Key Takeaways:

- Target Corporation (TGT, Financial) is innovating by shipping directly from factories to customers, aiming to enhance its competitiveness.

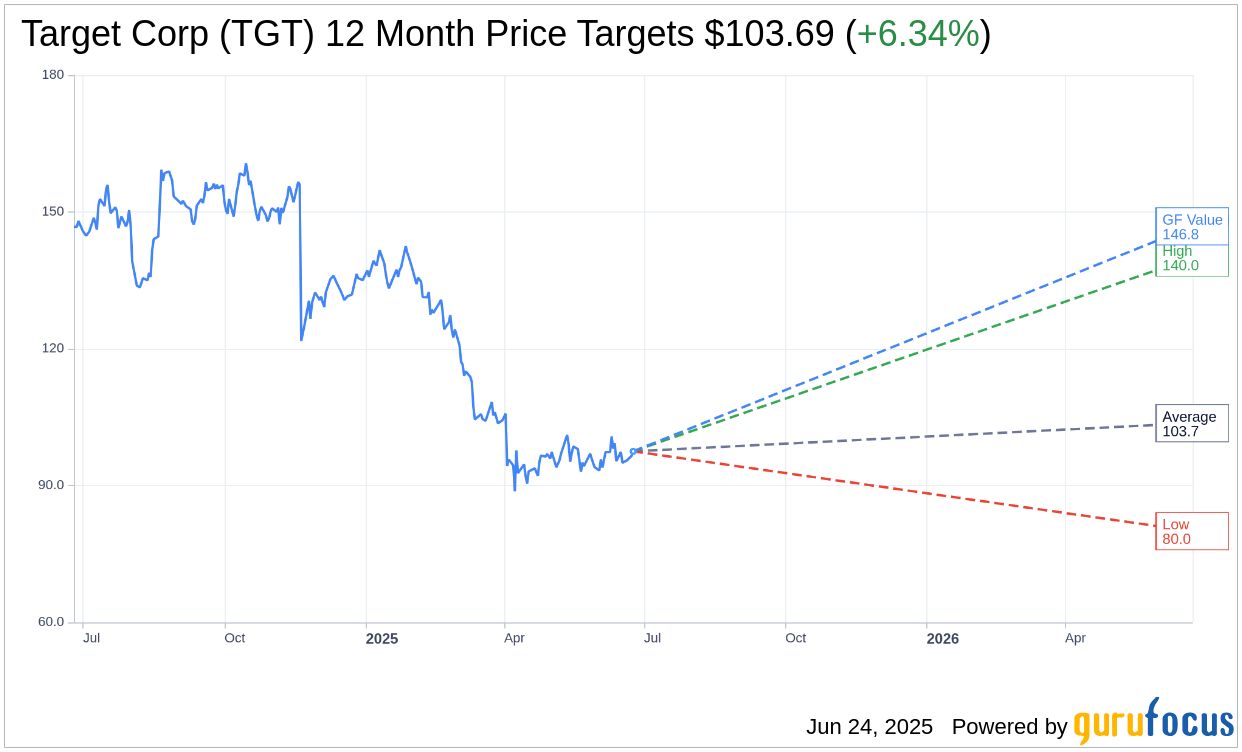

- Wall Street's average price target for TGT is $103.69, implying a potential upside of 6.34% from its current trading price.

- The GF Value estimate suggests a 50.6% upside, indicating a significant potential gain from the current price of $97.51.

Target's Innovative Strategy

Target Corporation (TGT) is exploring a new strategy that could reshape its market approach by shipping products directly from factories to customer homes. This initiative aligns with its objective to boost low-cost offerings and strengthen its position against competitors, particularly discounters. Despite a dip in Q1 net sales to $23.8 billion, Target remains optimistic about recalibrating its strategies to adjust to these changes.

Wall Street Analysts' Forecast

Wall Street analysts have set a one-year target price for Target Corp (TGT, Financial), averaging at $103.69. This projection ranges from a high of $140.00 to a low of $80.00. The average price target indicates a potential upside of 6.34% from the current market price of $97.51. For a more in-depth analysis of these estimates, visit the Target Corp (TGT) Forecast page.

Brokerage Recommendations

The brokerage community, consisting of 39 firms, currently provides a consensus "Hold" recommendation for Target Corp (TGT, Financial), with an average rating of 2.7 on a scale of 1 to 5. Here, 1 suggests a Strong Buy and 5 indicates a Sell. This neutral stance reflects the balance of opinions on Target's near-term prospects.

GuruFocus Valuation

According to GuruFocus, the estimated GF Value for TGT in one year stands at $146.85. This valuation suggests a robust upside of 50.6% from its current price of $97.51. The GF Value represents GuruFocus' calculated fair value for the stock, derived from historical trading multiples, past business growth, and projected future performance. More comprehensive data regarding this valuation can be accessed on the Target Corp (TGT, Financial) Summary page.