Key Takeaways:

- FedEx (FDX, Financial) stock dropped by 2.4% in after-hours trading despite earnings per share beating expectations.

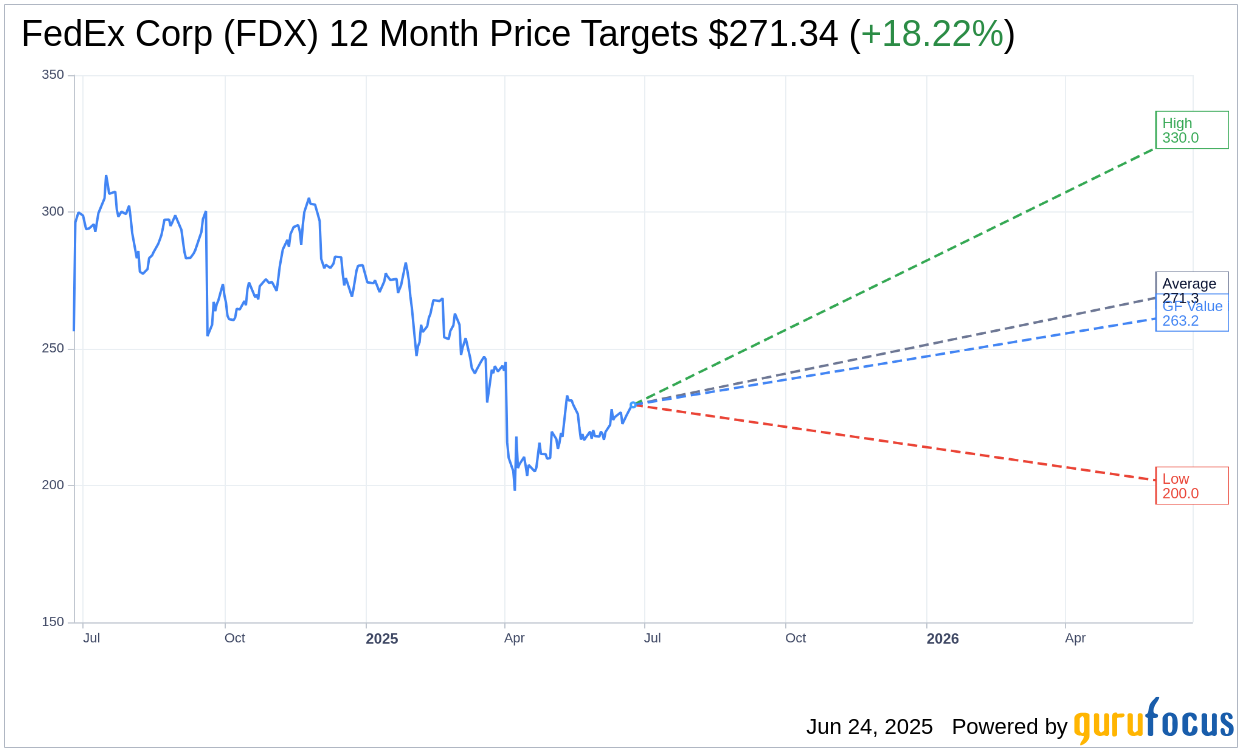

- Wall Street analysts see an 18.22% potential upside with a target price of $271.34.

- FedEx is projected to have a GF Value upside of 14.7% from current levels, indicating a potential investment opportunity.

FedEx Corp (FDX) experienced a notable 2.4% decline in after-hours trading following its fourth-quarter earnings release. Although the company reported a slight uptick in revenue, reaching $22.2 billion, its revenue forecast did not meet market expectations. Nevertheless, earnings per share came in at $6.07, surpassing consensus estimates. For the upcoming quarter, FedEx anticipates flat to modest revenue growth.

Analyst Price Target Insights

According to data from 27 analysts providing one-year price targets, FedEx Corp (FDX, Financial) holds an average target price of $271.34. The forecasts range from a high of $330.00 to a low of $200.00, suggesting an average potential upside of 18.22% from the current stock price of $229.51. Investors interested in delving deeper can find more detailed estimates on the FedEx Corp (FDX) Forecast page.

Brokerage Recommendations

FedEx Corp (FDX, Financial) currently carries an average brokerage recommendation of 2.2, which indicates an "Outperform" status. This consensus comes from 32 brokerage firms and uses a rating scale from 1 to 5, where 1 signifies a Strong Buy and 5 a Sell.

GF Value Estimation and Upside

Per GuruFocus estimates, FedEx Corp (FDX, Financial) is anticipated to have a GF Value of $263.24 within one year. This suggests a potential upside of 14.7% from its current price of $229.51. The GF Value is an assessment of the stock's fair value, derived from historical trading multiples, past business growth, and future business performance projections. For further insights, investors can explore more detailed data on the FedEx Corp (FDX) Summary page.