GeoVax Labs (GOVX, Financial) has announced the issuance of new common units, each comprising one share of common stock paired with two warrants, allowing the purchase of an additional share of common stock. This move is part of GeoVax's strategy to attract investors by offering potential future growth opportunities tied to their investment. By structuring the units in this manner, the company aims to provide an incentive for investment, aligning the warrants' performance with the stock's future value trajectory.

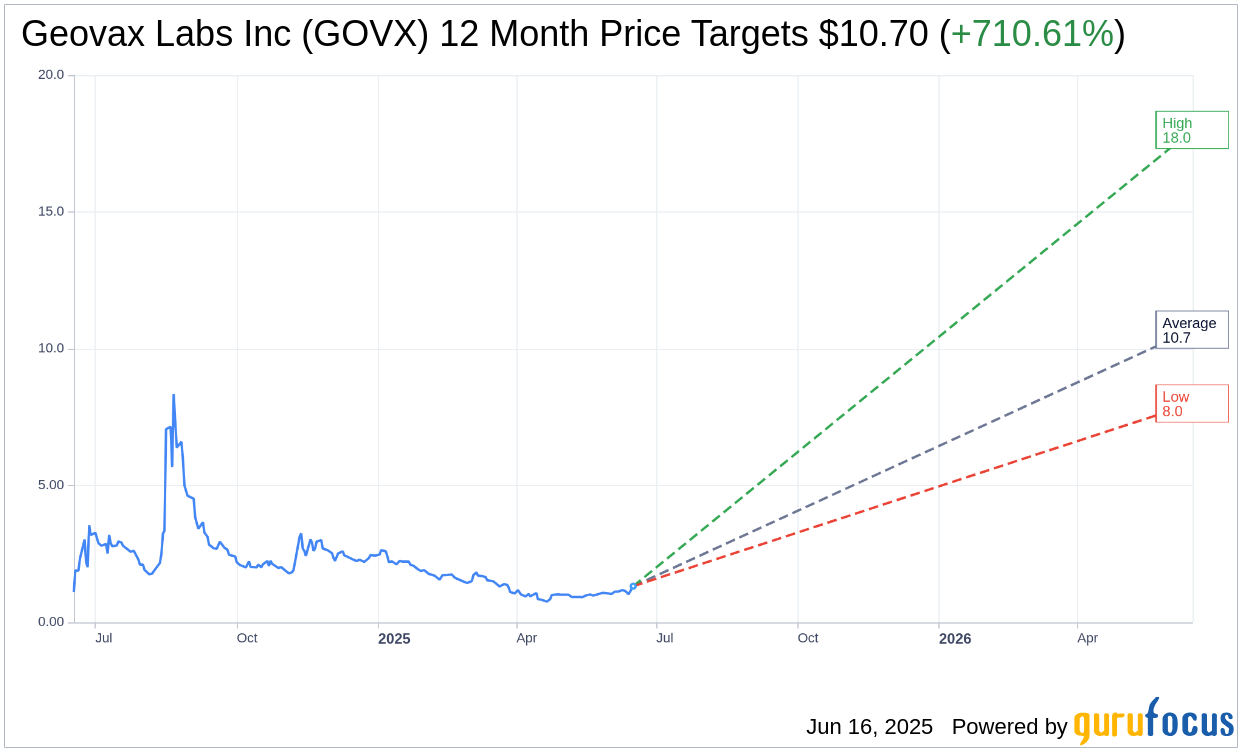

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Geovax Labs Inc (GOVX, Financial) is $10.70 with a high estimate of $18.00 and a low estimate of $8.00. The average target implies an upside of 710.61% from the current price of $1.32. More detailed estimate data can be found on the Geovax Labs Inc (GOVX) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Geovax Labs Inc's (GOVX, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

GOVX Key Business Developments

Release Date: March 27, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Geovax Labs Inc (GOVX, Financial) received a significant Project NextGen Award valued at almost $400 million to support their next-generation COVID-19 vaccine, CMO4S1.

- The company has completed CGMP product and quality release for their Mpox and smallpox vaccine candidate, GOMVA, with plans for clinical evaluation in the second half of the year.

- Geovax Labs Inc (GOVX) is advancing its MVA manufacturing process, which is expected to significantly reduce costs and support decentralized vaccine manufacturing.

- The company's COVID-19 vaccine, CMO4S1, is designed to address unmet needs among immunocompromised patients and has shown potential for broader use as a booster to current mRNA vaccines.

- Geovax Labs Inc (GOVX) is actively pursuing strategic partnerships and collaborations to support worldwide development and commercialization of their vaccines.

Negative Points

- Geovax Labs Inc (GOVX) reported a net loss of approximately $25 million for 2024, driven by increased manufacturing activities and costs associated with the BARDA contract.

- The company's cash balance decreased to $5.5 million at the end of 2024, reflecting significant cash usage in operating activities.

- There is uncertainty regarding the ability to sell the Mpox vaccine without clinical testing, despite the urgent global need.

- The start of the next Gein trial has been pushed back to mid to late 2025 due to manufacturing and cell line issues.

- Geovax Labs Inc (GOVX) faces challenges in securing equitable vaccine access and manufacturing partnerships in low-income countries, despite ongoing discussions.