Ooma, Inc. (OOMA, Financial) has forecasted its revenue for the second quarter to range between $65.5 million and $66.1 million. This projection closely aligns with the consensus estimate of $66.09 million, indicating market expectations are on track. The company's outlook suggests a steady performance for the upcoming quarter.

Wall Street Analysts Forecast

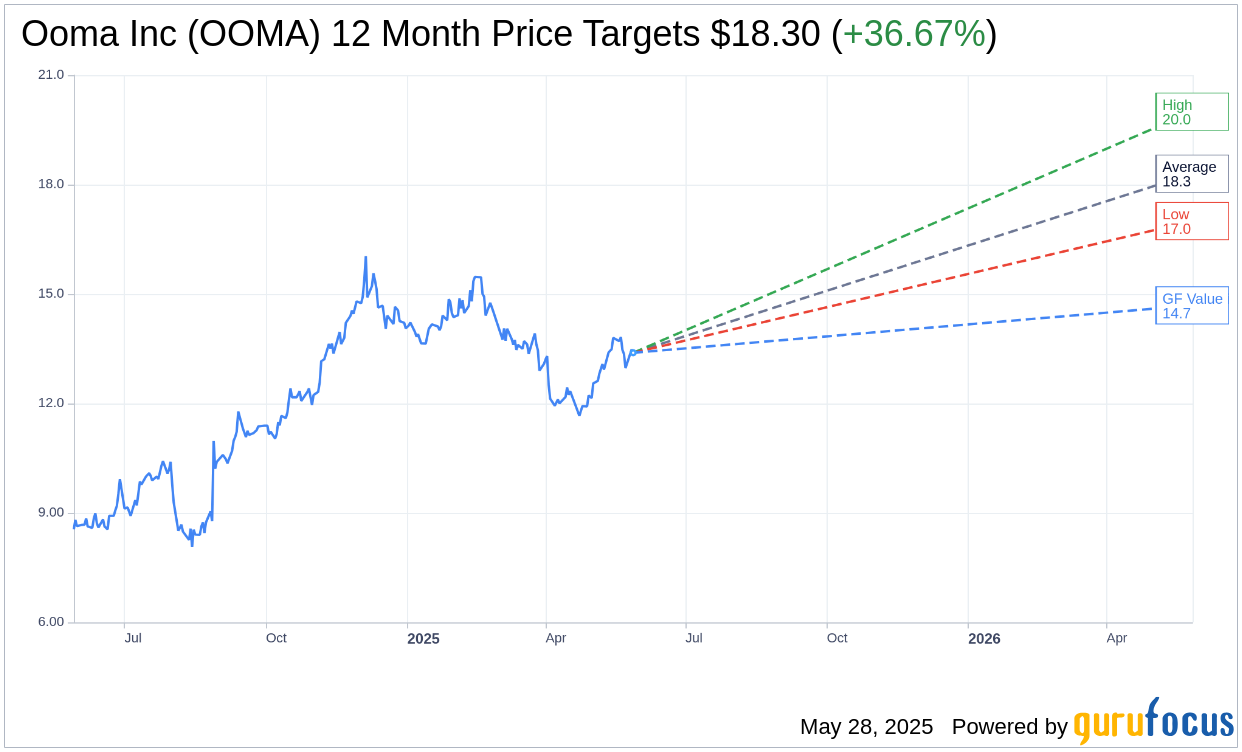

Based on the one-year price targets offered by 5 analysts, the average target price for Ooma Inc (OOMA, Financial) is $18.30 with a high estimate of $20.00 and a low estimate of $17.00. The average target implies an upside of 36.67% from the current price of $13.39. More detailed estimate data can be found on the Ooma Inc (OOMA) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Ooma Inc's (OOMA, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Ooma Inc (OOMA, Financial) in one year is $14.69, suggesting a upside of 9.71% from the current price of $13.39. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Ooma Inc (OOMA) Summary page.

OOMA Key Business Developments

Release Date: March 04, 2025

- Revenue: $65.1 million for Q4 FY25, up 6% year over year; $256.9 million for FY25, up 8% year over year.

- Non-GAAP Net Income: $5.8 million for Q4 FY25, up 17% year over year; $18 million for FY25.

- Free Cash Flow: Over $20 million generated in FY25.

- Stock Repurchase: Approximately $9 million spent on repurchasing Ooma stock in FY25.

- Business Subscription and Services Revenue: 61% of total revenue in Q4 FY25; 13% growth year over year for FY25.

- Product and Other Revenue: $4.5 million in Q4 FY25, up from $3.7 million in the prior year quarter.

- Gross Margin: Subscription and services gross margin at 72% for Q4 FY25; total gross margin at 63% for Q4 FY25.

- Adjusted EBITDA: $6.9 million for Q4 FY25, 11% of total revenue.

- Core Users: 1,234,000 at the end of Q4 FY25, with 503,000 business users.

- Average Revenue Per User (ARPU): $15.26, up 4% year over year.

- Net Dollar Subscription Retention Rate: 98% for Q4 FY25.

- Cash and Investments: $17.9 million at the end of Q4 FY25.

- Fiscal 2026 Revenue Guidance: $267 million to $270 million.

- Fiscal 2026 Non-GAAP Net Income Guidance: $22 million to $23.5 million.

- Fiscal 2026 Non-GAAP EPS Guidance: $0.77 to $0.82 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Ooma Inc (OOMA, Financial) reported a solid Q4 FY25 with $65.1 million in revenue and $5.8 million in non-GAAP net income, marking a significant improvement from prior quarters.

- The company achieved an 8% year-over-year revenue growth for FY25, with non-GAAP net income growing by 17% year-over-year.

- Ooma Inc (OOMA) generated over $20 million in free cash flow and repurchased approximately $9 million of its stock, indicating strong financial health.

- The company secured a large new Ooma Office customer with 282 users and several new office customers with over 25 users each, demonstrating successful customer acquisition.

- Ooma Inc (OOMA) received Marriott Brand certification for its AirDial product, positioning it as the preferred POTS replacement solution for Marriott properties.

Negative Points

- Ooma Inc (OOMA) experienced a sequential decline in total core users, primarily due to seat reductions with IWG, which was anticipated.

- The company faces challenges in predicting the timing of revenue ramp-up with new partners and customers, leading to cautious guidance.

- There is limited visibility on the pace at which new resale partners will ramp up sales, creating uncertainty in revenue projections.

- Ooma Inc (OOMA) expects additional churn from IWG in the first quarter of fiscal 2026, impacting short-term growth.

- The company is cautious about the economic environment and its potential impact on the SMB market, which could affect future growth.