In recent stock market news, ChargePoint Holdings, Inc. (CHPT, Financial) has received an updated analyst rating from Needham. The analyst, Chris Pierce, has reiterated a "Hold" rating for the company.

The decision to maintain the current rating reflects a continued cautious stance by Needham regarding the potential performance of ChargePoint Holdings. As of the latest update, there is no change in the price target or percentage change provided for CHPT.

This reaffirmation of the "Hold" rating indicates that, according to the analyst, the stock is likely to perform in line with the market, suggesting investors should not expect significant upward or downward movement in the share price in the near future. No specific price target figures were disclosed in this update.

ChargePoint Holdings, a key player in the electric vehicle infrastructure sector, continues to garner attention from market analysts as it navigates a rapidly evolving industry landscape. Investors and stakeholders are advised to stay informed on further developments regarding CHPT for potential future impacts on their investment strategies.

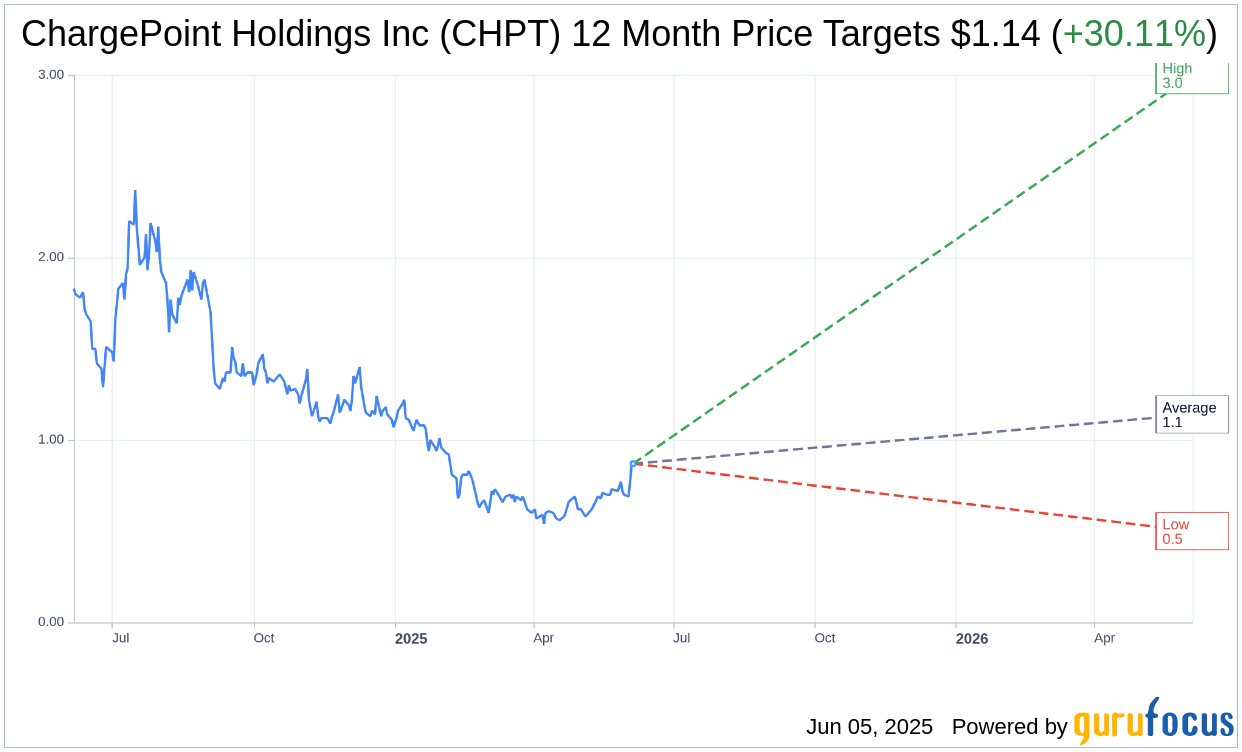

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for ChargePoint Holdings Inc (CHPT, Financial) is $1.14 with a high estimate of $3.00 and a low estimate of $0.50. The average target implies an upside of 30.11% from the current price of $0.87. More detailed estimate data can be found on the ChargePoint Holdings Inc (CHPT) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, ChargePoint Holdings Inc's (CHPT, Financial) average brokerage recommendation is currently 3.1, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ChargePoint Holdings Inc (CHPT, Financial) in one year is $3.94, suggesting a upside of 351.11% from the current price of $0.8734. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ChargePoint Holdings Inc (CHPT) Summary page.