Summary:

- Nvidia (NVDA, Financial) is set to benefit substantially from Co-Packaged Optics (CPO) technology, crucial for AI infrastructure.

- The average price target from analysts for Nvidia suggests a significant growth potential from its current valuation.

- GuruFocus estimates Nvidia's fair market value to nearly double in the coming year, highlighting its promising outlook.

J.P. Morgan has identified Nvidia (NVDA) as a significant beneficiary of Co-Packaged Optics (CPO) technology. CPO is essential for improving AI infrastructure, addressing challenges in bandwidth, power, and cost. As AI technologies advance, Nvidia is poised to capitalize on the widespread adoption of CPO solutions.

Wall Street Analysts' Forecast

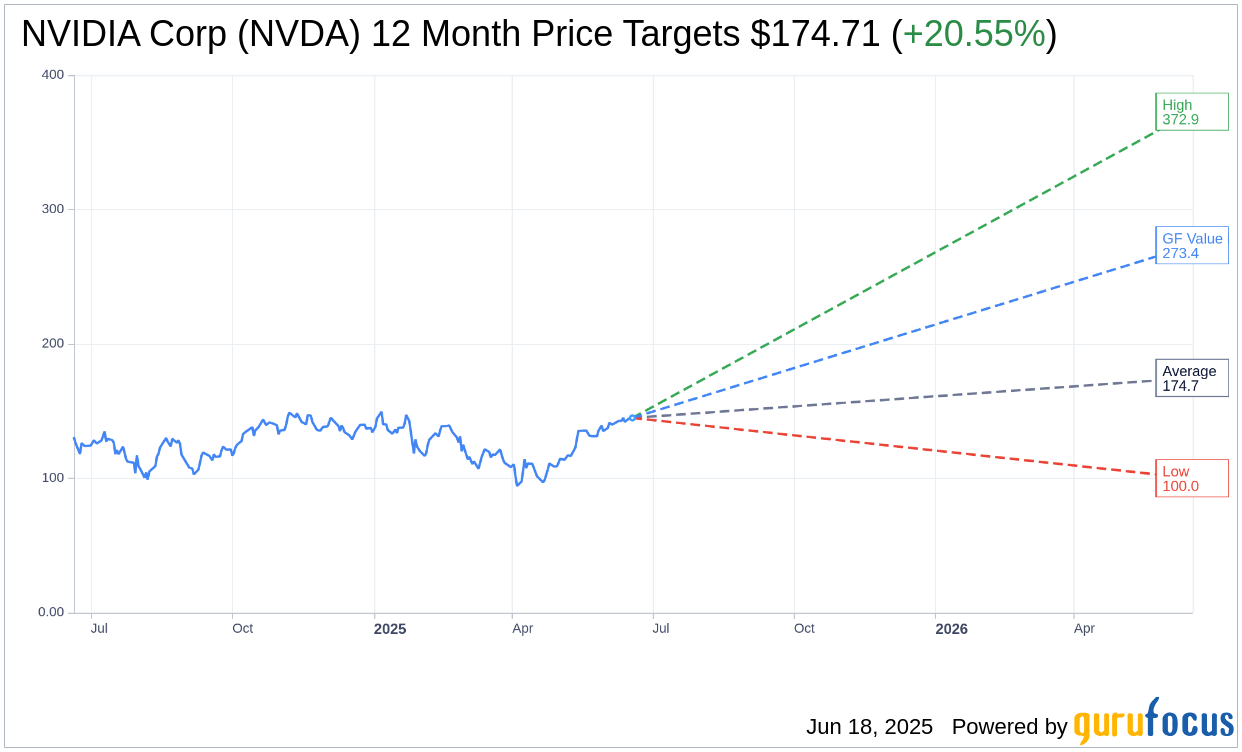

According to projections from 52 analysts, the one-year average price target for NVIDIA Corp (NVDA, Financial) is $174.71. This target includes a high estimate of $372.87 and a low of $100.00, indicating an anticipated upside of 20.55% from its current trading price of $144.93. Investors can explore more detailed estimates on the NVIDIA Corp (NVDA) Forecast page.

The consensus from 65 brokerage firms rates NVIDIA Corp's (NVDA, Financial) average recommendation at 1.8, suggesting an "Outperform" status. This rating system ranges from 1, indicating a Strong Buy, to 5, which represents a Sell.

GuruFocus Valuation Estimate

According to GuruFocus calculations, the estimated GF Value for NVIDIA Corp (NVDA, Financial) in the next year is $273.40. This suggests an extraordinary upside of 88.64% from its current price of $144.93. The GF Value is based on historical trading multiples, past business growth, and future projected performance. For comprehensive data and insights, visit the NVIDIA Corp (NVDA) Summary page.