Key Highlights:

- Boeing's stock declined nearly 5% after a recent crash in India involving its 787 Dreamliner.

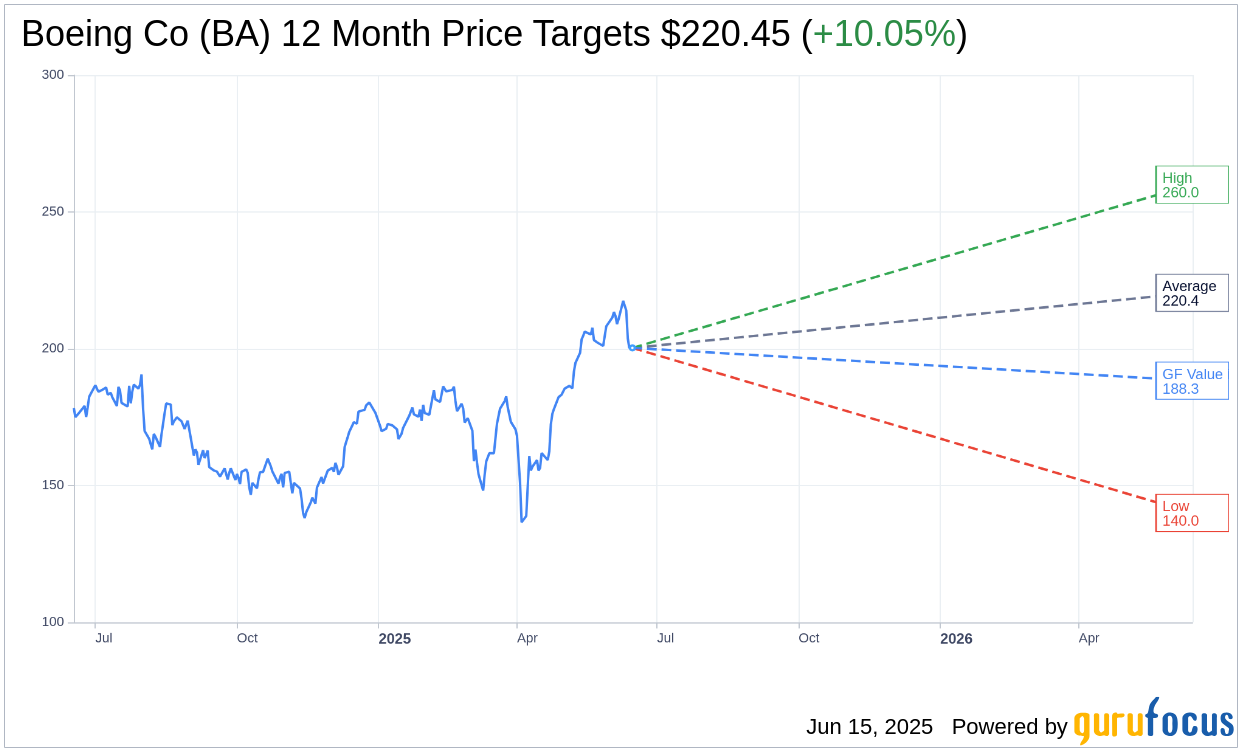

- Analysts see a potential upside of 10.05% for Boeing's stock based on average price targets.

- Current consensus rates Boeing as "Outperform," indicating positive long-term prospects.

Boeing Co. (BA) has witnessed a 4.97% decline in its stock price in light of a tragic 787 Dreamliner crash in India. This incident has sparked intensified scrutiny over Boeing's safety protocols, amplifying existing pressures related to geopolitical tensions within the industrial sector. Travel-related stocks, in particular, have felt the impact of these developments.

Wall Street Analysts' Insights

According to predictions from 23 analysts, the average one-year price target for Boeing Co. (BA, Financial) stands at $220.45. Price expectations vary, with the highest estimate at $260.00 and the lowest at $140.00. This average target suggests a potential upside of 10.05% from the current stock price of $200.32. For a more detailed view of these estimates, visit the Boeing Co (BA) Forecast page.

Brokerage Recommendations

The consensus recommendation from 29 brokerage firms rates Boeing Co. (BA, Financial) at 2.0, indicating it as an "Outperform." The rating scale ranges from 1 to 5, where 1 represents a Strong Buy and 5 denotes a Sell, reflecting a generally favorable outlook for Boeing's stock performance.

GF Value Estimate

According to GuruFocus estimates, the one-year GF Value for Boeing Co. (BA, Financial) is projected to be $188.34. This projection indicates a potential downside of 5.98% from the current price of $200.32. The GF Value is GuruFocus' calculation of the fair value at which the stock should trade, derived from historical trading multiples, past growth, and future performance estimates. For further insights, visit the Boeing Co (BA) Summary page.