ReposiTrak (TRAK, Financial) has announced its third consecutive 10% hike in its quarterly cash dividend over the past three years. The updated dividend, now set at 2 cents per share, will be distributed to shareholders of record as of September 30, with payments expected around November 14. Moving forward, dividends will be issued within 45 days following each fiscal quarter's conclusion.

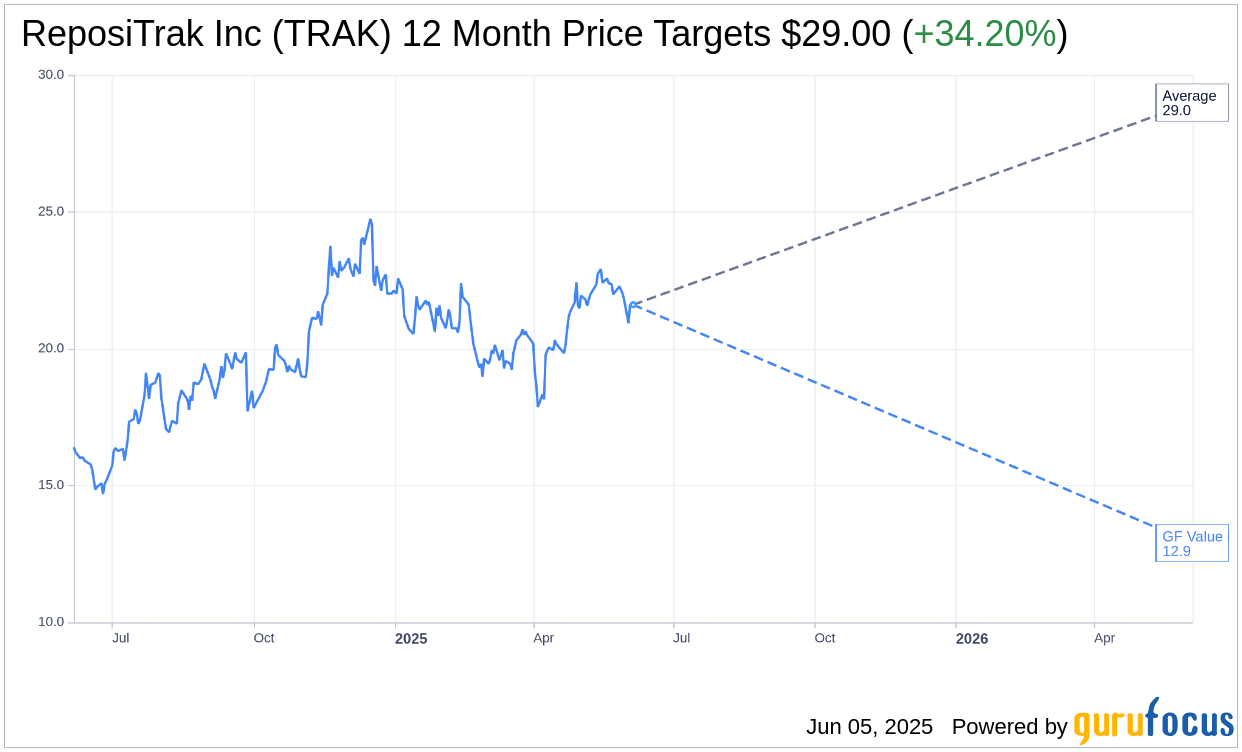

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for ReposiTrak Inc (TRAK, Financial) is $29.00 with a high estimate of $29.00 and a low estimate of $29.00. The average target implies an upside of 34.20% from the current price of $21.61. More detailed estimate data can be found on the ReposiTrak Inc (TRAK) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, ReposiTrak Inc's (TRAK, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ReposiTrak Inc (TRAK, Financial) in one year is $12.90, suggesting a downside of 40.31% from the current price of $21.61. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ReposiTrak Inc (TRAK) Summary page.

TRAK Key Business Developments

Release Date: May 15, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ReposiTrak Inc (TRAK, Financial) reported a 16% increase in revenue for the third fiscal quarter, reaching $5.9 million.

- The company achieved a 27% growth in net income, translating $828,000 in incremental revenue into $415,000 in incremental net income.

- ReposiTrak Inc (TRAK) has a strong cash position with over $28 million on the balance sheet as of March 31, 2025.

- The company is experiencing growth across all lines of business, including traceability, compliance, and supply chain.

- Cross-selling initiatives are gaining momentum, contributing to overall growth and leveraging a single technology platform for operational efficiencies.

Negative Points

- Operating expenses increased by 7%, reflecting ongoing investments in marketing, technology, and customer onboarding.

- The percentage of recurring to total revenue slightly declined from 99% to 98% due to one-time setup fees associated with customer onboarding.

- Cost of revenue increased by 10% due to investments in developer resources for expanding their proprietary platform.

- Sales and marketing expenses rose by 4% as the company continues to invest in raising awareness of its solutions.

- The company acknowledges that some quarters may have higher or lower revenue growth, indicating potential volatility in quarterly performance.