On June 4, 2025, Planet Labs PBC (PL, Financial) released its 8-K filing for the first quarter of fiscal year 2026, showcasing a robust financial performance that exceeded analyst expectations. The Earth-imaging company reported record revenue of $66.3 million, a 10% increase year-over-year, surpassing the estimated revenue of $62.30 million. The company's GAAP net loss per share was $0.04, which is better than the estimated loss of $0.08 per share.

Company Overview

Planet Labs PBC is a leading Earth-imaging company that leverages space technology to provide daily data and insights about our planet. Its platform, which includes imagery, insights, and machine learning, empowers various sectors such as agriculture, energy, and government to make informed decisions. The company's solutions are pivotal in areas like Broad Area Management, and its product offerings include Planet Monitoring, Planet Tasking, and Planet Analytic Feeds, among others.

Financial Achievements and Challenges

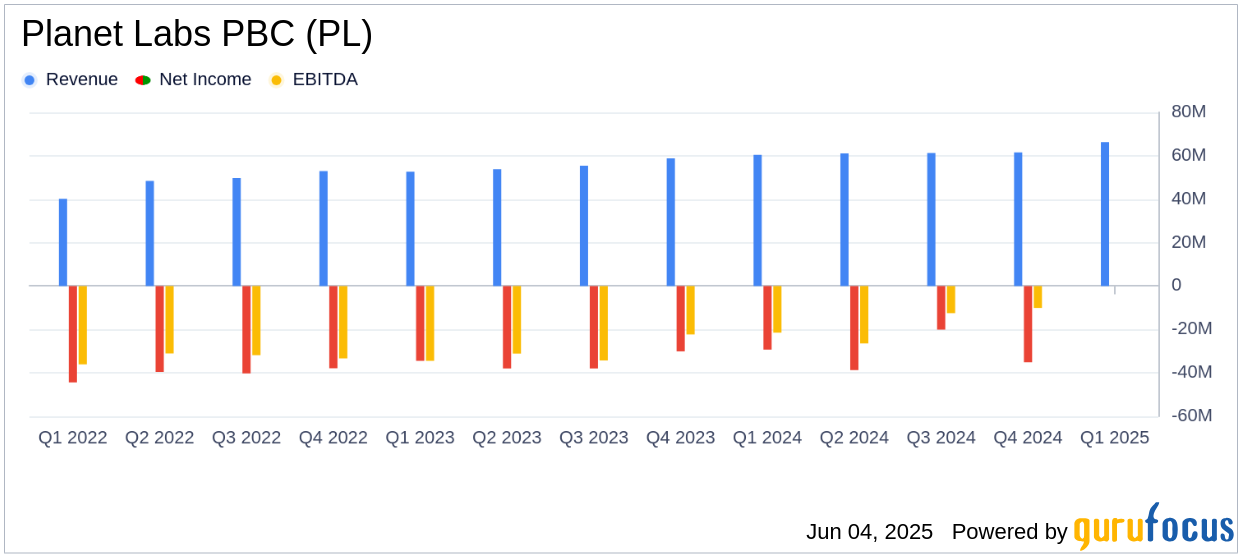

Planet Labs PBC's first quarter results reflect significant financial achievements, including a 262% year-over-year increase in Remaining Performance Obligations (RPOs) to $451.9 million and a 140% increase in backlog to $527.0 million. The company also achieved its first-ever quarter of positive free cash flow at $8.0 million, alongside generating $17.3 million of net cash from operating activities. These achievements underscore the company's strategic direction and execution capabilities.

Despite these successes, the company reported a net loss of $12.6 million, although this was a marked improvement from the $29.3 million loss in the same quarter of the previous year. The challenges of maintaining profitability while expanding its satellite services and AI-enabled solutions remain a focus for Planet Labs PBC.

Key Financial Metrics

Planet Labs PBC's gross margin improved to 55% from 52% in the previous year, with a non-GAAP gross margin of 59%, up from 55%. The adjusted EBITDA turned positive at $1.2 million, compared to a loss of $8.4 million in the prior year. The company's balance sheet remains strong with $226.1 million in cash, cash equivalents, and short-term investments.

| Metric | Q1 FY2026 | Q1 FY2025 |

|---|---|---|

| Revenue | $66.3 million | $60.4 million |

| Net Loss | ($12.6) million | ($29.3) million |

| Adjusted EBITDA | $1.2 million | ($8.4) million |

| Free Cash Flow | $8.0 million | N/A |

Strategic Initiatives and Market Expansion

Planet Labs PBC continues to expand its market presence through strategic contracts and partnerships. Notable agreements include an eight-figure ACV contract with a European defense and intelligence customer and a multi-year contract with the California Air Resource Board for methane data. These partnerships highlight the company's growing influence in the defense and environmental sectors.

In terms of technological advancements, Planet Labs PBC introduced new products such as the Aircraft Detection Analytic Feed and enhanced its Insights Platform for small customers. These innovations are part of the company's strategy to deliver global insights at scale and support its diverse customer base.

Conclusion

Planet Labs PBC's first quarter results demonstrate its ability to exceed expectations and achieve significant financial milestones. The company's focus on expanding its satellite services and AI-enabled solutions positions it well for future growth. However, the challenge of achieving sustained profitability remains, as the company continues to invest in its strategic initiatives and technological advancements.

Explore the complete 8-K earnings release (here) from Planet Labs PBC for further details.