Key Takeaways:

- AMD fortifies its AI footprint with a series of strategic acquisitions.

- Analysts predict a potential upside for AMD stock with a noteworthy price target.

- GuruFocus estimates significant growth potential in AMD’s stock valuation.

Advanced Micro Devices (AMD, Financial) continues to bolster its presence in the artificial intelligence arena by integrating the engineering team from Untether AI. This strategic decision forms part of AMD's recent acquisition spree, which includes the notable additions of Enosemi and Brium, aimed at enhancing their prowess in AI hardware and software development.

Analysts’ Predictions and Price Targets

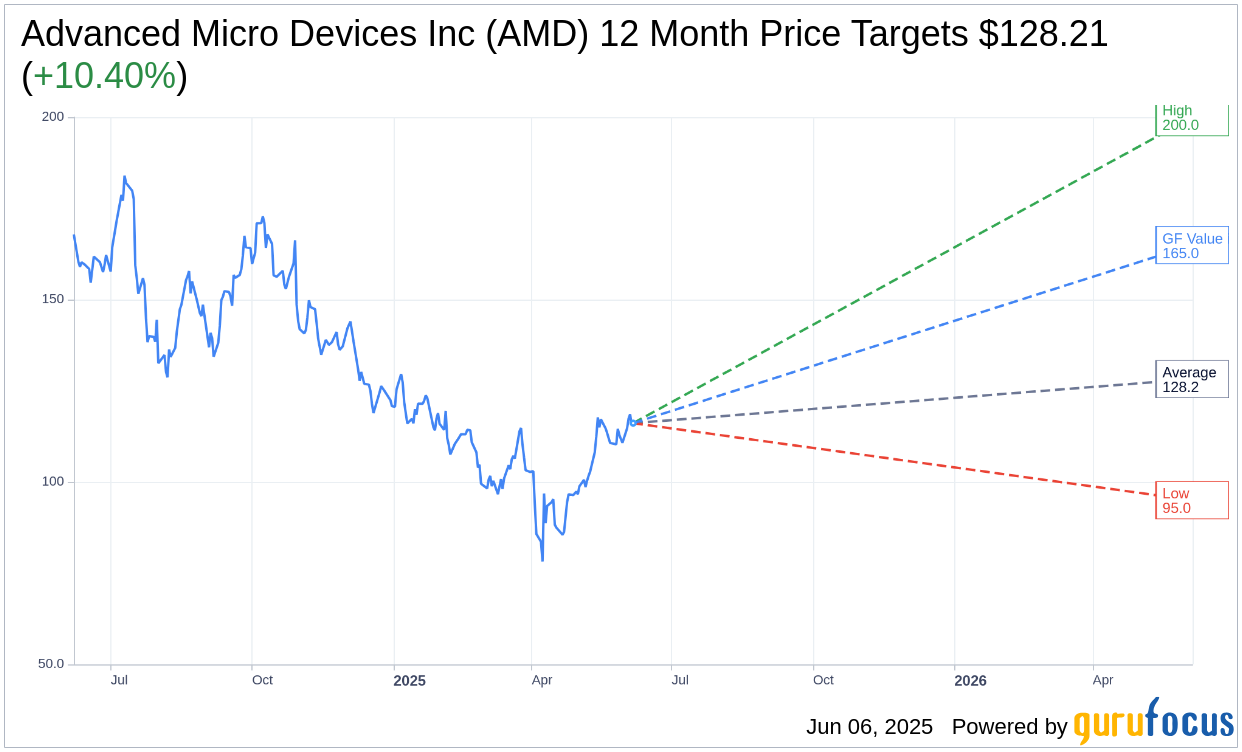

Wall Street analysts are optimistic about Advanced Micro Devices Inc (AMD, Financial), offering an average one-year price target of $128.21. This estimate spans from a high of $200.00 to a low of $95.00, implying a potential upside of 10.40% compared to AMD's current market price of $116.13. Investors can access in-depth estimate details on the Advanced Micro Devices Inc (AMD) Forecast page.

Moreover, the consensus recommendation from 52 brokerage firms stands at 2.1, signaling an "Outperform" status for AMD. This rating positions AMD favorably on a scale from 1 (Strong Buy) to 5 (Sell).

GuruFocus Valuation Insights

GuruFocus presents an insightful valuation, estimating the GF Value for Advanced Micro Devices Inc (AMD, Financial) at $164.96 in one year. This suggests a remarkable upside of 42.05% from the current price of $116.13. The GF Value metric reflects the stock's fair market value, derived from historical trading multiples, past business growth, and future performance projections. For more comprehensive data, visit the Advanced Micro Devices Inc (AMD) Summary page.