Key Highlights:

- Lumen Technologies announces a strategic move to refinance $924.522 million of its senior secured notes through a new $1 billion note issue.

- Wall Street analysts offer a diverse range of price targets, with potential upsides and downsides reflecting market sentiment.

- GuruFocus' estimated GF Value indicates a potential downside, emphasizing the importance of thorough analysis before investing.

Lumen Technologies' Strategic Financial Move

Lumen Technologies (LUMN, Financial) has revealed that its subsidiary, Level 3 Financing, plans to issue $1 billion in First Lien Notes set to mature in 2033. The company intends to utilize the proceeds, alongside its existing cash reserves, to refinance $924.522 million of its 10.500% Senior Secured Notes, which are due in 2030.

Wall Street's Perspective on Lumen Technologies

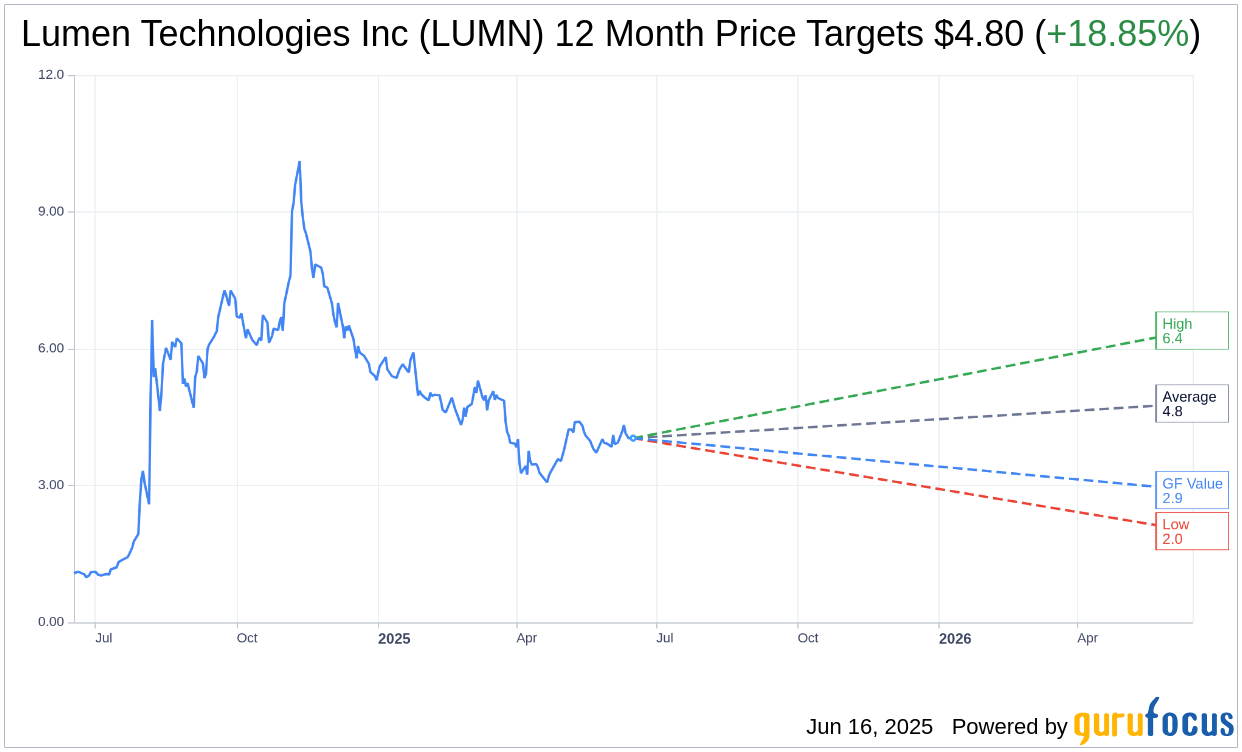

According to projections from 12 analysts, the average one-year target price for Lumen Technologies Inc (LUMN, Financial) is $4.80. This reflects a potential upside of 18.85% from the current market price of $4.04. The price targets vary significantly, with a high estimate of $6.40 and a low of $2.00. More comprehensive estimate data is available on the Lumen Technologies Inc (LUMN) Forecast page.

Analyst Recommendations

The consensus recommendation from a pool of 14 brokerage firms indicates a "Hold" status for Lumen Technologies Inc (LUMN, Financial), with an average brokerage recommendation of 2.7 on a scale where 1 is a Strong Buy and 5 is a Sell.

Analyzing the GF Value for Lumen Technologies

GuruFocus estimates suggest the GF Value for Lumen Technologies Inc (LUMN, Financial) is $2.90 over the next year, pointing to a potential downside of 28.22% from its current price of $4.04. The GF Value represents the fair trading value of the stock, calculated from historical trading multiples, past business growth, and future performance projections. Investors can find more detailed data on the Lumen Technologies Inc (LUMN) Summary page.

For investors considering positions in Lumen Technologies, understanding these forecasts and utilizing GuruFocus metrics can be crucial in making informed decisions.