Key Highlights:

- Regeneron (REGN, Financial) shares fell by nearly 18% after a Phase 3 trial setback.

- Despite the drop, analysts' average target price suggests significant upside potential.

- Current brokerage consensus indicates an "Outperform" rating for Regeneron.

Regeneron's Recent Market Turbulence

Regeneron Pharmaceuticals Inc (REGN) recently faced a significant challenge, as shares plunged by nearly 18% following the unsuccessful outcome of a Phase 3 trial for itepekimab. This antibody therapy, developed in collaboration with Sanofi, was intended to treat chronic obstructive pulmonary disease (COPD). The trial's disappointing results prompted Wells Fargo to downgrade the stock. Nevertheless, other financial analysts continue to recommend buying Regeneron's stock, reflecting a mixed but still optimistic market sentiment.

Analysts' Price Targets and Predictions

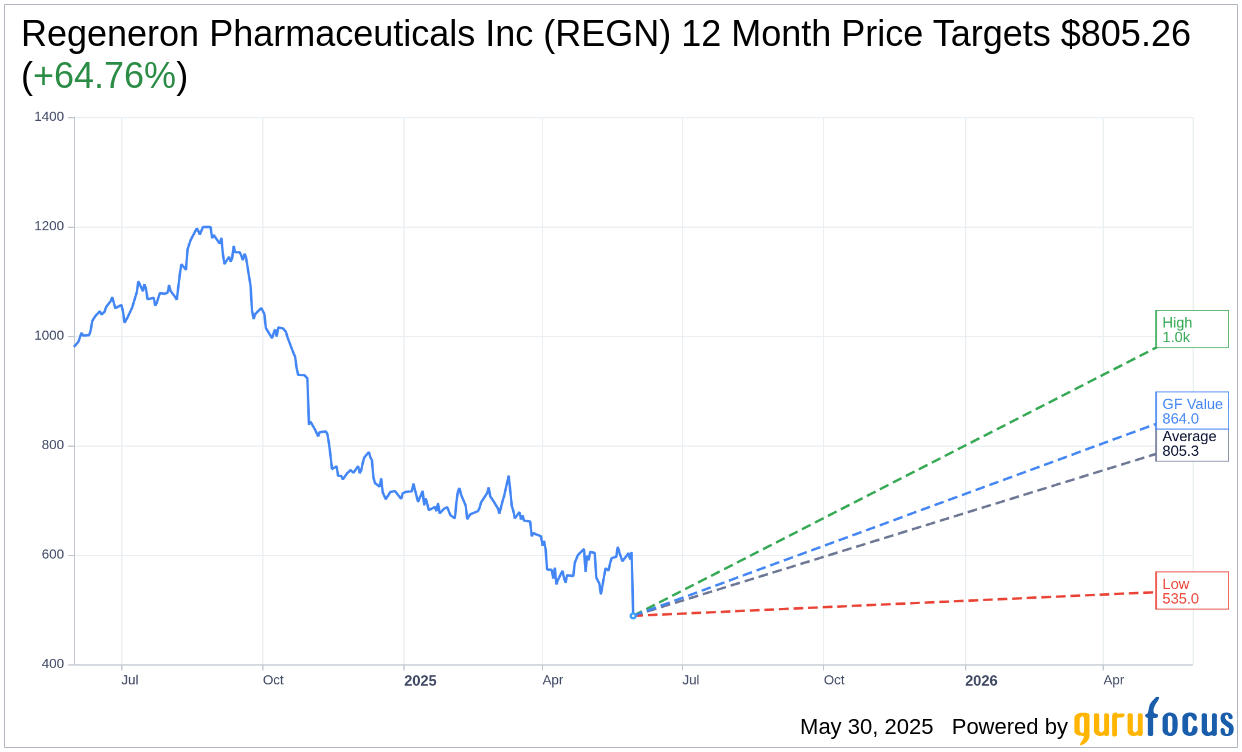

Twenty-four analysts have provided one-year price targets for Regeneron, with an average target price set at $805.26. This range includes high and low estimates of $1,013.00 and $535.00, respectively. Given the current price of $488.73, the average target implies a significant upside of 64.76%. For an in-depth look at these estimates, please visit the Regeneron Pharmaceuticals Inc (REGN, Financial) Forecast page.

Brokerage Recommendations and Market Outlook

The consensus among 28 brokerage firms results in an average brokerage recommendation of 1.9 for Regeneron, placing the stock in the "Outperform" category. This rating is based on a scale where 1 signifies a Strong Buy and 5 indicates a Sell, suggesting that the majority of analysts favor the stock's performance potential.

GF Value and Long-Term Potential

According to GuruFocus estimates, the projected GF Value for Regeneron in one year stands at $863.95. This suggests a substantial upside of 76.77% from the current trading price of $488.73. The GF Value represents GuruFocus' assessment of the stock's fair value, calculated using historical trading multiples, past business growth, and future performance forecasts. For a comprehensive overview of Regeneron's valuation, visit the Regeneron Pharmaceuticals Inc (REGN, Financial) Summary page.