- By 2027, Kraft Heinz (KHC, Financial) plans to eliminate FD&C colors from its U.S. products.

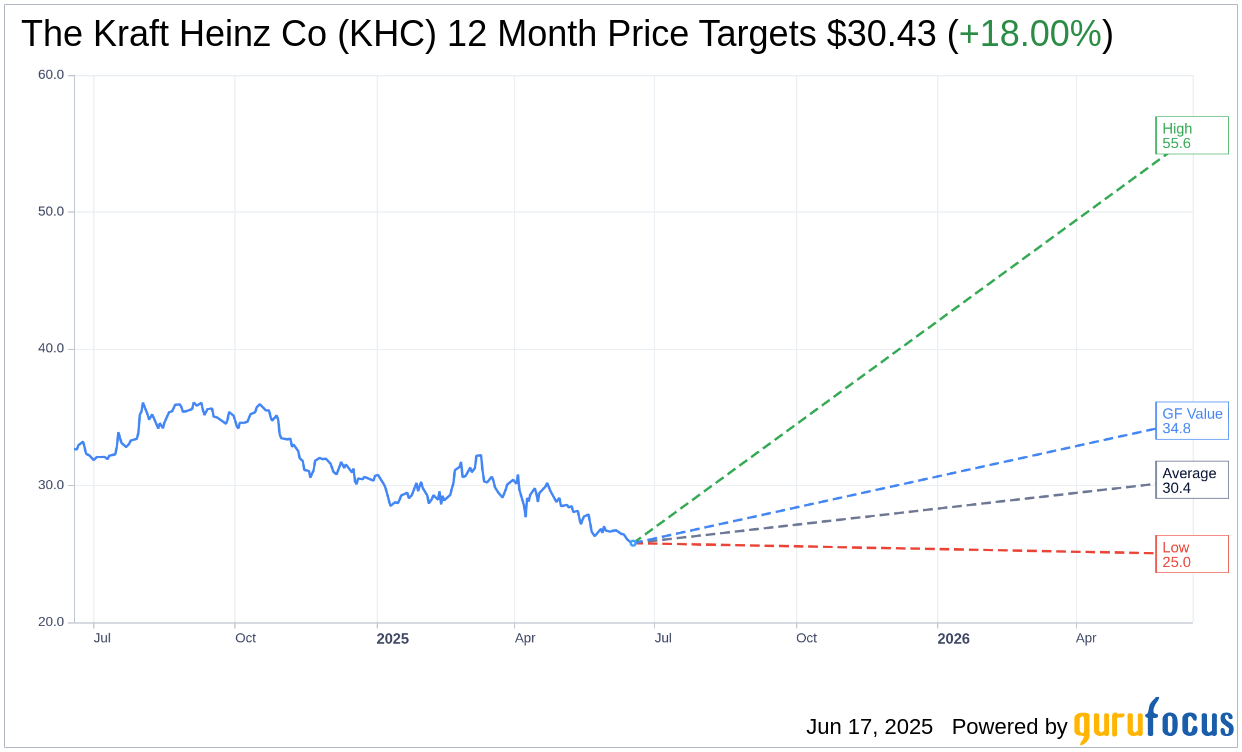

- Analysts predict an average price target of $30.43, with potential upsides.

- GuruFocus estimates a 34.74% upside based on GF Value.

Kraft Heinz Co. (KHC) is taking a significant step toward sustainability and consumer health by committing to remove Food, Drug & Cosmetic (FD&C) colors across its U.S. product range by the end of 2027. With nearly 90% of its current product lineup already free from these artificial colors, the company aims to introduce natural color alternatives wherever feasible, enhancing its appeal to health-conscious consumers.

Wall Street Analysts Forecast

Wall Street analysts have set a one-year price target for Kraft Heinz (KHC, Financial), averaging at $30.43. This projection suggests a potential upside of 18.00% from the existing stock price of $25.79. The forecasts also indicate a high estimate of $55.60 and a low of $25.00. For further insights into these projections, visit our detailed analysis on The Kraft Heinz Co (KHC) Forecast page.

When examining the consensus recommendation from 24 brokerage firms, Kraft Heinz (KHC, Financial) holds an average rating of 3.1, aligning with a "Hold" status. This recommendation scale spans from 1 to 5, with 1 reflecting a "Strong Buy" and 5 indicating "Sell."

GF Value Insights

According to GuruFocus's proprietary metrics, the estimated GF Value for Kraft Heinz (KHC, Financial) stands at $34.75, providing an anticipated upside of 34.74% from the current price of $25.79. The GF Value represents GuruFocus's assessment of the stock's fair trading value, derived from historical multiples, past business growth, and future performance forecasts. Additional detailed information can be accessed on The Kraft Heinz Co (KHC) Summary page.