Cibus (CBUS, Financial) has successfully concluded the U.S. Food and Drug Administration's Plant Biotechnology Consultation Program for its altered lignin alfalfa trait. The FDA has informed Cibus that there are no remaining inquiries regarding the use of this modified alfalfa in food and animal feed.

This innovative trait, developed in collaboration with S&W Seed Company, offers enhanced nutrient availability for livestock. Additionally, it provides farmers with greater latitude in deciding when to harvest. The altered lignin profile results in more valuable alfalfa production on existing acreage without requiring extra resources, ultimately increasing profitability for farmers.

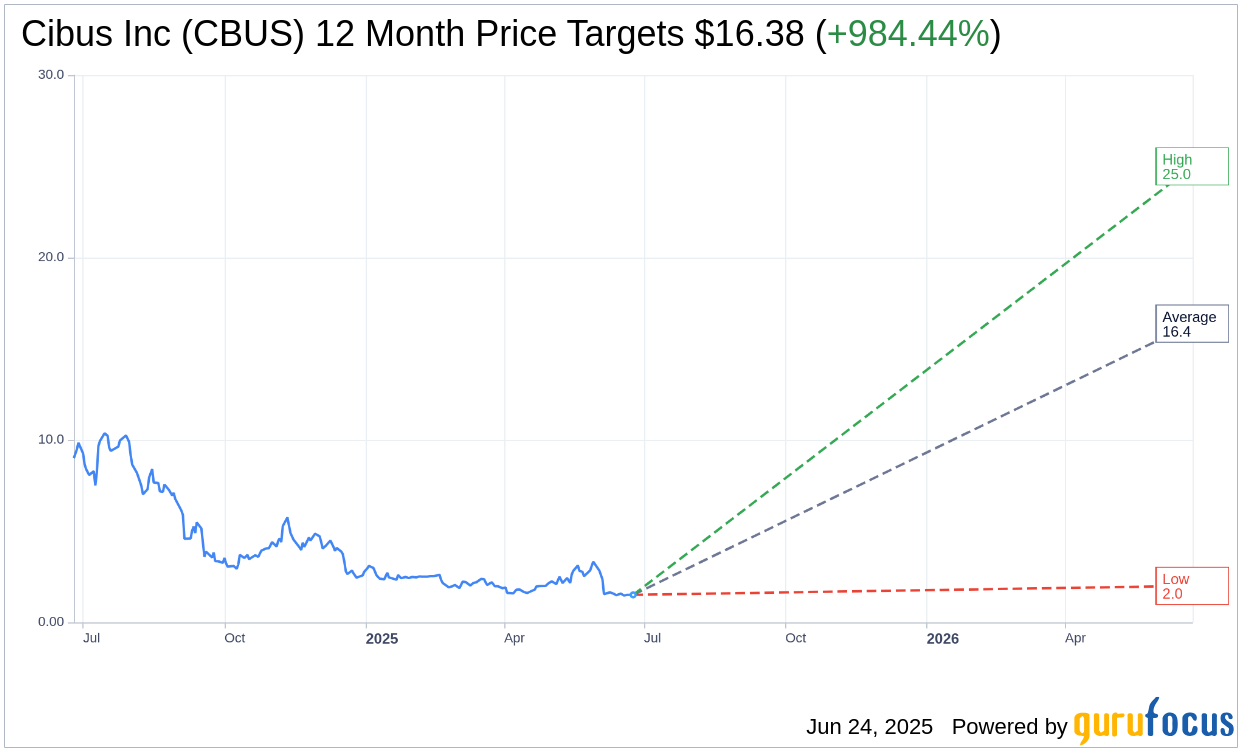

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Cibus Inc (CBUS, Financial) is $16.38 with a high estimate of $25.00 and a low estimate of $2.00. The average target implies an upside of 984.44% from the current price of $1.51. More detailed estimate data can be found on the Cibus Inc (CBUS) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Cibus Inc's (CBUS, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Cibus Inc (CBUS, Financial) in one year is $7.46, suggesting a upside of 394.04% from the current price of $1.51. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Cibus Inc (CBUS) Summary page.

CBUS Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Cibus Inc (CBUS, Financial) has demonstrated clear validation of its commercial strategy and the transformative potential of its RTDS technology platform.

- The company has secured agreements with major rice seed companies, representing approximately 40% of accessible rice acres across North and Latin America.

- Cibus Inc (CBUS) achieved a significant milestone with field trial results for stacked, gene-edited, herbicide tolerance traits in rice.

- The company has made progress in disease resistance traits, particularly in canola, with multiple modes of action for sclerotonia resistance.

- Cibus Inc (CBUS) has advanced its bio-based fermentation bio fragrance products, anticipating commercialization agreements with consumer packaged goods partners this year.

Negative Points

- Cibus Inc (CBUS) reported a net loss of $49.4 million for the first quarter of 2025, compared to a net loss of $27 million in the year-ago period.

- The increase in net loss was primarily due to a $21 million non-cash goodwill impairment recorded in the first quarter of 2025.

- General and administrative expenses increased to $9.9 million for the first quarter of 2025, primarily due to a $3 million litigation accrual.

- The company's cash and cash equivalents are expected to fund planned operating expenses only into the third quarter of 2025.

- Cibus Inc (CBUS) is focused on significantly reducing its cash burn rate in 2025, indicating financial constraints.