- AMD shares surged by nearly 6% after a favorable upgrade due to promising sales forecasts and innovative product launches.

- CFRA's increased price target for AMD is set at $165, highlighting expectations for growth in the GPU server market.

- Current analyst consensus indicates an "Outperform" status for AMD, with a significant potential upside.

Shares of Advanced Micro Devices (AMD, Financial) experienced a sharp increase of nearly 6% following an upgrade by CFRA. This upgrade was largely attributed to encouraging sales forecasts and the unveiling of new products. CFRA anticipates that AMD will close the competitive gap with industry leader NVIDIA, particularly with the launch of its MI400x series and significant strides in AI technology. The firm's price target for AMD now stands at $165, projecting a resurgence in the GPU server market by the end of the year, which could substantially fuel AMD's growth.

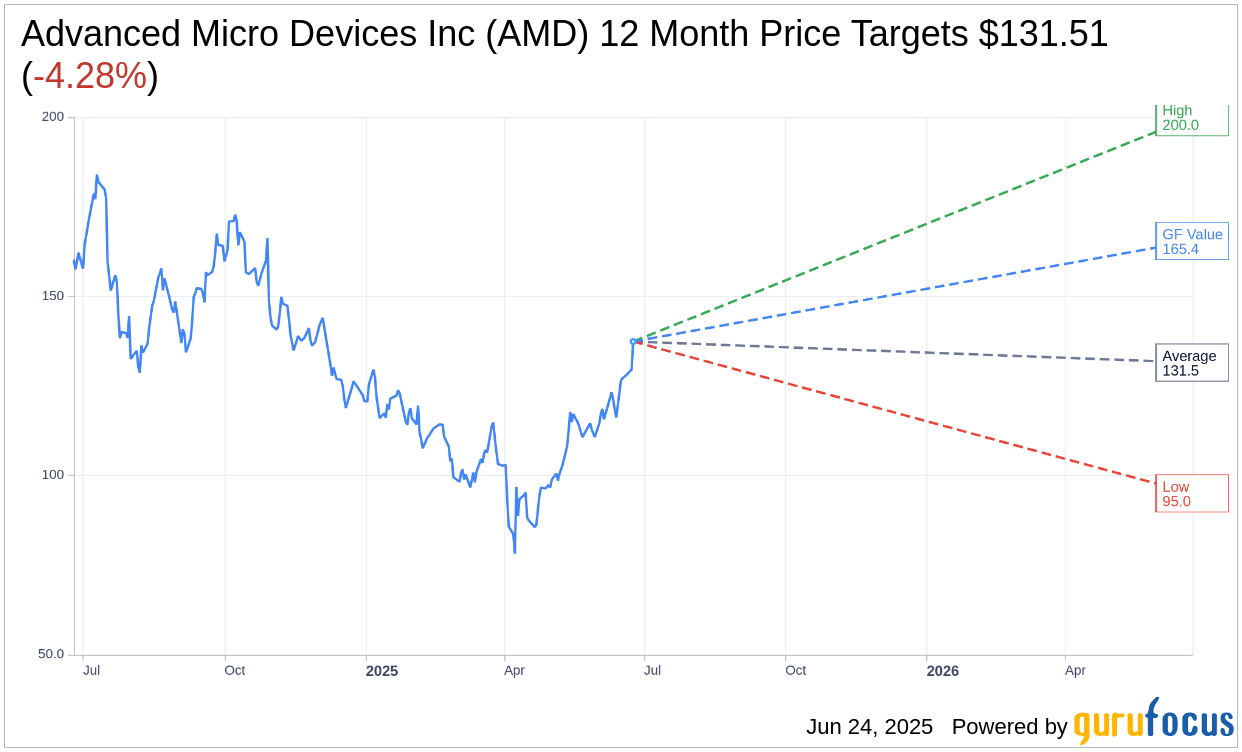

Wall Street Analysts Forecast

According to the one-year price targets provided by 40 analysts, the average target price for Advanced Micro Devices Inc (AMD, Financial) is $131.51. This includes a high estimate of $200.00 and a low estimate of $95.00. The average target suggests a downside of 4.28% from the current price of $137.39. For more comprehensive estimate data, visit the Advanced Micro Devices Inc (AMD) Forecast page.

Among 52 brokerage firms, the consensus recommendation for Advanced Micro Devices Inc (AMD, Financial) positions the stock at an average brokerage recommendation of 2.1, which corresponds to an "Outperform" rating. The rating scale ranges from 1 (Strong Buy) to 5 (Sell).

Based on GuruFocus estimates, the projected GF Value for Advanced Micro Devices Inc (AMD, Financial) in the next year is $165.43. This projection indicates a upside of 20.41% from the current price of $137.389. The GF Value represents GuruFocus' estimation of the fair trading value for the stock, calculated using historical trading multiples, past business growth, and future performance estimates. For a deeper dive into these figures, refer to the Advanced Micro Devices Inc (AMD) Summary page.