Willis Lease Finance Corporation (WLFC, Financial) has announced that its subsidiary, Willis Engine Structured Trust VIII, plans to issue $524 million in Series A Fixed Rate Notes and $72 million in Series B Fixed Rate Notes. These notes will be backed by the subsidiary's stakes in a portfolio comprising 62 aircraft engines and two airframes. The acquisition of these assets will occur through an agreement with WLFC or other affiliates.

The funds raised from this offering will primarily cover offering-related costs and establish reserve accounts for maintenance and other obligations. Additionally, over a 270-day period, WLFC will receive payments for the aircraft engines and airframes as part of this strategic financing initiative. The proceeds that WLFC retains will be used to settle secured debts and for general corporate expenses.

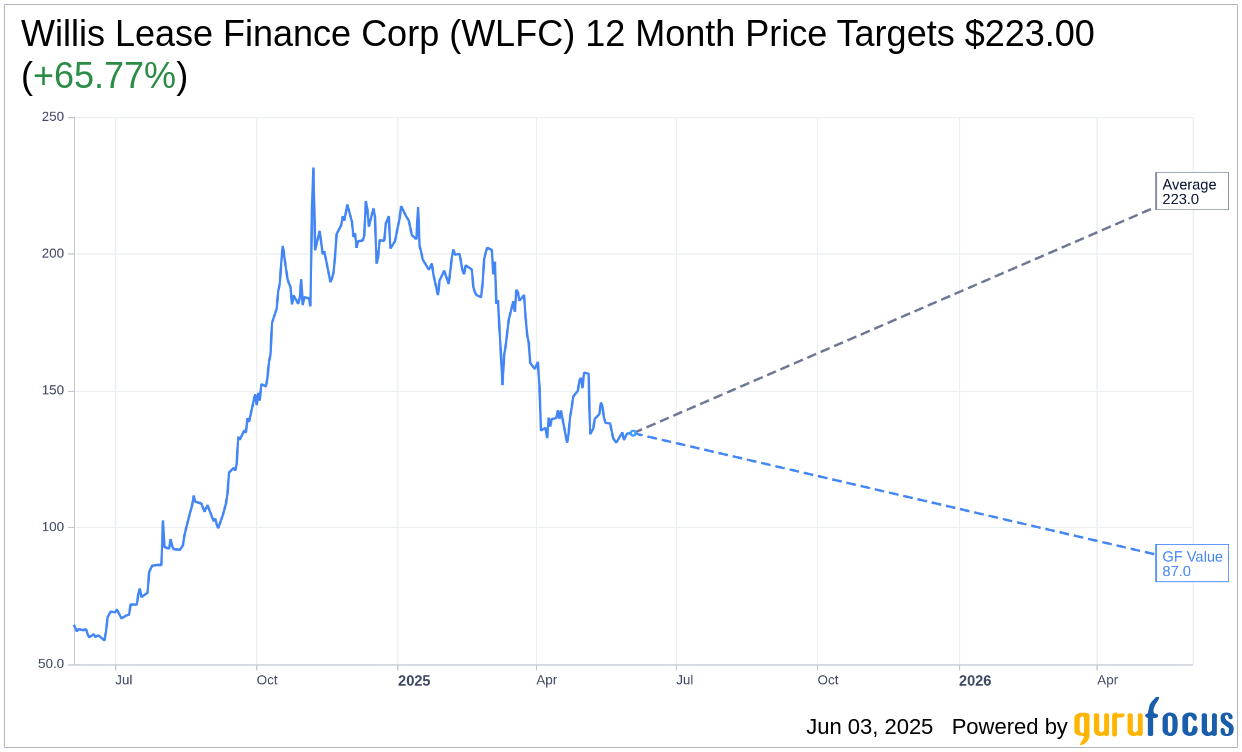

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Willis Lease Finance Corp (WLFC, Financial) is $223.00 with a high estimate of $223.00 and a low estimate of $223.00. The average target implies an upside of 65.77% from the current price of $134.52. More detailed estimate data can be found on the Willis Lease Finance Corp (WLFC) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Willis Lease Finance Corp's (WLFC, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Willis Lease Finance Corp (WLFC, Financial) in one year is $87.03, suggesting a downside of 35.3% from the current price of $134.52. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Willis Lease Finance Corp (WLFC) Summary page.

WLFC Key Business Developments

Release Date: May 06, 2025

- Total Revenue: $157.7 million, up 33% from Q1 2024.

- Pre-Tax Income (EBT): $25.3 million.

- Core Lease Rent Revenue: $67.7 million.

- Interest Revenue: $3.9 million.

- Maintenance Reserve Revenues: $54.9 million, up 25% from Q1 2024.

- Parts and Equipment Sales: $18.2 million, up 455% from Q1 2024.

- Gain on Sale of Leased Equipment: $4.8 million.

- Maintenance Service Revenue: $5.6 million.

- Depreciation Expense: $25 million, up 11.3%.

- G&A Expenses: $47.7 million, up from $29.6 million in Q1 2024.

- Net Finance Costs: $32.1 million, up from $23.0 million in Q1 2024.

- Net Income Attributable to Common Shareholders: $15.5 million.

- Diluted EPS: $2.21.

- Net Cash Provided by Operating Activities: $41.0 million.

- Total Debt Obligations: Increased to $2.2 billion from $1.7 billion in March 2024.

- Leverage Ratio: 3.31 times, down from 3.48 times at year-end 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- WLFC reported record quarterly revenues of $157.7 million, a 33% increase from the same quarter in 2024.

- The company achieved a significant increase in portfolio utilization, rising from 76.7% at the end of 2024 to 86.4% by the end of Q1 2025.

- WLFC paid its fourth consecutive quarterly dividend of $0.25 per share, reflecting strong financial health and shareholder returns.

- The company announced strategic transactions, including the purchase of 30 additional leap engines and a new constant thrust deal with Air India Express.

- WLFC is expanding its capabilities with a joint venture to build an engine test facility in Florida, addressing industry testing capacity shortages.

Negative Points

- Net finance costs increased to $32.1 million in Q1 2025, up from $23.0 million in the same period in 2024, due to higher indebtedness and interest rates.

- The gain on sale of leased equipment was lower than previous quarters, at $4.8 million compared to $9.2 million in the prior period.

- General and administrative expenses rose significantly to $47.7 million, driven by consultant-related fees and share-based compensation.

- The company's maintenance reserve liability increased, indicating deferred revenue that has not yet been recognized.

- There is ongoing macroeconomic uncertainty, including potential impacts from tariffs, which could affect future business operations and asset values.