Key Takeaways:

- Cloudflare (NET, Financial) announces a $1.75 billion Convertible Senior Notes offering, maturing in 2030.

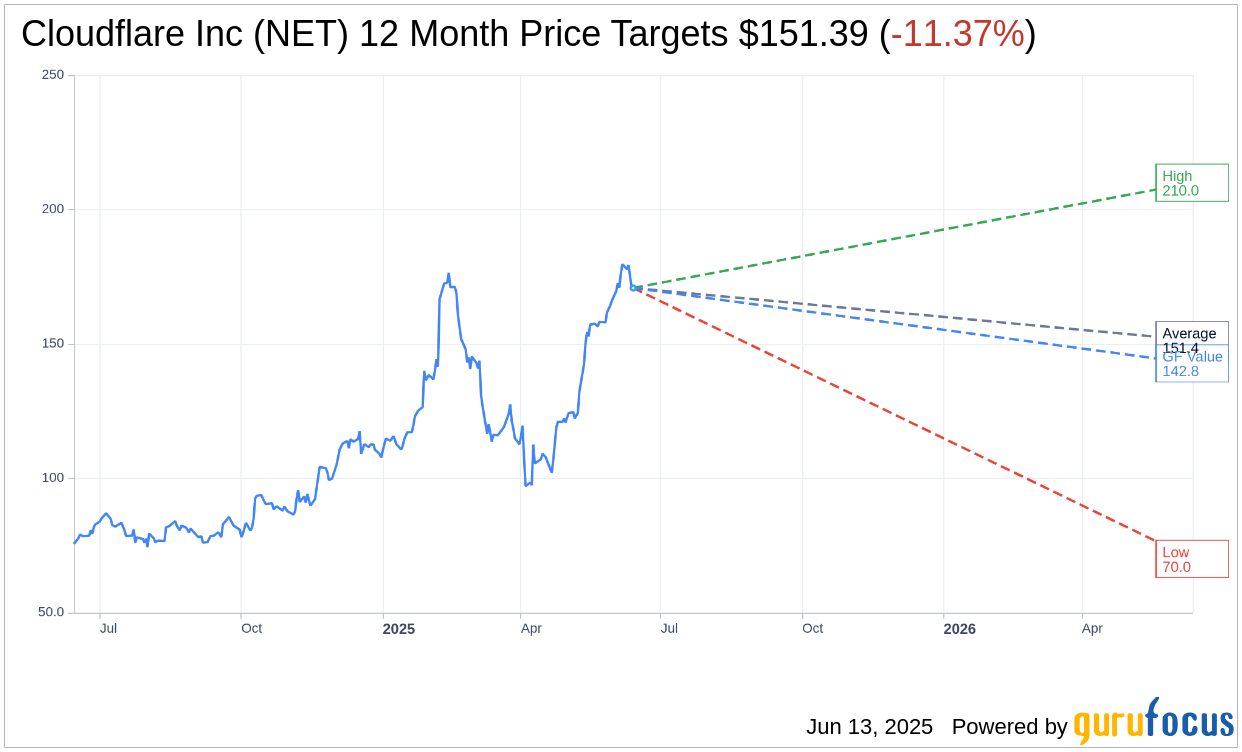

- Analysts' average price target suggests an 11.37% downside from the current market price.

- GuruFocus estimates imply a 16.43% downside from the stock's current trading price.

Cloudflare Inc. (NET) has recently disclosed the terms for its anticipated $1.75 billion Convertible Senior Notes, set to mature in 2030. With an additional $250 million option, these notes offer a conversion rate of 4.0376 shares for each $1,000 principal, translating to a conversion price of $247.67 per share.

Wall Street Analysts Forecast

Wall Street analysts have provided one-year target prices for Cloudflare Inc (NET, Financial) based on evaluations from 29 experts. The average target price sits at $151.39, with estimates ranging from a high of $210.00 to a low of $70.00. This average suggests an 11.37% downside compared to the current stock price of $170.81. Investors can explore comprehensive target data on the Cloudflare Inc (NET) Forecast page.

Furthermore, consensus recommendations from 35 brokerage firms place Cloudflare Inc's (NET, Financial) average recommendation at 2.3, which reflects an "Outperform" rating. This ranking falls within a scale where 1 represents a Strong Buy and 5 indicates a Sell.

Evaluations from GuruFocus suggest a GF Value for Cloudflare Inc (NET, Financial) in one year at $142.75, indicating a potential downside of 16.43% from the current price of $170.81. The GF Value is derived from historical multiples, past business growth, and projections for future performance. Detailed analyses and data insights are available on the Cloudflare Inc (NET) Summary page.