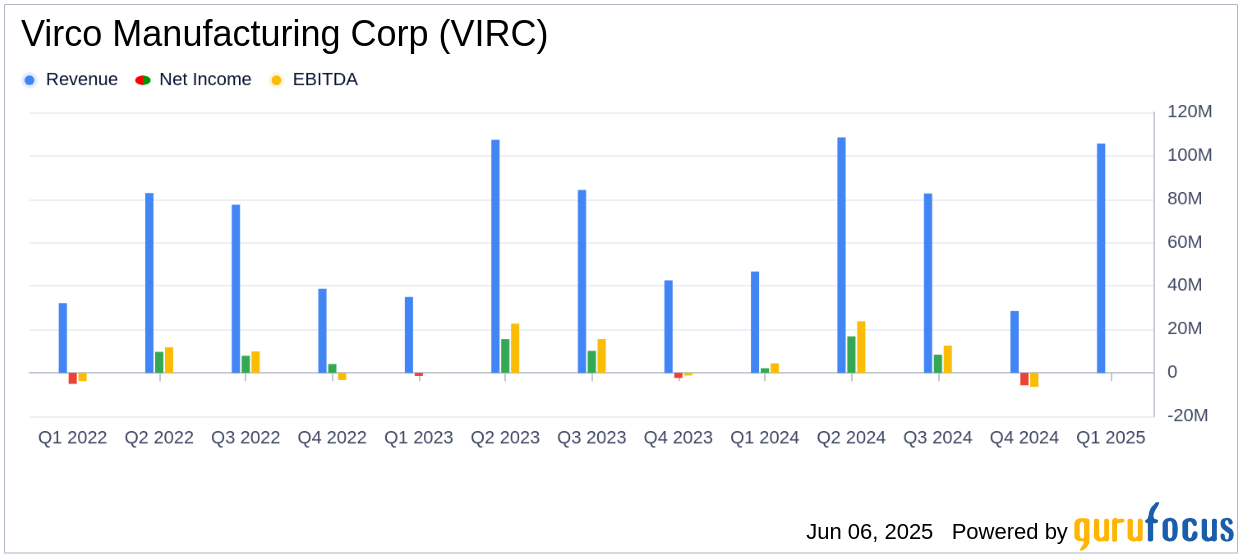

On June 6, 2025, Virco Manufacturing Corp (VIRC, Financial) released its 8-K filing, reporting a first-quarter profit of $0.7 million, despite a decline in demand for school furniture. The company, a prominent manufacturer of furniture for educational and commercial markets, saw its net income decrease from $2.1 million in the same period last year, which was bolstered by a significant disaster recovery order. The company's gross margin improved by 400 basis points to 47.5%, reflecting its commitment to domestic manufacturing.

Company Overview

Virco Manufacturing Corp is a leading designer, producer, and distributor of quality furniture for the commercial and education markets. The company offers a wide range of products, including mobile tables, storage equipment, desks, computer furniture, chairs, and activity tables. Its primary furniture lines are constructed using tubular metal legs and frames, combined with wood and plastic tops, plastic seats and backs, and upholstered components.

Performance and Challenges

Virco Manufacturing Corp's performance in the first quarter highlights the challenges posed by a slowdown in demand, particularly in the educational sector. The company's shipments plus backlog declined by 22.9% to $105.6 million. This reduction in revenue is significant as it underscores the seasonal nature of the business and the impact of extraordinary orders in previous periods. Despite these challenges, the company managed to improve its gross margin, which is crucial for maintaining profitability in a competitive industry.

Financial Achievements

The improvement in gross margin from 43.5% to 47.5% is a notable achievement for Virco Manufacturing Corp, especially in the furnishings, fixtures, and appliances industry, where cost management is critical. The company's focus on domestic manufacturing has helped mitigate the impact of tariffs and supply chain disruptions, allowing it to maintain competitive pricing and timely deliveries.

Key Financial Metrics

Virco Manufacturing Corp reported net sales of $33.8 million for the first quarter, a decrease from $46.7 million in the same period last year. The company's operating income turned negative at $(94) thousand, compared to a positive $2.97 million previously. However, net income per common share was $0.05, surpassing the analyst estimate of -$0.13. This performance is significant as it demonstrates the company's ability to manage costs effectively despite revenue challenges.

| Metric | 4/30/2025 | 4/30/2024 |

|---|---|---|

| Net Sales | $33.8 million | $46.7 million |

| Gross Profit | $16.0 million | $20.3 million |

| Net Income | $0.7 million | $2.1 million |

| EPS (Basic) | $0.05 | $0.13 |

Analysis and Commentary

Virco Manufacturing Corp's strategic focus on domestic production and investment in capital equipment has positioned it well to navigate current market challenges. The company's decision to repurchase $4.0 million worth of shares and distribute $0.4 million in dividends reflects confidence in its financial stability and future prospects. Chairman and CEO Robert Virtue emphasized the importance of investing in employee training and maintaining liquidity to capitalize on future opportunities.

Having been through a number of cycles during our 75-year history, we knew that it would be a challenge to match last year’s disaster recovery order. We also believed that thoughtful deployment of those profits would position us to take advantage of similar opportunities should they develop again." - Robert Virtue, Chairman and CEO

Overall, while Virco Manufacturing Corp faces a challenging market environment, its strategic initiatives and financial discipline provide a solid foundation for future growth. The company's ability to improve margins and maintain profitability despite revenue declines is a testament to its operational resilience and commitment to shareholder value.

Explore the complete 8-K earnings release (here) from Virco Manufacturing Corp for further details.