CrowdStrike (CRWD, Financial) is still growing like a rocket, but Wall Street just hit the brakes. The stock dropped yesterday after the company issued a softer-than-expected revenue forecast for its fiscal Q2—$1.14 to $1.15 billion versus consensus at $1.16 billion. EPS guidance came in stronger at $0.82–$0.84, but that wasn't enough to outweigh revenue concerns. The latest quarter delivered solid headline growth—up nearly 20% YoY to $1.10 billion—but net income swung sharply negative at -$110.2 million, compared to a $42.8 million profit in the same quarter last year. Higher spending on sales, R&D, and admin—partly tied to a 2024 software outage—continues to weigh on margins.

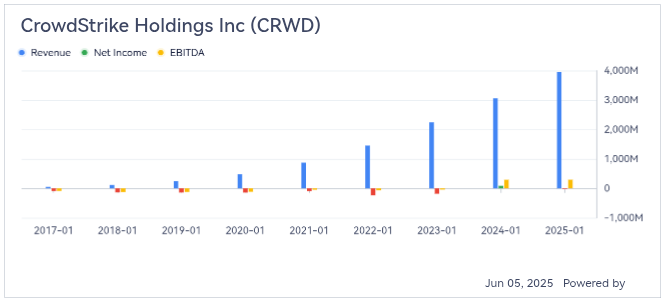

Zoom out, though, and CrowdStrike's chart tells a more nuanced story. Revenue has surged every single year since 2017, with 2025 showing a steep climb to over $4 billion. But profit? That's been stuck below the surface. Net income remains negative, and while EBITDA is finally moving in the right direction, it's still modest compared to top-line growth.

The company has announced a $1 billion stock buyback, reaffirmed full-year EPS guidance ($3.44–$3.56), and kept revenue forecasts steady. But the big shift may be internal: after cutting 500 jobs last month, CFO Burt Podbere says they're targeting free cash flow margins north of 30% by FY2027.

Here's the real tension: can CrowdStrike keep spending to grow while convincing investors it's on the road to durable profits? With a sticky platform, a high cash burn, and strong customer retention, CRWD still has a long runway—if it can turn the corner on efficiency. This one isn't about whether the market is growing. It's about whether CrowdStrike can start winning on the bottom line too. Investors should stay close to how margins evolve in the next two quarters—this could be the tell.