Dynavax Technologies Corporation has encouraged its shareholders to cast their votes in favor of re-electing its four current directors. The directors up for re-election are Brent MacGregor, Scott Myers, Lauren Silvernail, and Elaine Sun. The company has emphasized the importance of this vote ahead of its Annual Meeting of Stockholders, scheduled for June 11, 2025. Dynavax (DVAX, Financial) believes the re-election of these directors is crucial for maintaining the company’s strategic direction and continued success. Shareholders are urged to approve all four nominees to ensure the company's leadership remains strong and effective.

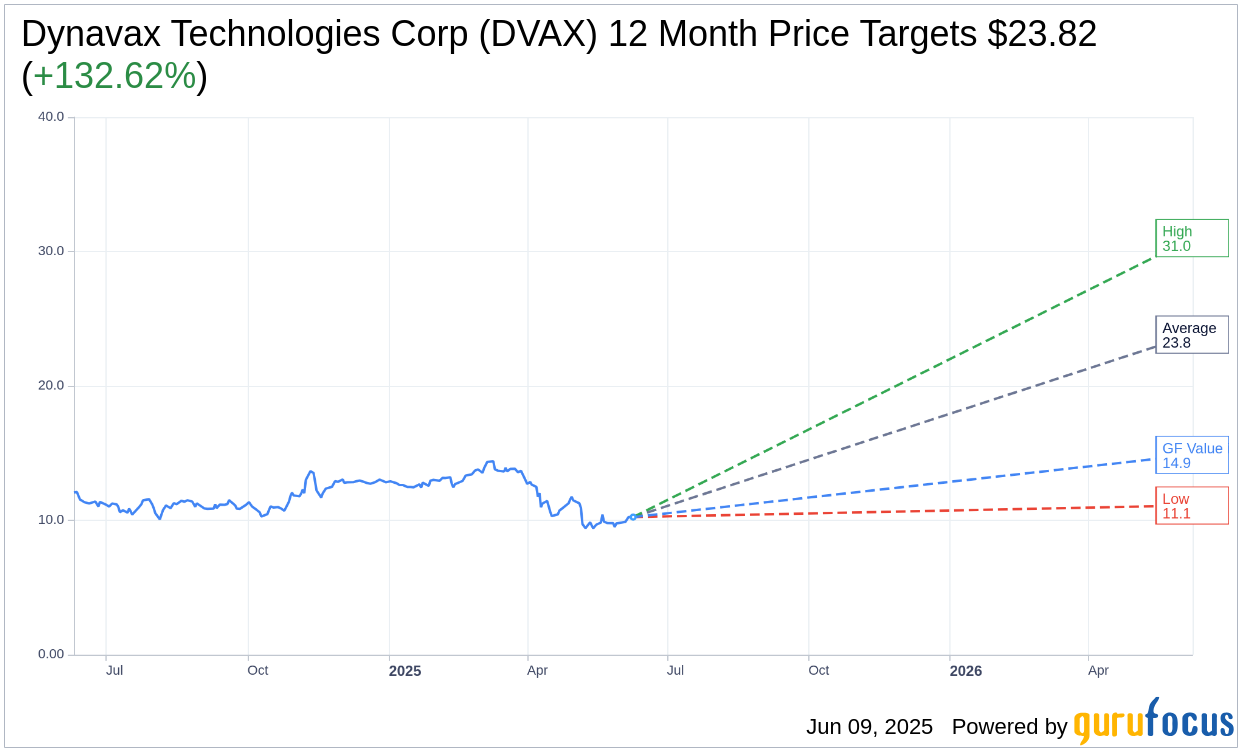

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Dynavax Technologies Corp (DVAX, Financial) is $23.82 with a high estimate of $31.00 and a low estimate of $11.10. The average target implies an upside of 132.62% from the current price of $10.24. More detailed estimate data can be found on the Dynavax Technologies Corp (DVAX) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Dynavax Technologies Corp's (DVAX, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Dynavax Technologies Corp (DVAX, Financial) in one year is $14.87, suggesting a upside of 45.21% from the current price of $10.24. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Dynavax Technologies Corp (DVAX) Summary page.

DVAX Key Business Developments

Release Date: May 06, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Dynavax Technologies Corp (DVAX, Financial) reported its highest ever first quarter net revenue for HAMB of $65 million, a 36% increase compared to the previous year.

- The company is on track to achieve the top half of its full-year guidance range for net product sales, projected between $305 to $325 million.

- Dynavax is advancing its development pipeline with key clinical trial milestones for shingles and plague vaccine programs, and new programs in pandemic influenza and Lyme disease.

- The company's shingles vaccine program shows promise with comparable immunogenicity and improved tolerability compared to existing market leaders.

- Dynavax has executed over 85% of its $200 million share repurchase program, demonstrating a disciplined approach to capital allocation and shareholder value.

Negative Points

- The company recorded a GAAP net loss of $96 million for the first quarter of 2025, primarily due to the GAAP accounting treatment of debt refinancing.

- R&D expenses increased to $19 million in the first quarter, up from $14 million the previous year, with expectations for further increases.

- SG&A expenses rose to $48 million, partly due to incremental proxy-related expenses.

- An allowance for doubtful accounts of $11 million was recorded due to heightened credit risks from Clover Biopharmaceuticals.

- The company faces uncertainties in the regulatory environment, particularly with potential changes in FDA requirements for vaccine trials.