**Summary:**

- Omnicom Group (OMC, Financial) has a significant portion of its shares on loan, indicating high short interest.

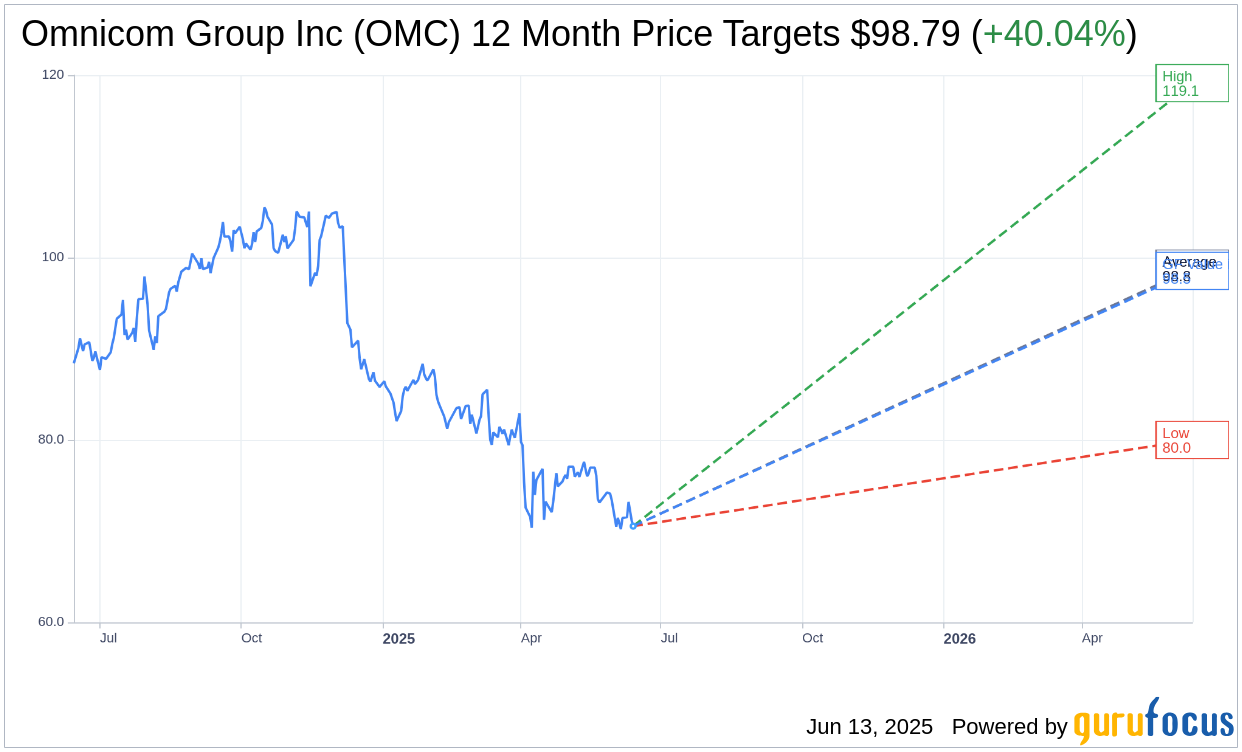

- Analysts foresee a potential upside of over 40% for Omnicom Group, with price targets suggesting growth.

- OMC is rated as "Outperform" by brokerage firms, highlighting investor confidence.

Current Short Interest Landscape

Omnicom Group (NYSE: OMC) stands out in the communication services sector with 13.48% of its shares on loan by the end of May, leading short interest among its peers. This is against a backdrop of diminishing shorting activity across the sector, as average short interest decreased to 1.75%. Notably, shares of Alphabet Inc. (NASDAQ: GOOG), the parent company of Google, were among the least shorted, indicating contrasting investor sentiment within the sector.

Analysts' Predictions for Omnicom

Within a one-year horizon, nine analysts have set their price targets for Omnicom Group Inc (NYSE: OMC). The consensus indicates an average target price of $98.79. This includes a high estimate of $119.13 and a low of $80.00. Notably, the average target suggests a promising upside of 40.04% from the current trading price of $70.55. Investors can explore more detailed estimate information on the Omnicom Group Inc (OMC, Financial) Forecast page.

Brokerage Recommendations and GF Value Insight

Omnicom Group Inc (NYSE: OMC) holds an average brokerage recommendation of 2.3 from 12 brokerage firms, classifying the stock as "Outperform." The recommendation scale spans from 1, symbolizing a Strong Buy, to 5, indicating a Sell. This positive sentiment suggests robust investor confidence in the stock's potential future performance.

According to GuruFocus, the estimated GF Value of Omnicom Group Inc (NYSE: OMC) in the next year is projected at $98.54, indicating an upside of 39.68% from its current price of $70.545. The GF Value represents GuruFocus' calculated fair value for the stock, derived from historical trading multiples, business growth patterns, and future performance estimates. Further data can be accessed on the Omnicom Group Inc (OMC, Financial) Summary page.