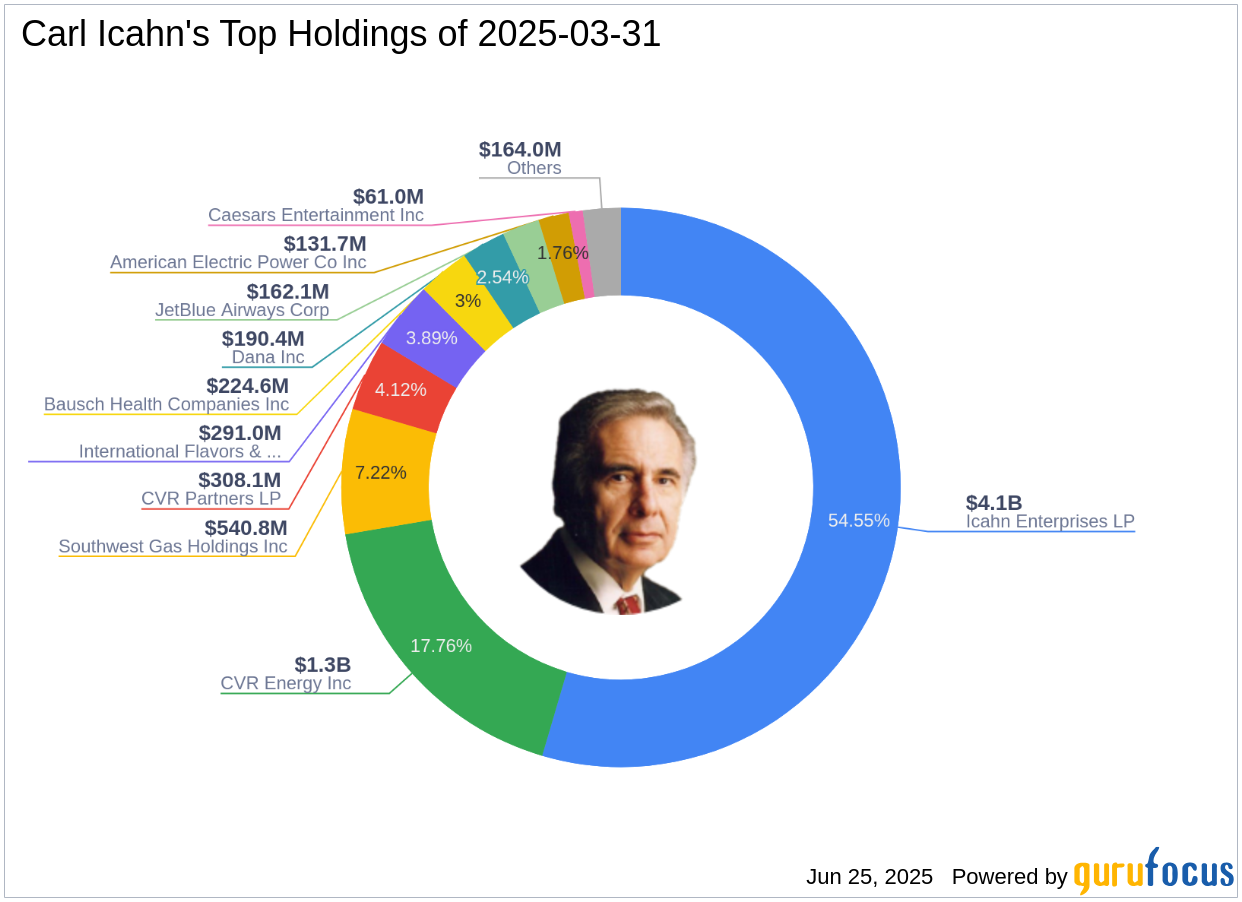

Significant Transaction by Carl Icahn (Trades, Portfolio)

On June 17, 2025, Carl Icahn (Trades, Portfolio) executed a notable transaction involving Dana Inc, a USA-based company. This transaction marked a complete exit from the position, with the firm selling out its entire holding of 14,286,505 shares. The decision to divest from Dana Inc reflects a strategic move by Icahn, known for making bold investment decisions. The transaction was executed at a trade price of $17.58 per share, resulting in a portfolio impact of -2.54. This move signifies a shift in Icahn's investment strategy, aligning with the firm's philosophy of exiting positions that no longer meet strategic objectives.

