- Cracker Barrel reports modest revenue growth in Q3 2025, driven by strategic marketing and cost efficiency.

- Analyst projections indicate a potential downside, with varying price targets and a "Hold" recommendation.

- GuruFocus' GF Value estimate suggests a more optimistic long-term upside potential.

Cracker Barrel's Q3 2025 Financial Performance

Cracker Barrel Old Country Store Inc. (CBRL, Financial) announced its Q3 2025 revenues hit $821.1 million, marking a 0.5% uptick compared to the previous year. The company attributed this growth to robust sequential store sales and judicious cost management strategies. Notable initiatives driving this performance include new culinary promotions and enhanced customer relationship management (CRM) through AI-driven personalization.

Wall Street Analysts' Forecast and Price Targets

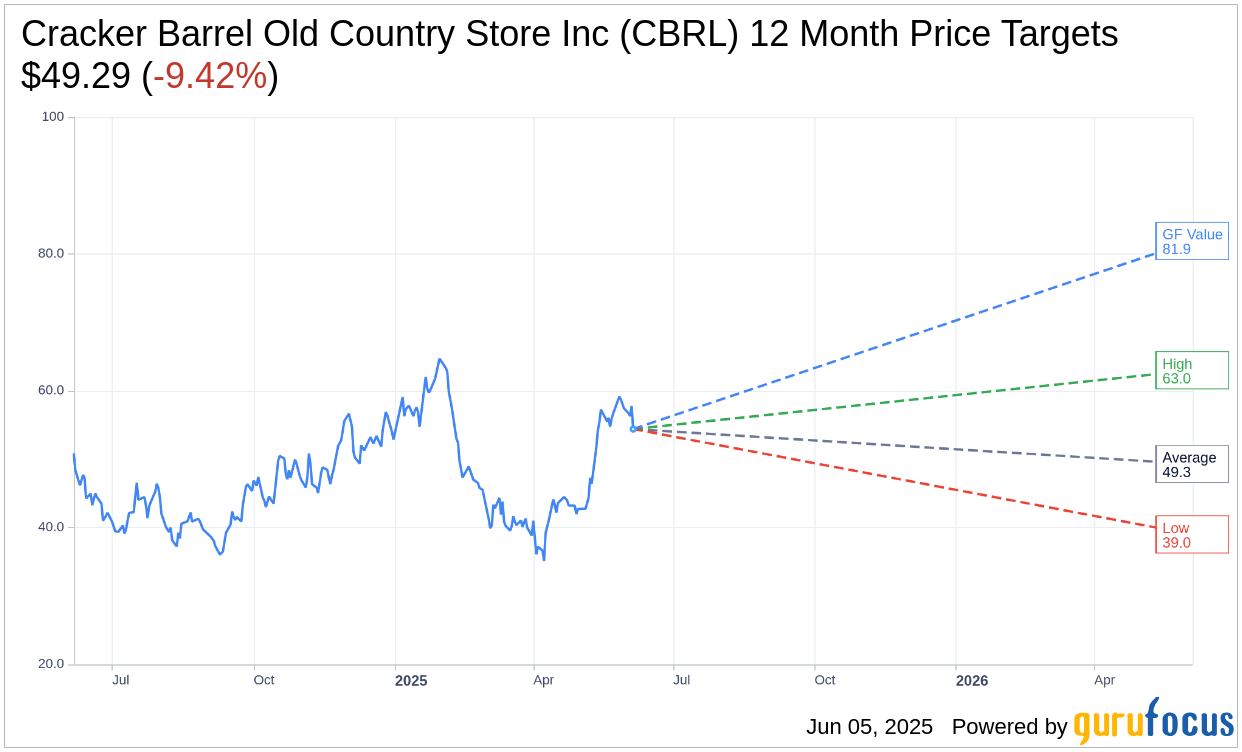

According to estimates from seven analysts, the average one-year price target for Cracker Barrel Old Country Store Inc. (CBRL, Financial) stands at $49.29. Predictions range from a high of $63.00 to a low of $39.00, indicating an implied downside of 9.42% from the current market price of $54.41. For more in-depth estimates, visit the Cracker Barrel Old Country Store Inc (CBRL) Forecast page.

Brokerage Recommendations

The consensus recommendation from ten brokerage firms places Cracker Barrel Old Country Store Inc's (CBRL, Financial) average brokerage rating at 3.2, suggesting a "Hold" status. This rating is derived from a scale where 1 signifies a Strong Buy and 5 indicates a Sell.

Long-Term Valuation Outlook According to GuruFocus

GuruFocus' estimates project the GF Value for Cracker Barrel Old Country Store Inc. (CBRL, Financial) to be $81.90 within one year. This estimate reflects a potential upside of 50.52% from the current price of $54.41. The GF Value represents GuruFocus' fair value assessment based on the stock's historical trading multiples, past business growth, and future performance forecasts. More comprehensive insights are available on the Cracker Barrel Old Country Store Inc (CBRL) Summary page.