Citizens JMP is set to host a virtual meeting on June 24, focusing on the company's performance and projections. Investors interested in (NCDL, Financial) will have the opportunity to gain insights into the company's strategies and future plans. This event aims to provide a comprehensive overview of potential growth areas and market resilience, helping investors make informed decisions. The meeting serves as an essential platform for stakeholders eager to understand more about (NCDL)'s trajectory.

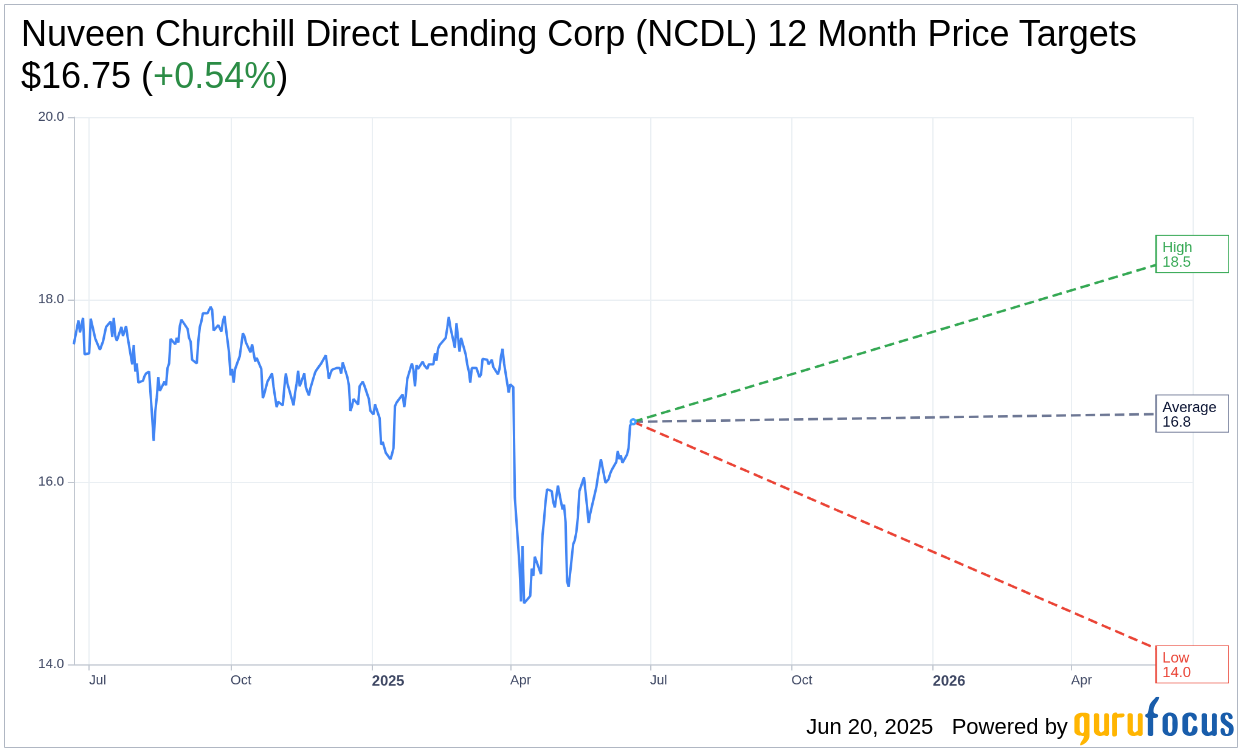

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Nuveen Churchill Direct Lending Corp (NCDL, Financial) is $16.75 with a high estimate of $18.50 and a low estimate of $14.00. The average target implies an upside of 0.54% from the current price of $16.66. More detailed estimate data can be found on the Nuveen Churchill Direct Lending Corp (NCDL) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Nuveen Churchill Direct Lending Corp's (NCDL, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

NCDL Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Nuveen Churchill Direct Lending Corp (NCDL, Financial) has a highly diversified portfolio with over 200 companies, reducing risk exposure.

- The company's investment portfolio is largely concentrated in non-cyclical and service-oriented businesses, providing stability during economic uncertainty.

- NCDL's conservative approach to underwriting is supported by a weighted average portfolio company net leverage of under 5 times and an interest coverage ratio of 2.4 times.

- The company has a strong balance sheet with no near-term debt maturities, providing financial flexibility.

- NCDL's investment activity volume was up 60% year over year in the first quarter, indicating strong growth and market activity.

Negative Points

- Net investment income decreased to $0.53 per share in the first quarter, impacted by non-recurring interest and debt financing expenses.

- Total investment income decreased to $53.6 million in the first quarter, primarily driven by a decline in interest income due to the decline in base rates.

- The net asset value per share declined from $18.18 to $17.96, primarily due to modest valuation declines in some watch list names.

- The company's gross debt to equity ratio increased to 1.31 times, indicating higher leverage.

- Market volatility and uncertainty around tariffs pose ongoing risks to the company's portfolio and future performance.