Key Takeaways:

- Arcutis Biotherapeutics' Zoryve cream shows promise in treating atopic dermatitis with long-term effectiveness.

- Analysts offer a positive outlook with an average price target of $21.14, predicting significant growth potential.

- The stock's recommendation remains strong with an "Outperform" consensus among brokers.

Arcutis Biotherapeutics (ARQT, Financial) has unveiled promising new data from their phase 3 clinical trial, which highlights the efficacy of their cream, Zoryve (roflumilast), in providing prolonged relief for atopic dermatitis symptoms. The open-label study demonstrated notable disease control in both children and adults, maintained over an extended duration of up to 281 days, with regular proactive application.

Wall Street Analysts Forecast

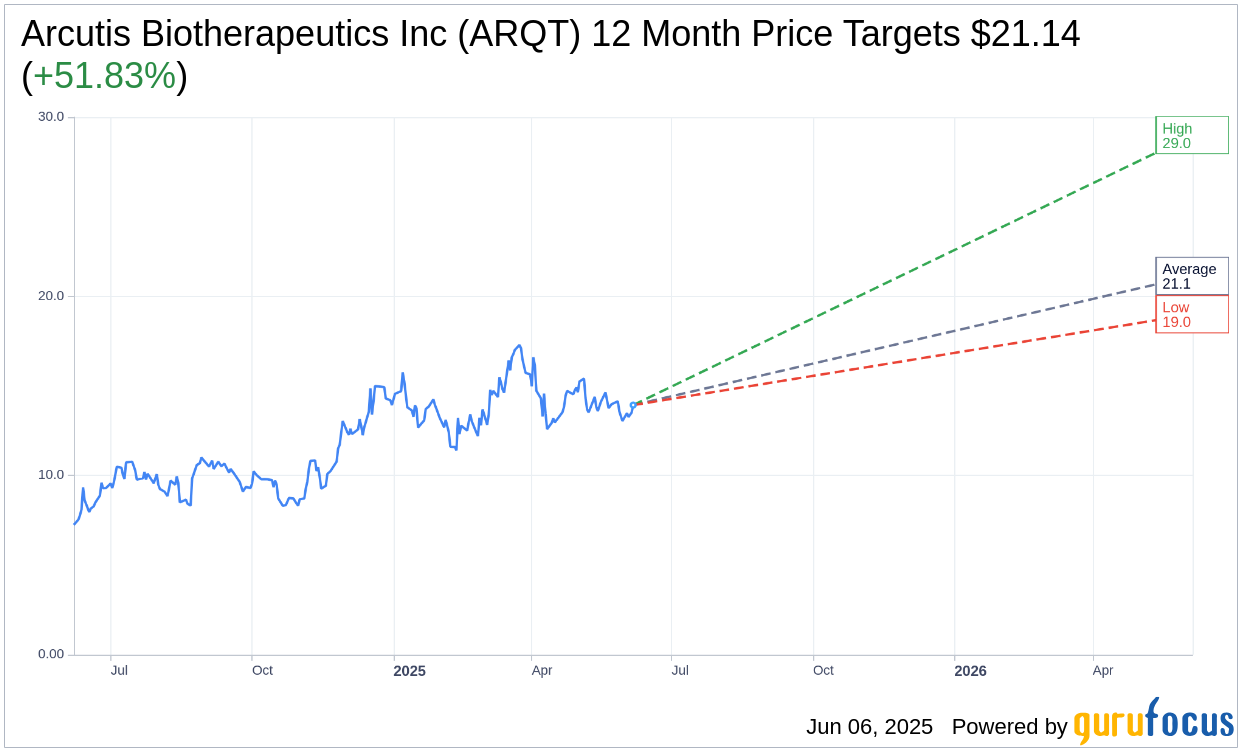

In a snapshot of analyst sentiments, seven financial experts have set a one-year price target for Arcutis Biotherapeutics Inc (ARQT, Financial), with an average target price pegged at $21.14. This reflects an optimistic range, with the highest estimate at $29.00 and the lowest at $19.00. This average target suggests a remarkable upside potential of 51.83% from the current trading price of $13.93. For deeper insights and detailed estimates, visit the Arcutis Biotherapeutics Inc (ARQT) Forecast page.

In addition to price forecasts, the consensus from seven brokerage firms places Arcutis Biotherapeutics Inc (ARQT, Financial) at an average brokerage recommendation of 1.7, categorizing the stock as having "Outperform" potential. This rating operates on a scale from 1 to 5, where 1 indicates a Strong Buy, and 5 represents a Sell. Investors are encouraged to consider this robust outlook as part of their investment evaluation process.