- Waste Management Inc. (WM, Financial) predicts a strong 9.4% annual revenue growth, reaching $28.88 billion by 2027.

- The company anticipates enhancements in Healthcare Solutions and sustainability alongside a 7.9% increase in free cash flow.

- Analysts forecast a potential stock price upside of 6.92% with an "Outperform" consensus recommendation.

Waste Management Inc. (WM), a leader in the waste management industry, is poised for significant growth. With an impressive 9.4% annual revenue growth rate projected, WM aims to reach $28.88 billion by 2027, surpassing initial forecasts. This growth is driven by a 5%-6% increase in Healthcare Solutions and notable advancements in sustainability initiatives. Additionally, Waste Management anticipates an EBITDA surge to $9 billion, accompanied by a 7.9% rise in free cash flow, underscoring its financial robustness.

Wall Street Analysts Forecast

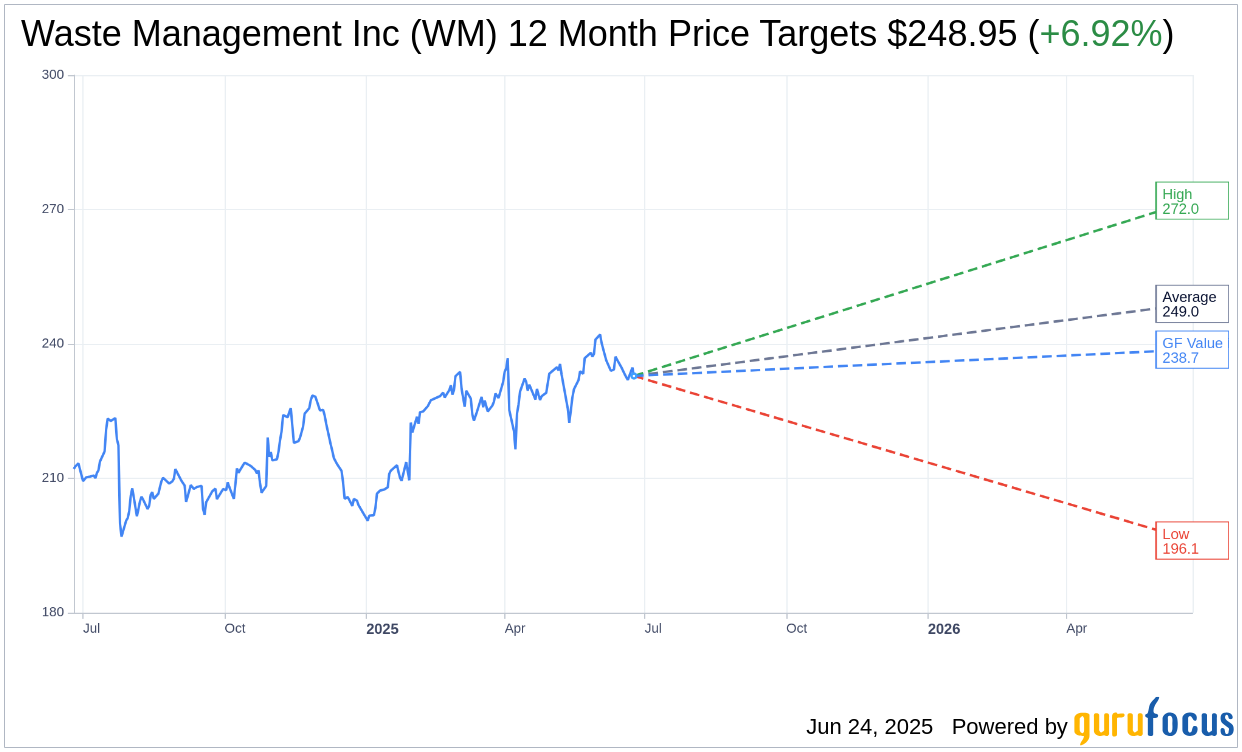

The consensus among 19 Wall Street analysts reveals an optimistic one-year price target for Waste Management Inc. (WM, Financial), with an average target price of $248.95. Forecasts range from a high of $272.00 to a low of $196.11, suggesting a potential upside of 6.92% from the current stock price of $232.85. Investors seeking more detailed estimate data can visit the Waste Management Inc (WM) Forecast page for comprehensive insights.

Furthermore, a consensus recommendation from 25 brokerage firms positions Waste Management Inc. (WM, Financial) at an average brokerage recommendation of 2.2, which reflects an "Outperform" status. This rating scale spans from 1 to 5, where 1 indicates a Strong Buy, and 5 signifies a Sell, showcasing market confidence in WM's strategic growth plans.

According to GuruFocus estimates, the GF Value of Waste Management Inc. (WM, Financial) in one year is estimated at $238.73. This suggests a modest upside of 2.53% from the current trading price of $232.8504. The GF Value represents GuruFocus' fair value estimation, calculated using historical trading multiples, past growth, and future performance projections. Interested investors can access more detailed data on the Waste Management Inc (WM) Summary page.