TOMI Environmental Solutions, under the ticker TOMZ, has announced promising breakthroughs in addressing the critical issue of honeybee colony collapse. A joint study with the U.S. Department of Agriculture, published on June 2, 2025, reveals that SteraMist ionized hydrogen peroxide effectively neutralizes Deformed Wing Virus (DWV), a primary factor in bee population decline. The research highlights SteraMist's capability to mitigate viral infections in hive environments, providing a non-toxic solution for safeguarding bees.

The study, titled “Deformed wing virus of honeybees is inactivated by cold plasma ionized hydrogen peroxide,” showcases the technology's potential to significantly reduce viral threats, particularly in DWV strains A and B. Pollinators like honeybees play a crucial role in maintaining the nation's food supply. The USDA continues to explore new methods to address the challenges posed by parasitic Varroa mites. TOMI's innovative approach with SteraMist presents a promising avenue for enhancing the resilience of honeybee colonies.

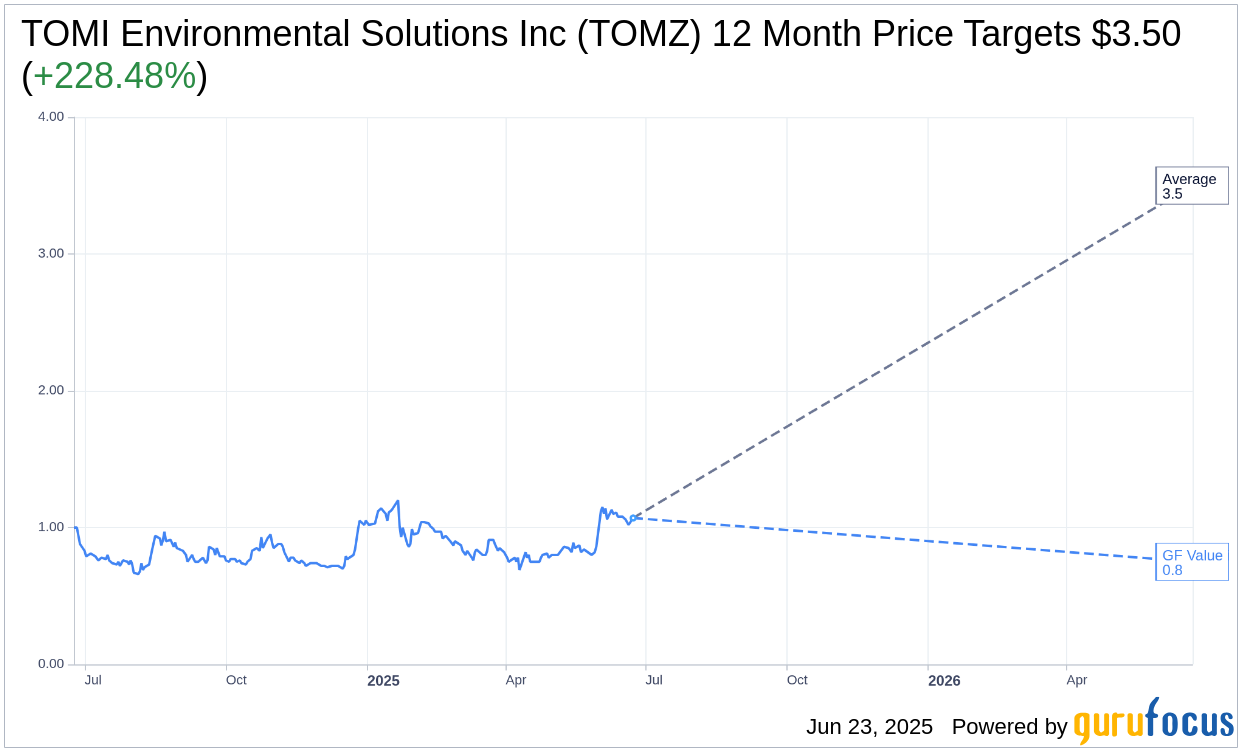

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for TOMI Environmental Solutions Inc (TOMZ, Financial) is $3.50 with a high estimate of $3.50 and a low estimate of $3.50. The average target implies an upside of 228.48% from the current price of $1.07. More detailed estimate data can be found on the TOMI Environmental Solutions Inc (TOMZ) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, TOMI Environmental Solutions Inc's (TOMZ, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for TOMI Environmental Solutions Inc (TOMZ, Financial) in one year is $0.75, suggesting a downside of 29.61% from the current price of $1.0655. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the TOMI Environmental Solutions Inc (TOMZ) Summary page.

TOMZ Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- TOMI Environmental Solutions Inc (TOMZ, Financial) reported a 42% increase in total sales for Q1 2025 compared to Q1 2024.

- The company experienced a 169% surge in bit solution sales year-to-date compared to the same period last year.

- TOMZ's gross margin improved slightly to 60.4% in Q1 2025 from 60.2% in the same period last year.

- The company has expanded its customer base, including new clients like a division of the US Army and a children's hospital in Philadelphia.

- TOMZ is actively expanding its distribution channels and recruiting independent representatives to support new sales initiatives.

Negative Points

- TOMZ reported an operating loss of approximately $754,000 for Q1 2025, though this is an improvement from the previous year.

- The company's net loss was approximately $256,000 for the quarter.

- There is uncertainty regarding the impact of international tariffs, as seen with a 15% tariff issue in South Korea.

- The timeline for implementation of some projects, such as the hybrid system at Merck, is still being determined.

- The company is still in the early stages of development for some initiatives, making it challenging to provide precise estimates for expected outcomes.