CarMax (KMX, Financial) announced its first-quarter revenue of $7.55 billion, surpassing projections of $7.53 billion. The company posted a 9.0% increase in retail used unit sales, while sales for comparable stores rose by 8.1%. Additionally, wholesale unit sales saw a modest growth of 1.2%. Overall, the combined sales of retail and wholesale used vehicles reached 379,727 units, marking a 5.8% rise compared to the previous year's first quarter.

CarMax's CEO highlighted the company's successful execution of its earnings growth strategy, attributing the achievements to their omni-channel capabilities, diverse business operations, and a focus on precise execution. The seamless integration of their workforce, retail locations, and digital tools fosters a customer-focused buying and selling environment, which CarMax views as a competitive advantage in a fragmented market. This approach positions the company to enhance sales, expand market share, and sustain earnings growth well into the future.

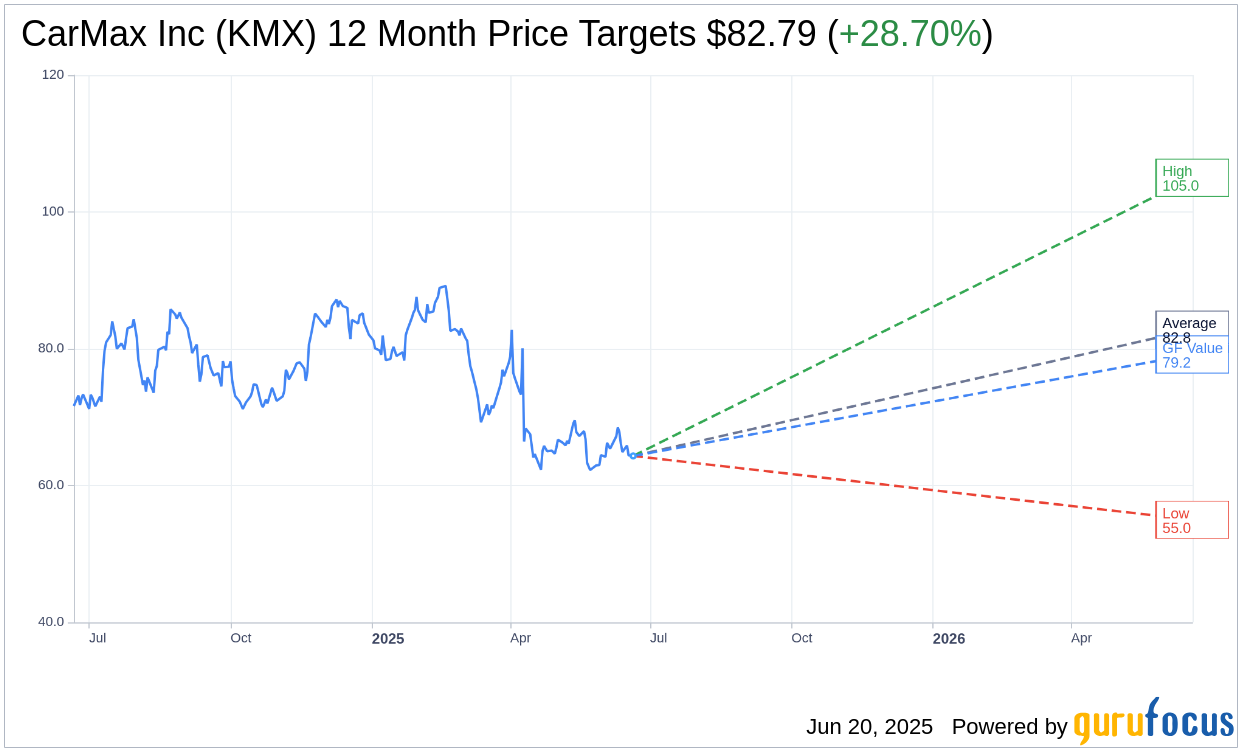

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for CarMax Inc (KMX, Financial) is $82.79 with a high estimate of $105.00 and a low estimate of $55.00. The average target implies an upside of 28.70% from the current price of $64.33. More detailed estimate data can be found on the CarMax Inc (KMX) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, CarMax Inc's (KMX, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CarMax Inc (KMX, Financial) in one year is $79.17, suggesting a upside of 23.07% from the current price of $64.33. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CarMax Inc (KMX) Summary page.

KMX Key Business Developments

Release Date: April 10, 2025

- Total Sales: $6 billion, up 7% year-over-year.

- Retail Unit Sales: Increased 6.2% year-over-year.

- Used Unit Comps: Up 5.1% year-over-year.

- Retail Gross Profit Per Used Unit: $2,322, a fourth-quarter record.

- Wholesale Unit Sales: Up 3.1% year-over-year.

- Wholesale Gross Profit Per Unit: $1,045, down from $1,120 last year.

- CAF Income: $159 million, up 8% year-over-year.

- Net Earnings Per Diluted Share: $0.58, up 81% year-over-year; adjusted EPS $0.64.

- Total Gross Profit: $668 million, up 14% year-over-year.

- SG&A Expenses: $611 million, up 5% year-over-year.

- Share Repurchase: Approximately 1.2 million shares for $99 million.

- New Store Openings: 6 planned for FY26, up from 5 in FY25.

- Capital Expenditures: Anticipated $575 million for FY26.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- CarMax Inc (KMX, Financial) reported robust year-over-year EPS growth, driven by increased unit volume in sales and buys, higher gross profit, and improved cost efficiencies.

- The company achieved a record in buying vehicles from dealers, with a 114% increase in dealer-sourced vehicles compared to last year.

- CarMax Inc (KMX) saw a significant increase in digital engagement, with approximately 67% of retail unit sales being omni sales, up from 64% last year.

- CarMax Auto Finance (CAF) delivered an 8% increase in income, supported by a steady net interest margin and strategic credit spectrum expansion.

- The company achieved a 14% increase in total gross profit, with notable improvements in service gross profit and efficiency measures.

Negative Points

- Wholesale gross profit per unit declined from $1,120 to $1,045 year-over-year, despite being historically strong.

- The average selling price for wholesale units remained flat year-over-year, indicating potential pricing pressures.

- SG&A expenses increased by 5% or $30 million from the prior year, driven by higher compensation and advertising costs.

- The company anticipates a larger provision for loan losses in the first quarter due to new origination volume and lower credit quality.

- CarMax Inc (KMX) withdrew the timeline for its $30 billion sales goal due to macroeconomic uncertainties, indicating potential challenges in achieving long-term targets.