The U.S. government is strategizing to implement the Defense Production Act to give precedence and financial support to rare earth projects considered vital for national security. According to sources familiar with the situation, MP Materials (MP, Financial) is anticipated to be a significant beneficiary of this initiative. Efforts are being coordinated by Deputy Defense Secretary Steve Feinberg to secure funding for the company, reflecting its importance in the strategic plan.

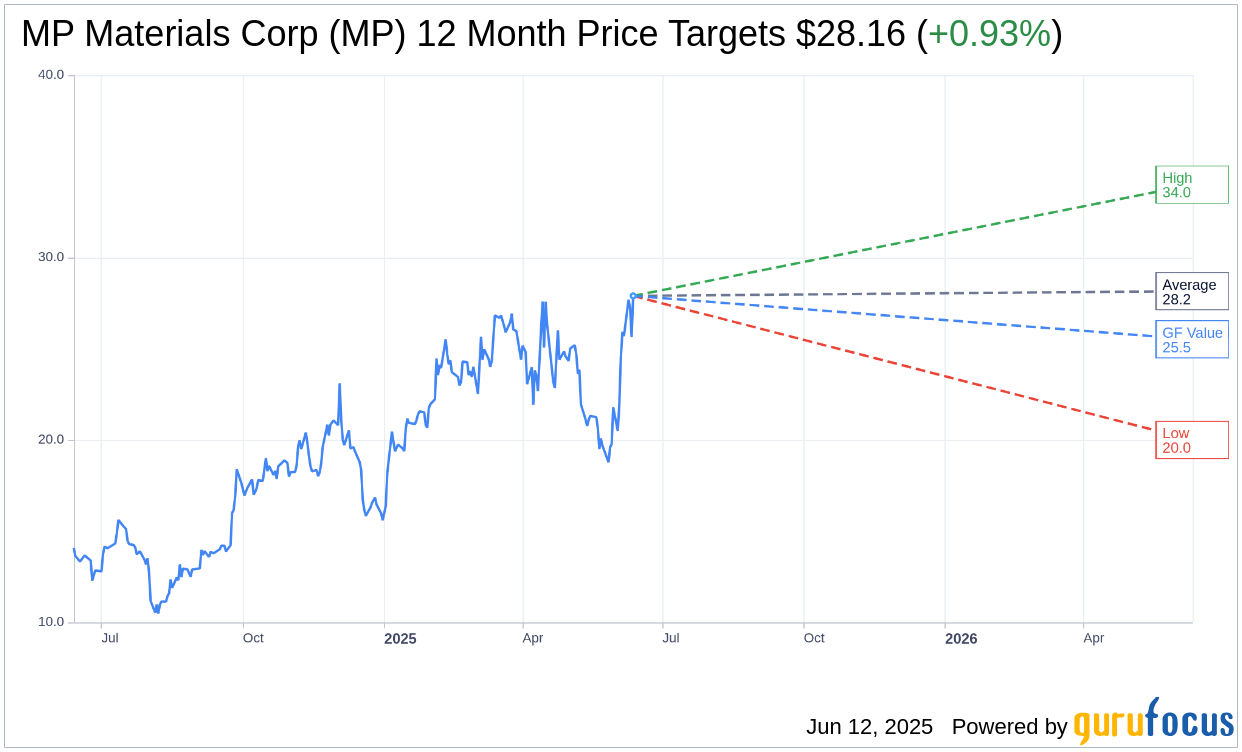

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for MP Materials Corp (MP, Financial) is $28.16 with a high estimate of $34.00 and a low estimate of $20.00. The average target implies an upside of 0.93% from the current price of $27.90. More detailed estimate data can be found on the MP Materials Corp (MP) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, MP Materials Corp's (MP, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for MP Materials Corp (MP, Financial) in one year is $25.52, suggesting a downside of 8.53% from the current price of $27.8999. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the MP Materials Corp (MP) Summary page.