AvePoint (AVPT, Financial) has unveiled enhancements to its AvePoint Elements Platform aimed at empowering managed service providers (MSPs) with improved data security capabilities. The new features facilitate streamlined IT management and enable MSPs to deliver optimization services more effectively on a larger scale. By integrating effortlessly with existing marketplaces, providing comprehensive risk insights, and optimizing licenses and storage, AvePoint is focused on boosting the profitability and operational efficiency of MSPs. These advancements support the development of more organized and secure service offerings, reinforcing AvePoint's dedication to meeting the evolving needs of MSPs.

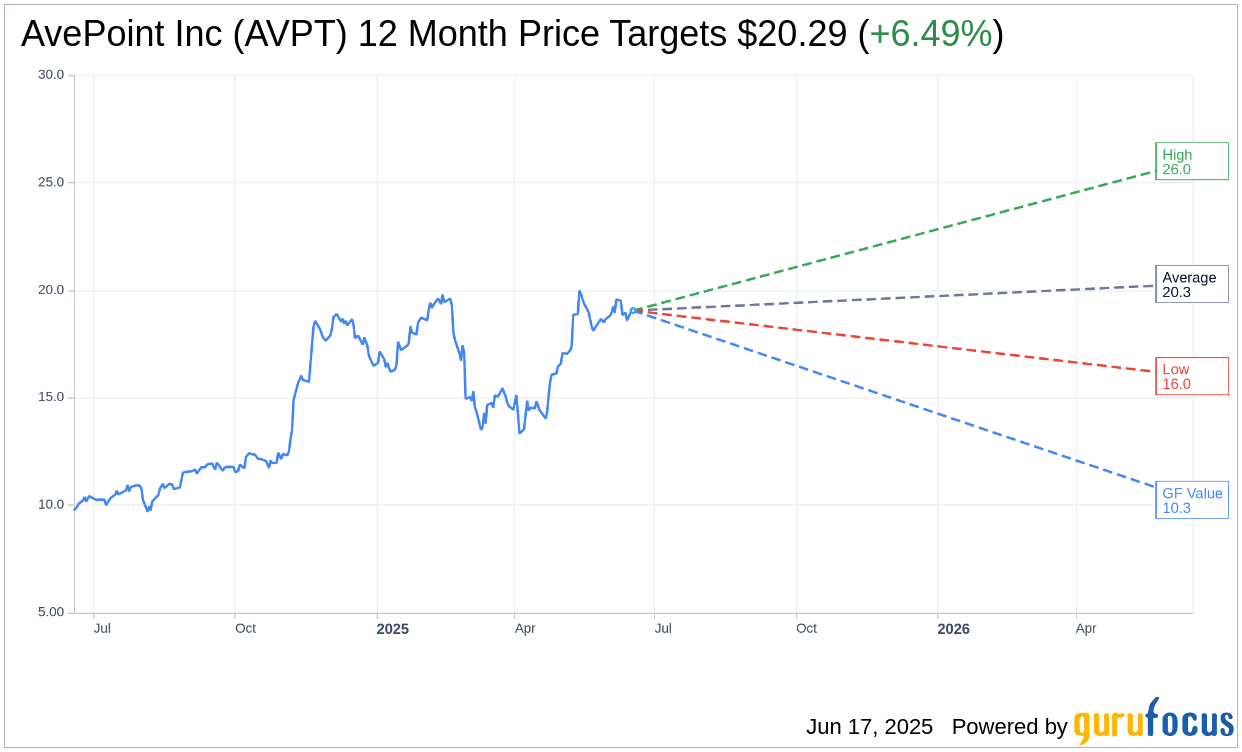

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for AvePoint Inc (AVPT, Financial) is $20.29 with a high estimate of $26.00 and a low estimate of $16.00. The average target implies an upside of 6.49% from the current price of $19.05. More detailed estimate data can be found on the AvePoint Inc (AVPT) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, AvePoint Inc's (AVPT, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for AvePoint Inc (AVPT, Financial) in one year is $10.25, suggesting a downside of 46.19% from the current price of $19.05. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the AvePoint Inc (AVPT) Summary page.

AVPT Key Business Developments

Release Date: May 08, 2025

- Total Revenue: $93.1 million, up 25% year-over-year.

- SaaS Revenue: $68.9 million, representing 34% year-over-year growth.

- Subscription Revenue Growth: 31% in Q1.

- Gross Margin: 75%, compared to 74.1% in Q1 2024.

- Operating Income: $13.4 million, with an operating margin of 14.4%.

- Cash and Equivalents: $351.8 million at the end of Q1.

- Net New ARR: $18.5 million, representing 57% organic growth year-over-year.

- ARR: $345.5 million, up 26% year-over-year.

- Customer Retention Rate (GRR): 89% adjusted for FX, 88% reported.

- Net Retention Rate (NRR): 111% adjusted for FX, 111% reported.

- Full-Year Revenue Guidance: $397.4 million to $405.4 million, growth of 20% to 23%.

- Full-Year ARR Guidance: $411.8 million to $417.8 million, growth of 26% to 28%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- AvePoint Inc (AVPT, Financial) reported a strong start to 2025 with Q1 revenues of $93.1 million, up 25% year-over-year, exceeding guidance.

- SaaS revenue grew by 34% year-over-year, comprising 74% of total revenues, highlighting the company's successful shift towards a subscription-based model.

- The company achieved record growth in net new ARR, with a 57% year-over-year increase, marking the highest growth rate since becoming a public company.

- AvePoint Inc (AVPT) expanded its platform capabilities with enhanced multi-cloud features and deeper AI integration, driving significant customer wins across various industries.

- The company maintained a strong balance sheet with $351.8 million in cash and short-term investments, providing financial stability and flexibility for future growth initiatives.

Negative Points

- Despite strong Q1 performance, AvePoint Inc (AVPT) maintained a cautious full-year ARR guidance due to macroeconomic uncertainties and geopolitical risks.

- Free cash flow was negative $1 million for the quarter, compared to positive $7.3 million in the same period last year, impacted by one-time tax payments.

- Maintenance revenue declined year-over-year, reflecting a shift away from traditional revenue streams.

- The company faces challenges in navigating complex regulatory environments and expanding compliance standards globally, adding operational complexity.

- AvePoint Inc (AVPT) is still in the early stages of AI deployment, with only a small percentage of customers fully implementing AI solutions, indicating potential delays in realizing full benefits.