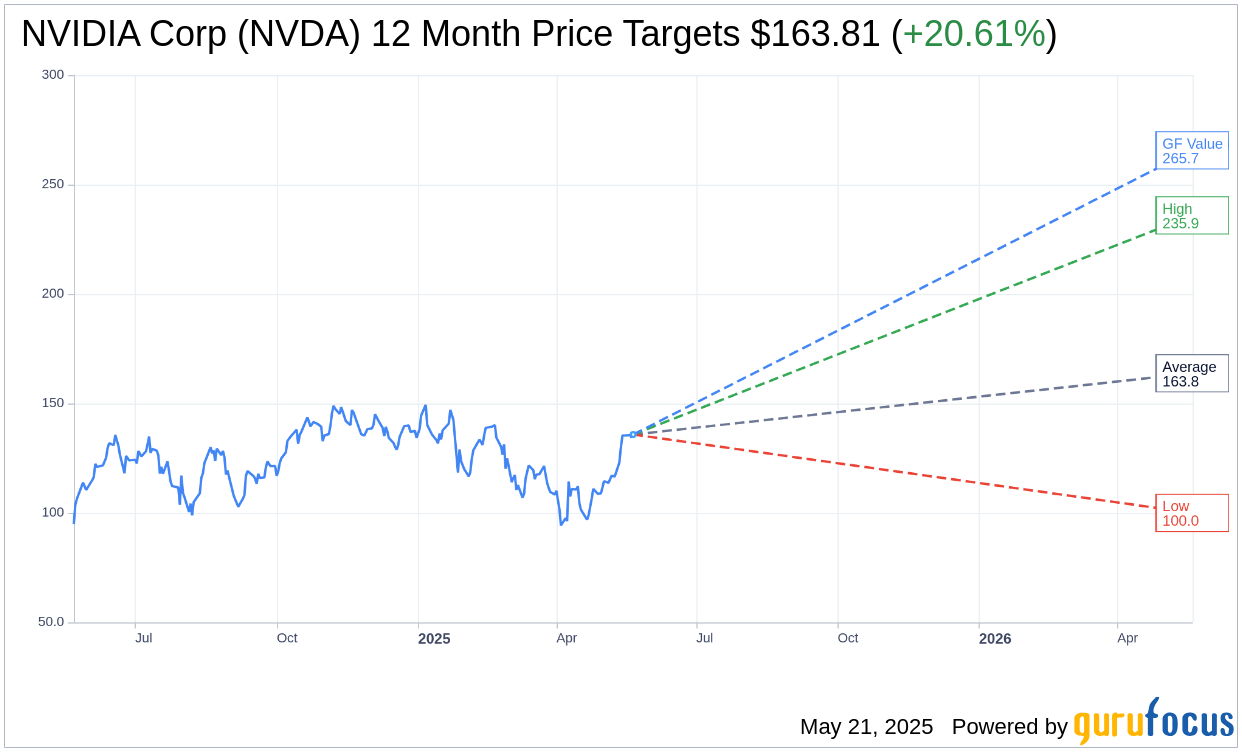

- Analyst consensus reveals significant upside potential based on both price targets and GF Value estimates.

Nvidia Corp. (NVDA) continues to solidify its leadership position in the artificial intelligence (AI) sector, as demonstrated by its latest technological advancements at the recent Computex event. Among these innovations is NVLink Fusion, which further underscores Nvidia's commitment to pushing the boundaries of AI technology.

Nvidia's Market Outlook and Analyst Opinions

Investment firm Citi has reiterated its positive outlook on Nvidia, maintaining a "Buy" rating with a price target of $150. Analyst Atif Malik projects quarterly revenues of $44.5 billion, acknowledging hurdles such as diminished demand in the Chinese market and declines associated with the Hopper architecture. Despite these challenges, Nvidia's growth prospects appear promising.

Wall Street Analysts' Price Projections

A survey of 51 analysts reveals a consensus one-year price target for Nvidia Corp (NVDA, Financial) set at $163.81, with projections ranging from a high of $235.92 to a low of $100.00. This average target indicates a potential upside of 20.46% from the current trading price of $135.98. For a more in-depth analysis, visit the NVIDIA Corp (NVDA) Forecast page.

Consensus Recommendations and Valuation Insights

The consensus recommendation among 64 brokerage firms positions Nvidia Corp (NVDA, Financial) at a 1.8 on a scale where 1 signifies a "Strong Buy" and 5 a "Sell," thus endorsing an "Outperform" rating. This aligns with Nvidia's robust market strategies and long-term growth trajectory.

GuruFocus' proprietary metrics further underscore Nvidia's valuation appeal. The estimated GF Value for Nvidia Corp (NVDA, Financial) over the next year is $265.67, suggesting an impressive upside of 95.37% from the current price of $135.9827. This valuation estimation is derived from historical trading multiples, past business growth, and future business performance forecasts. Additional insights can be found on the NVIDIA Corp (NVDA) Summary page.