The Shyft Group, trading under the ticker SHYF, has secured strong shareholder approval for its planned merger with a subsidiary of Aebi Schmidt Group. The merger received overwhelming support, with roughly 99% of votes cast in favor. The deal is anticipated to be finalized around July 1, pending standard closing conditions.

Following the completion of this merger, the newly formed entity will adopt the name "Aebi Schmidt Group" and is expected to be listed on NASDAQ under the symbol "AEBI." This marks a significant transition for The Shyft Group as it integrates with Aebi Schmidt.

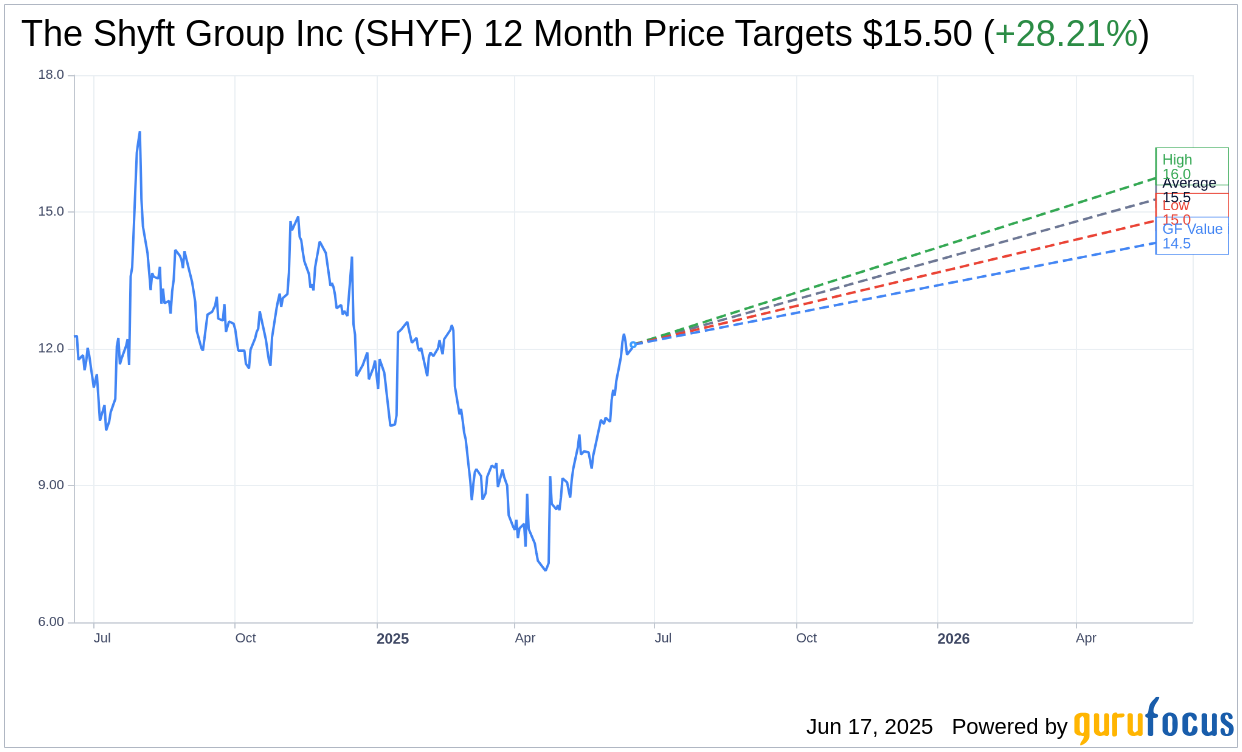

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for The Shyft Group Inc (SHYF, Financial) is $15.50 with a high estimate of $16.00 and a low estimate of $15.00. The average target implies an upside of 28.21% from the current price of $12.09. More detailed estimate data can be found on the The Shyft Group Inc (SHYF) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, The Shyft Group Inc's (SHYF, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Shyft Group Inc (SHYF, Financial) in one year is $14.48, suggesting a upside of 19.77% from the current price of $12.09. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Shyft Group Inc (SHYF) Summary page.