Compass Diversified (CODI, Financial) is experiencing typical options trading leading up to its earnings report, with a slight preference for puts over calls in a 6:5 ratio. The current implied volatility indicates that traders anticipate a price change of approximately 8.8%, equivalent to 56 cents, following the earnings announcement. Historically, the average price movement for CODI after earnings has been 2.6% over the last eight quarters.

Wall Street Analysts Forecast

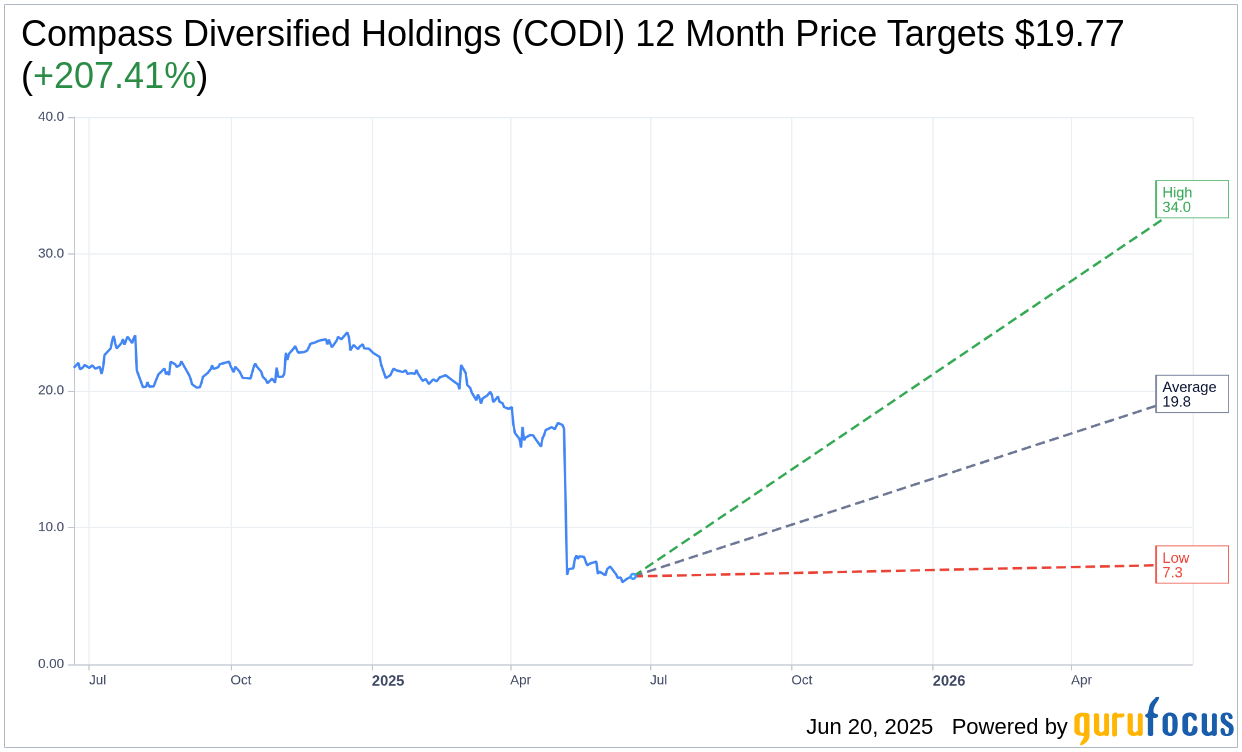

Based on the one-year price targets offered by 3 analysts, the average target price for Compass Diversified Holdings (CODI, Financial) is $19.77 with a high estimate of $34.00 and a low estimate of $7.30. The average target implies an upside of 207.41% from the current price of $6.43. More detailed estimate data can be found on the Compass Diversified Holdings (CODI) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Compass Diversified Holdings's (CODI, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Compass Diversified Holdings (CODI, Financial) in one year is $25.72, suggesting a upside of 300% from the current price of $6.43. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Compass Diversified Holdings (CODI) Summary page.