Profile of Carl Icahn (Trades, Portfolio)

Carl Icahn (Trades, Portfolio) is a renowned activist investor, recognized for acquiring significant stakes in public companies and advocating for change. The firm employs a strategy of purchasing undervalued assets, often in distressed conditions, and revitalizing them for future sale. Icahn's investment approach is characterized by a contrarian mindset, focusing on companies that are out of favor or in industries facing challenges. The firm operates through various investment vehicles, including Icahn Partners, American Real Estate Partners, and Icahn Management LP. GuruFocus tracks the portfolio of Icahn Capital Management, which encompasses a diverse range of stocks.

Overview of Dana Inc

Dana Inc is a prominent player in the design and manufacturing of propulsion and energy-management solutions for various mobility markets. The company operates through segments such as Light Vehicles, Power Technologies, Commercial Vehicle, and Off-Highway. Dana Inc's Light Vehicles segment generates the majority of its revenue, providing products for light trucks, SUVs, CUVs, vans, and passenger cars. With a market capitalization of $2.49 billion and a current stock price of $17.09, Dana Inc is considered significantly overvalued, with a GF Value of $12.94 and a Price to GF Value ratio of 1.32.

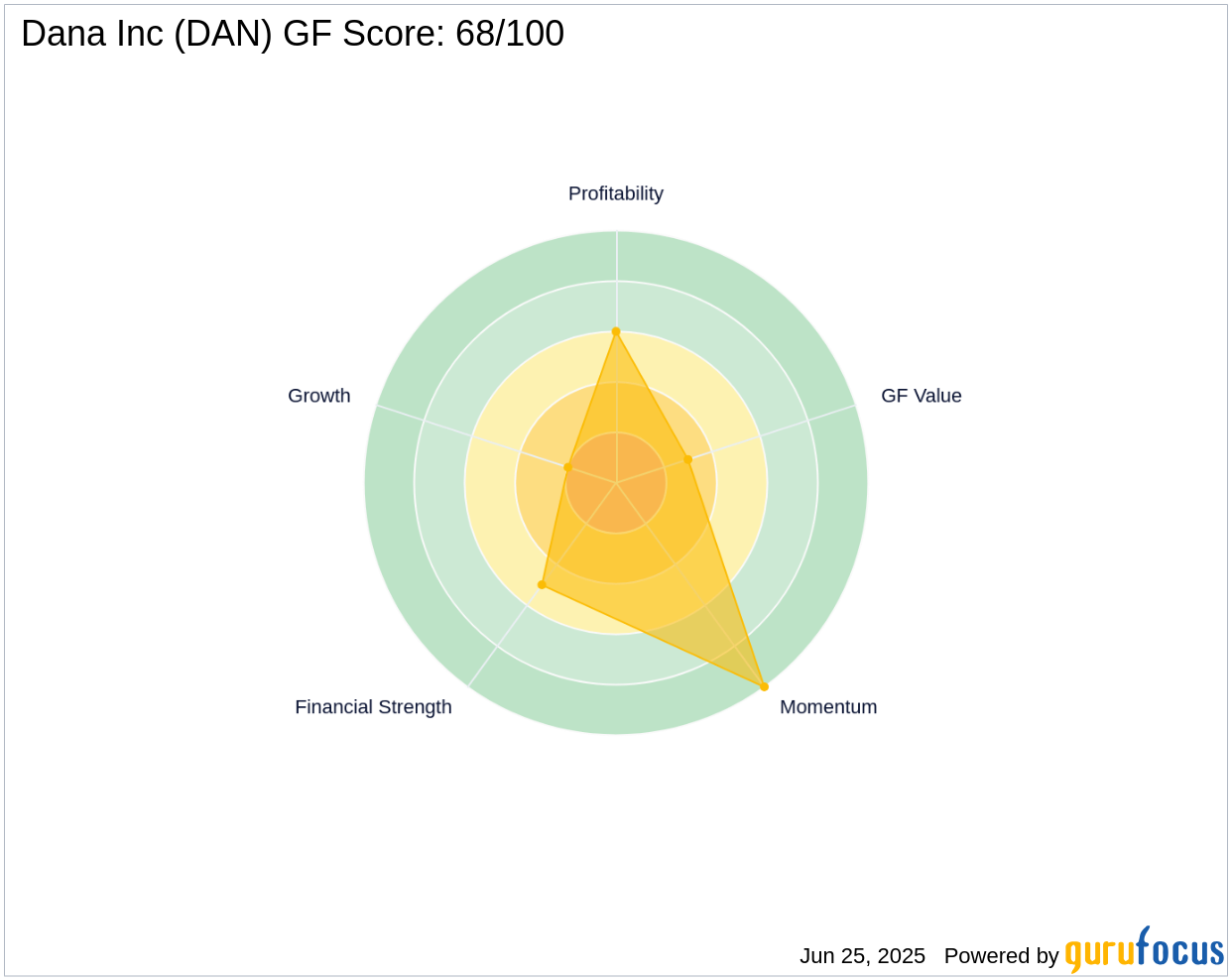

Financial Metrics and Valuation of Dana Inc

Dana Inc's financial metrics reveal a mixed performance. The company has a [GF-Score](https://www.gurufocus.com/term/gf-score/DAN) of 68/100, indicating poor future performance potential. Despite a 5% revenue growth over three years, Dana Inc faces challenges with negative earnings and EBITDA growth. The company's [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/DAN) is ranked 5/10, while its [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/DAN) stands at 6/10. The [Piotroski F-Score](https://www.gurufocus.com/term/fscore/DAN) is 4, and the [Altman Z score](https://www.gurufocus.com/term/zscore/DAN) is 1.83, indicating potential financial distress. Dana Inc's [interest coverage](https://www.gurufocus.com/term/interest-coverage/DAN) is 2.07, reflecting its ability to meet interest obligations.

Impact of the Transaction

