Lake Street has initiated coverage on Alphatec (ATEC, Financial) with a Buy rating, setting a price target at $18. The analyst highlights Alphatec as a distinct presence in the spine sector, emphasizing its dedication to enhancing spinal outcomes. This focus sets the company apart in an industry that often appears disorganized. The analyst anticipates Alphatec's robust growth trajectory to persist, reflecting confidence in the company's strategic direction and market position.

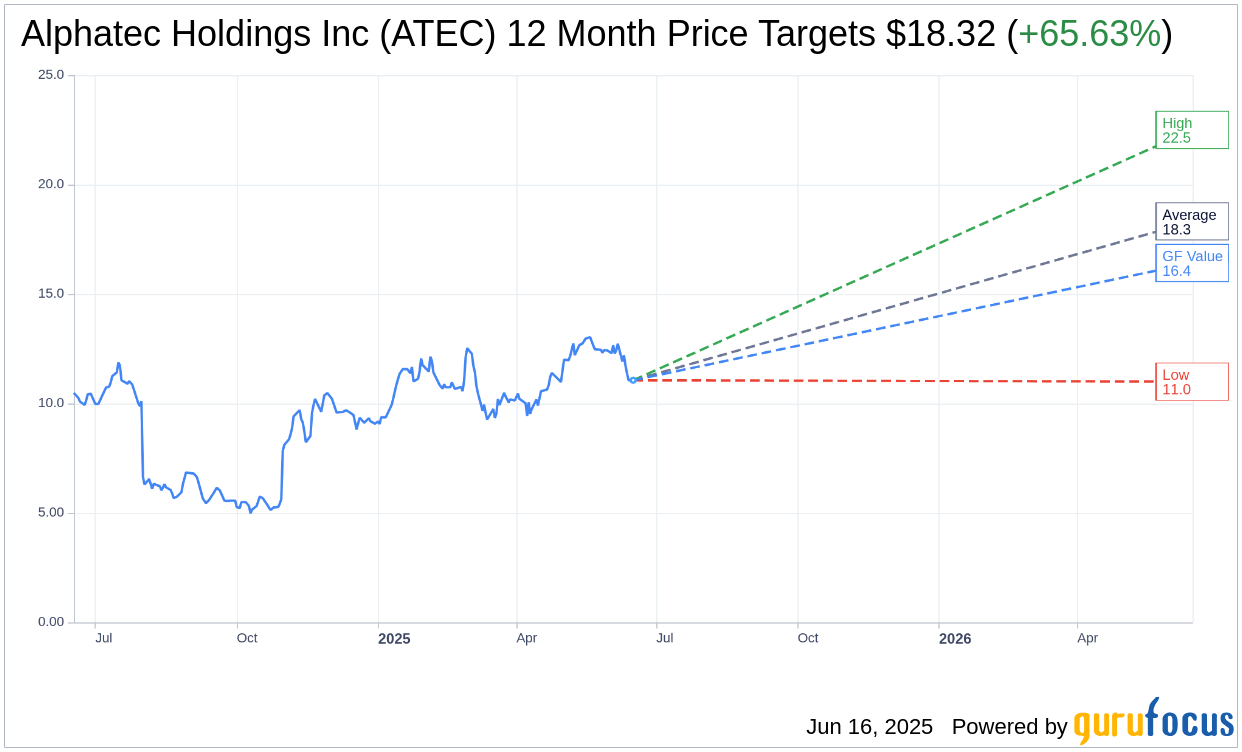

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for Alphatec Holdings Inc (ATEC, Financial) is $18.32 with a high estimate of $22.50 and a low estimate of $11.00. The average target implies an upside of 65.63% from the current price of $11.06. More detailed estimate data can be found on the Alphatec Holdings Inc (ATEC) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Alphatec Holdings Inc's (ATEC, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Alphatec Holdings Inc (ATEC, Financial) in one year is $16.42, suggesting a upside of 48.46% from the current price of $11.06. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Alphatec Holdings Inc (ATEC) Summary page.

ATEC Key Business Developments

Release Date: May 01, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Alphatec Holdings Inc (ATEC, Financial) reported a strong start to 2025 with a 22% revenue growth and 24% surgical growth, significantly outperforming the market.

- The company achieved $11 million in adjusted EBITDA, marking its second-best quarter ever and exceeding expectations.

- Surgical revenue grew by 24% year-over-year, driven by a 17% increase in procedural volume and an 18% rise in surgeon adoption.

- Alphatec Holdings Inc (ATEC) ended the first quarter with $153 million in cash and access to an additional $60 million in available borrowing, reinforcing its financial stability.

- The company successfully refinanced its 2026 convertible note, extending maturity to 2030 and maintaining a low coupon rate, providing financial flexibility.

Negative Points

- Non-GAAP gross margin decreased by 50 basis points compared to the previous year, primarily due to product mix.

- The company faced modest and transient working capital headwinds, impacting cash flow performance.

- Tariff exposure is expected to impact the cost of goods sold in the low single-digit millions, primarily affecting EOS units imported from France.

- Despite strong revenue growth, the company still experienced a cash burn of $15 million in the first quarter.

- Alphatec Holdings Inc (ATEC) is still in the early phases of its international expansion, with significant growth potential yet to be realized in markets like Japan.