On June 10, a meeting focusing on Palantir (PLTR, Financial) will take place in New York, organized by Loop Capital. This event presents an opportunity for investors to gain deeper insights into Palantir's performance and strategic direction.

For those looking for intelligent investment decisions, tools like TipRanks' new KPI Data can provide useful analytical insights. Additionally, TipRanks offers a Smart Value Newsletter, delivering information on undervalued and market-resilient stocks.

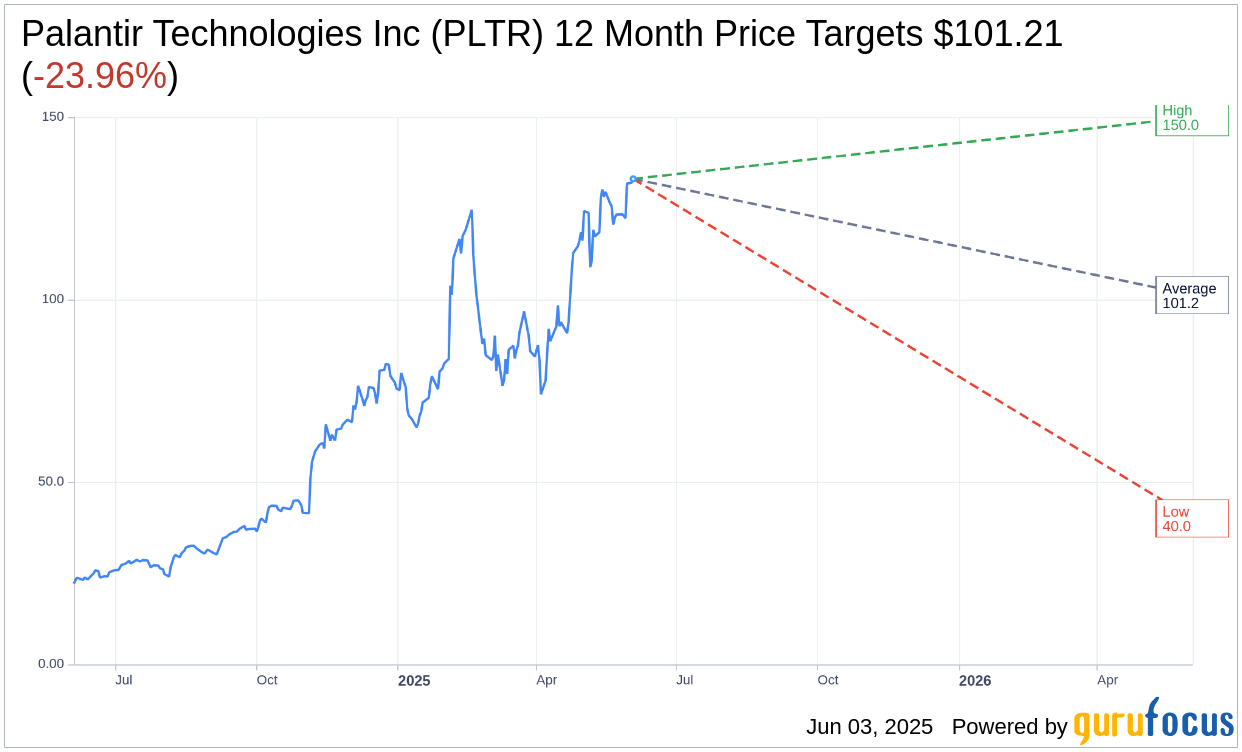

Wall Street Analysts Forecast

Based on the one-year price targets offered by 20 analysts, the average target price for Palantir Technologies Inc (PLTR, Financial) is $101.21 with a high estimate of $150.00 and a low estimate of $40.00. The average target implies an downside of 23.96% from the current price of $133.10. More detailed estimate data can be found on the Palantir Technologies Inc (PLTR) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Palantir Technologies Inc's (PLTR, Financial) average brokerage recommendation is currently 2.9, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Palantir Technologies Inc (PLTR, Financial) in one year is $31.25, suggesting a downside of 76.52% from the current price of $133.095. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Palantir Technologies Inc (PLTR) Summary page.

PLTR Key Business Developments

Release Date: May 05, 2025

- Revenue Growth: 39% year-over-year, reaching $884 million.

- US Revenue: Grew 55% year-over-year to $628 million.

- US Commercial Revenue: Increased 71% year-over-year, surpassing $1 billion annual run rate.

- US Government Revenue: Grew 45% year-over-year to $373 million.

- Adjusted Operating Margin: 44%, an 800 basis points increase from the previous year.

- Adjusted Free Cash Flow: $370 million, representing a 42% margin.

- Customer Count: Increased 39% year-over-year to 769 customers.

- Net Dollar Retention: 124%, up 400 basis points from last quarter.

- GAAP Net Income: $214 million, representing a 24% margin.

- GAAP Earnings Per Share: $0.08.

- Adjusted Earnings Per Share: $0.13.

- Total Remaining Deal Value: $5.97 billion, up 45% year-over-year.

- Cash and Cash Equivalents: $5.4 billion at the end of the quarter.

- Q2 2025 Revenue Guidance: Between $934 million and $938 million.

- Full Year 2025 Revenue Guidance: Raised to between $3.89 billion and $3.902 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Palantir Technologies Inc (PLTR, Financial) reported a 39% year-over-year revenue growth, showcasing strong performance.

- US revenue grew 55% year-over-year, now constituting 71% of the overall business, with US commercial revenue growing 71% year-over-year.

- The company achieved a $1 billion annual run rate in its US commercial business for the first time.

- Palantir Technologies Inc (PLTR) raised its full-year 2025 revenue guidance midpoint to $3.896 billion, representing a 36% year-over-year growth rate.

- The company reported a strong cash flow quarter with adjusted free cash flow of $370 million, representing a margin of 42%.

Negative Points

- International commercial revenue declined 5% year-over-year and 11% sequentially, driven by continued headwinds in Europe.

- Revenue from strategic commercial contracts is expected to decrease in the second quarter of 2025 compared to the same period in 2024.

- The company anticipates a more significant increase in expenses in 2025 due to investments in technical talent and AI production use cases.

- There are concerns about the impact of US Department of Defense budget cuts on current and future contracts.

- Palantir Technologies Inc (PLTR) faces challenges in Europe, where the market is not yet fully embracing AI, affecting growth potential in that region.