- Veeva Systems (VEEV, Financial) enhances its global reach by expanding its collaboration with Amazon Web Services.

- Analysts predict a modest upside potential for VEEV, with an average price target of $292.62.

- Veeva Systems holds an "Outperform" status from leading financial institutions.

Veeva Systems (VEEV) is intensifying its partnership with Amazon Web Services (AWS). By leveraging AWS's advanced cloud infrastructure, Veeva aims to scale its Veeva Vault applications—including the Veeva Vault CRM Suite—worldwide. This strategic move is designed to strengthen Veeva's software and data offerings on a global scale, capitalizing on the robust capabilities of AWS's cloud technology.

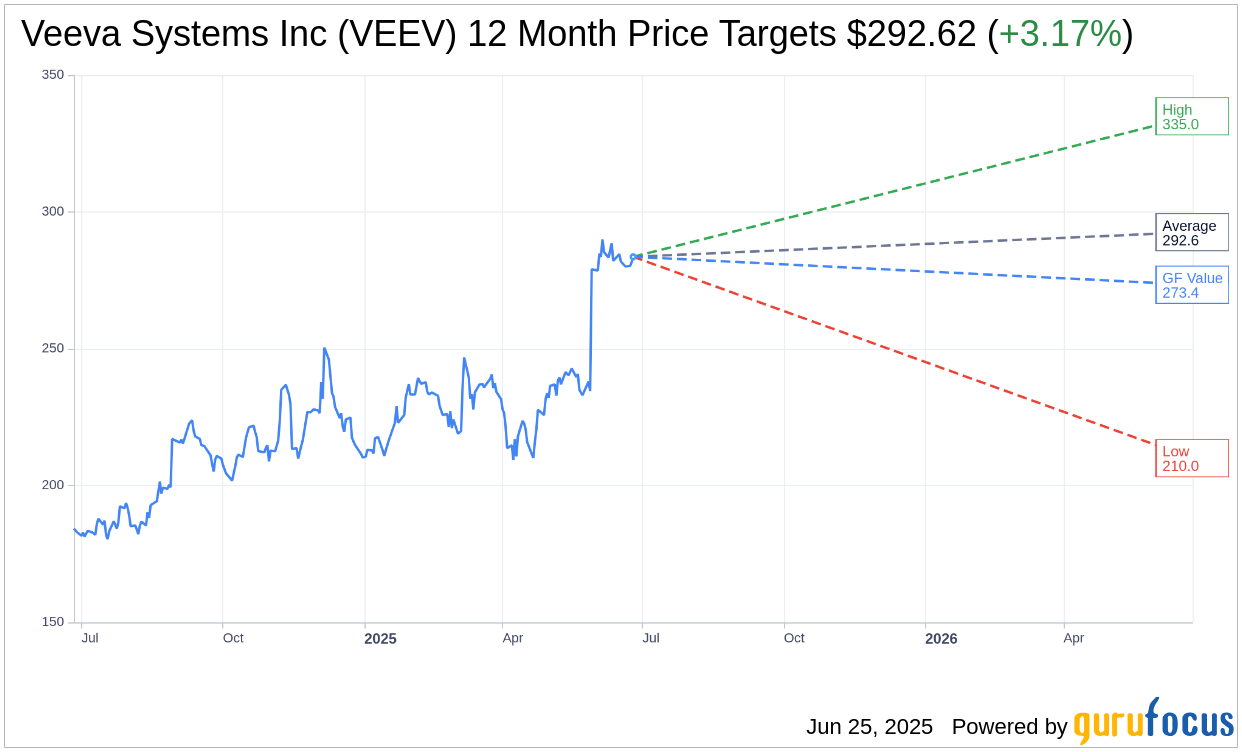

Wall Street Analysts Forecast

According to one-year price targets set by 28 analysts, Veeva Systems Inc (VEEV, Financial) has an average target price of $292.62. Estimates range between a high of $335.00 and a low of $210.00, suggesting a potential upside of 3.17% from the current price of $283.62. Investors can access more detailed estimates by visiting the Veeva Systems Inc (VEEV) Forecast page.

Furthermore, based on consensus from 32 brokerage firms, Veeva Systems Inc (VEEV, Financial) has an average brokerage recommendation of 2.2, indicating an "Outperform" status. This rating uses a scale from 1 to 5, with 1 representing a Strong Buy and 5 signaling a Sell.

In terms of valuation, GuruFocus estimates that the GF Value for Veeva Systems Inc (VEEV, Financial) in one year stands at $273.41. This represents a projected downside of 3.6% from the current price of $283.62. The GF Value reflects GuruFocus' assessment of the fair value at which the stock should trade. It is calculated using historical trading multiples, past business growth, and forecasts for future business performance. For a deeper dive into these estimates, investors can refer to the Veeva Systems Inc (VEEV) Summary page.