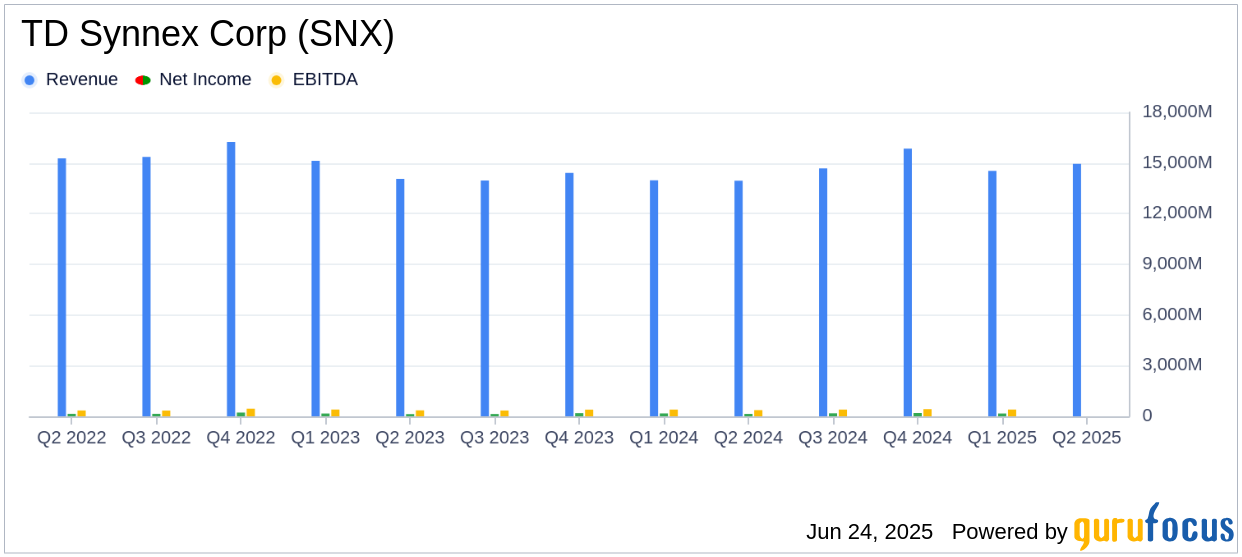

On June 24, 2025, TD Synnex Corp (SNX, Financial) released its 8-K filing for the fiscal second quarter ended May 31, 2025. The company, a leading distributor and solutions aggregator for the IT ecosystem, reported a revenue of $14.9 billion, surpassing the analyst estimate of $14,315.11 million and marking a 7.2% increase year over year. The diluted earnings per share (EPS) stood at $2.21, exceeding the estimated EPS of $1.92.

Company Overview

TD Synnex Corp is a prominent player in the IT distribution sector, providing a wide range of IT hardware, software, and systems solutions. The company's operations span across the Americas, Europe, and the Asia-Pacific and Japan (APJ) regions, catering to a diverse clientele with its comprehensive product offerings.

Performance Highlights and Challenges

The company's performance in Q2 2025 was bolstered by growth in both its Endpoint Solutions and Advanced Solutions portfolios. Despite a greater percentage of sales being presented on a net basis, which negatively impacted revenue by approximately 5%, TD Synnex managed to achieve a revenue increase of 7.2% year over year. This growth is significant as it reflects the company's ability to navigate challenges in the IT distribution market, such as fluctuating currency rates and changing product mixes.

Financial Achievements

TD Synnex's financial achievements in the quarter include non-GAAP gross billings of $21.6 billion, a 12.1% increase from the previous year. The company's gross profit rose to $1,046 million, with a gross margin of 7.0%, slightly improved from the previous year's 6.98%. These achievements underscore the company's robust operational capabilities and its strategic positioning in the high-growth IT sector.

Key Financial Metrics

| Metric | Q2 FY25 | Q2 FY24 | Change |

|---|---|---|---|

| Revenue | $14,946.3 million | $13,947.9 million | 7.2% |

| Gross Profit | $1,046.4 million | $973.5 million | 7.5% |

| Operating Income | $328.1 million | $263.9 million | 24.3% |

| Net Income | $184.9 million | $143.6 million | 28.8% |

| Diluted EPS | $2.21 | $1.66 | 33.1% |

Analysis and Commentary

TD Synnex's strong financial performance is indicative of its effective strategy and execution in the IT distribution market. The company's ability to grow ahead of market expectations is highlighted by CEO Patrick Zammit's statement:

Our Q2 results demonstrate the continued strength of the IT Distribution and Hyperscaler markets, meanwhile, our strategy and the execution of our team are enabling us to grow ahead of market."This growth is crucial for maintaining competitive advantage and ensuring long-term sustainability in a rapidly evolving industry.

Conclusion

TD Synnex Corp's Q2 2025 results reflect its strong market position and operational efficiency. The company's ability to exceed revenue and earnings expectations amidst market challenges underscores its resilience and strategic foresight. As the IT ecosystem continues to expand, TD Synnex's comprehensive solutions and global reach position it well for future growth.

Explore the complete 8-K earnings release (here) from TD Synnex Corp for further details.