On June 13, 2025, analyst J.R. Weston from Raymond James initiated coverage on Entergy Corporation, with the stock ticker (ETR, Financial). The analyst has assigned a "Market Perform" rating. Entergy Corporation, operating on the NYSE, is a well-regarded utility company known for its significant presence in the power sector.

Raymond James, a prominent financial services firm, disseminated this latest analysis which reflects their professional assessment of Entergy's current market position. Although no specific price target has been provided by the analyst, the designation of "Market Perform" indicates an expectation that (ETR, Financial)'s stock will perform in line with the overall market average in the near term.

This move by Raymond James places Entergy under the investment community's radar with this new coverage, potentially steering investor attention and informing market decisions surrounding (ETR, Financial). Investors and stakeholders may want to closely monitor any future reports or updates concerning Entergy's stock performance and any potential shifts in market outlook.

Wall Street Analysts Forecast

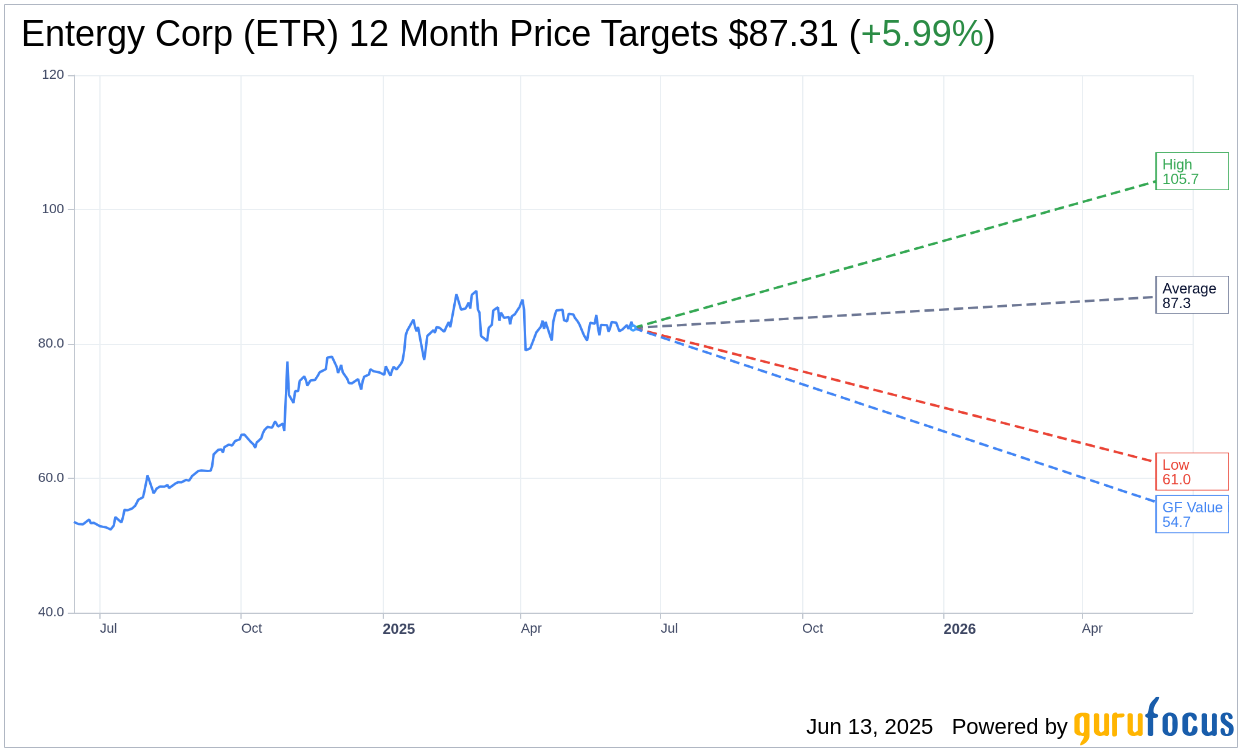

Based on the one-year price targets offered by 17 analysts, the average target price for Entergy Corp (ETR, Financial) is $87.31 with a high estimate of $105.72 and a low estimate of $61.00. The average target implies an upside of 5.99% from the current price of $82.38. More detailed estimate data can be found on the Entergy Corp (ETR) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, Entergy Corp's (ETR, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Entergy Corp (ETR, Financial) in one year is $54.66, suggesting a downside of 33.65% from the current price of $82.38. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Entergy Corp (ETR) Summary page.