Synchronoss Technologies (SNCR, Financial) has been included in the US small-cap Russell 2000 Index as of June 30. This addition is part of the 2025 Russell indexes reconstitution, marking an important milestone for the firm's growth and visibility in the market. Inclusion in the Russell 2000 Index will extend for one year and is contingent upon its membership in the broader Russell 3000 Index.

Alongside its entry into the Russell 2000, Synchronoss (SNCR, Financial) will also be featured in the relevant growth and value indexes. This move is expected to enhance the company's profile among investors, potentially impacting its market presence positively.

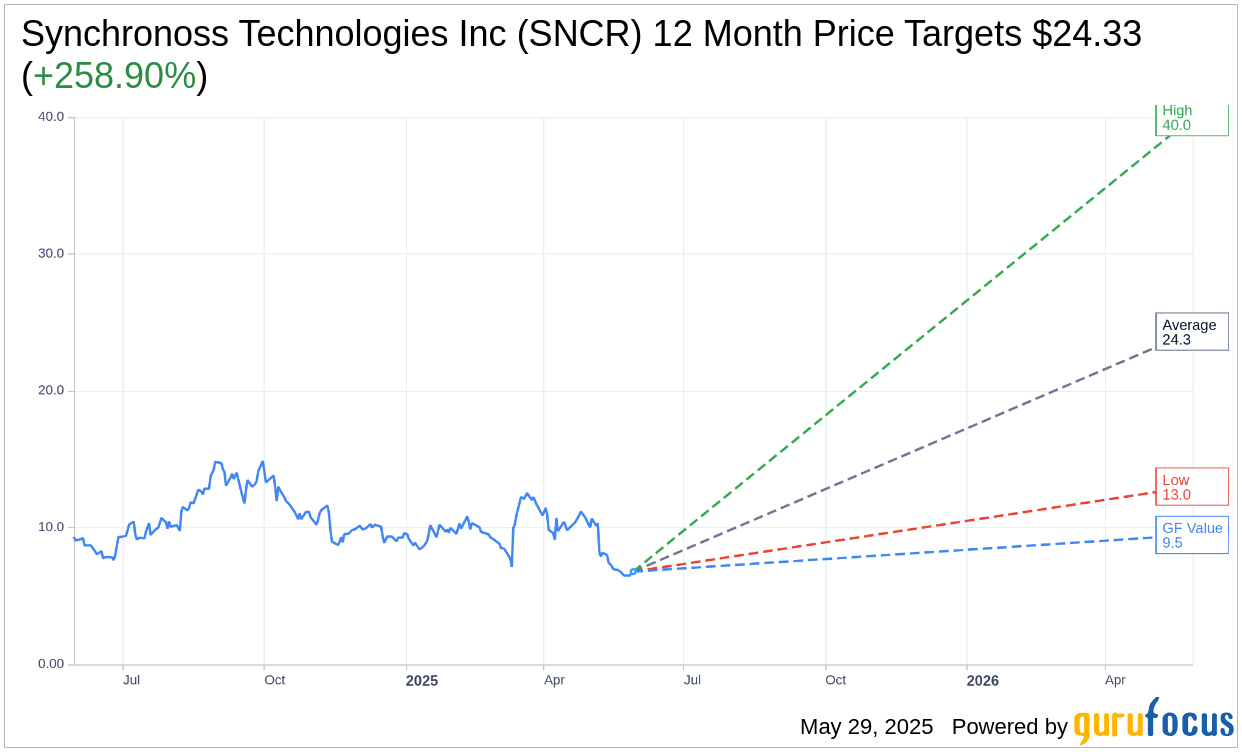

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Synchronoss Technologies Inc (SNCR, Financial) is $24.33 with a high estimate of $40.00 and a low estimate of $13.00. The average target implies an upside of 258.90% from the current price of $6.78. More detailed estimate data can be found on the Synchronoss Technologies Inc (SNCR) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Synchronoss Technologies Inc's (SNCR, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Synchronoss Technologies Inc (SNCR, Financial) in one year is $9.46, suggesting a upside of 39.53% from the current price of $6.78. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Synchronoss Technologies Inc (SNCR) Summary page.

SNCR Key Business Developments

Release Date: May 06, 2025

- Revenue: $42.2 million, down from $43 million in the prior year period.

- Cloud Subscriber Growth: 3.3% increase.

- Recurring Revenue: 93.1% of total revenue.

- Adjusted EBITDA: $12.7 million, representing a 30.2% margin.

- Adjusted Gross Profit: $33.4 million or 79% of total revenue.

- Income from Operations: $8.2 million, up 79.8% year-over-year.

- Operating Expenses: Decreased 11.5% from $38.4 million to $34 million.

- Net Loss: $3.8 million or a negative $0.37 per share.

- Cash and Cash Equivalents: $29.1 million as of March 31, 2025.

- Free Cash Flow: Negative $3 million.

- Adjusted Free Cash Flow: Negative $3.3 million.

- New Term Loan: $200 million, four-year term loan.

- Guidance for 2025: Revenue between $170 million and $180 million; Adjusted Gross Margin between 78% and 80%; Adjusted EBITDA between $52 million and $56 million; Free Cash Flow between $11 million and $16 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Revenue for the quarter was $42.4 million, with a 3.3% increase in subscriber growth across the global customer base.

- Adjusted EBITDA increased by 17% year-over-year to $12.7 million, representing a margin of 30.2%.

- Over 90% of revenue is classified as recurring, with long-term contracts with major carriers like AT&T, Verizon, and SoftBank.

- The company successfully refinanced its debt with a $200 million, four-year term loan, strengthening its capital structure.

- Operational expenses were reduced by 11.5% year-over-year, demonstrating effective cost control measures.

Negative Points

- Total revenue decreased slightly from $43 million in the prior year period due to the expiration of a customer contract.

- Net loss was reported at $3.8 million, primarily due to $5.6 million in non-cash foreign exchange losses.

- Free cash flow was negative $3 million, reflecting a cash spend-heavy period in the first quarter.

- The macroeconomic landscape, including tariffs and global trade uncertainties, poses challenges.

- Potential impact of tariffs could slow phone upgrade cycles, affecting short-term subscriber growth.