The sale of Dana Inc shares by Carl Icahn (Trades, Portfolio) had a significant impact on the stock and the firm's portfolio. The transaction resulted in a -2.79% price change since the sale, reflecting market reactions to the complete exit. The decision to divest from Dana Inc aligns with Icahn's investment philosophy of exiting positions that no longer align with strategic goals. This move underscores the dynamic nature of investment strategies and the importance of adapting to changing market conditions.

Performance and Growth Indicators

Dana Inc's performance and growth indicators present a challenging outlook. The company's [Growth Rank](https://www.gurufocus.com/term/rank-growth/DAN) is 2/10, and its [GF Value Rank](https://www.gurufocus.com/term/rank-gf-value/DAN) is 3/10, indicating limited growth potential. Despite a [Momentum Rank](https://www.gurufocus.com/term/rank-momentum/DAN) of 10/10, Dana Inc faces hurdles with negative earnings and EBITDA growth. The company's operating margin growth is -3.00%, and its gross margin growth is -6.80%, highlighting operational challenges.

Other Gurus Involved

Besides Carl Icahn (Trades, Portfolio), other notable investors holding positions in Dana Inc include Mario Gabelli (Trades, Portfolio), Richard Pzena (Trades, Portfolio), and Jefferies Group (Trades, Portfolio). These investors have maintained their positions in Dana Inc, reflecting diverse perspectives on the company's potential. The involvement of multiple gurus underscores the complexity of investment decisions and the varying strategies employed by different investors.

Conclusion

Carl Icahn (Trades, Portfolio)'s decision to sell out of Dana Inc aligns with the firm's investment philosophy of exiting positions when they no longer align with strategic goals. The transaction highlights the dynamic nature of investment strategies and the importance of adapting to market conditions. As Dana Inc navigates its financial challenges, the involvement of other notable investors suggests a continued interest in the company's potential. This transaction serves as a reminder of the ever-evolving landscape of investment decisions and the need for strategic adaptability.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: