On June 25, 2025, Culp Inc (CULP, Financial) released its 8-K filing detailing the financial results for the fourth quarter and fiscal year ended April 27, 2025. Culp Inc, a prominent manufacturer and marketer of mattress and upholstery fabrics, operates through two main segments: Mattress Fabrics and Upholstery Fabrics. The company derives significant revenue from the United States, focusing on providing high-quality fabric solutions for bedding and furniture industries.

Performance Overview and Challenges

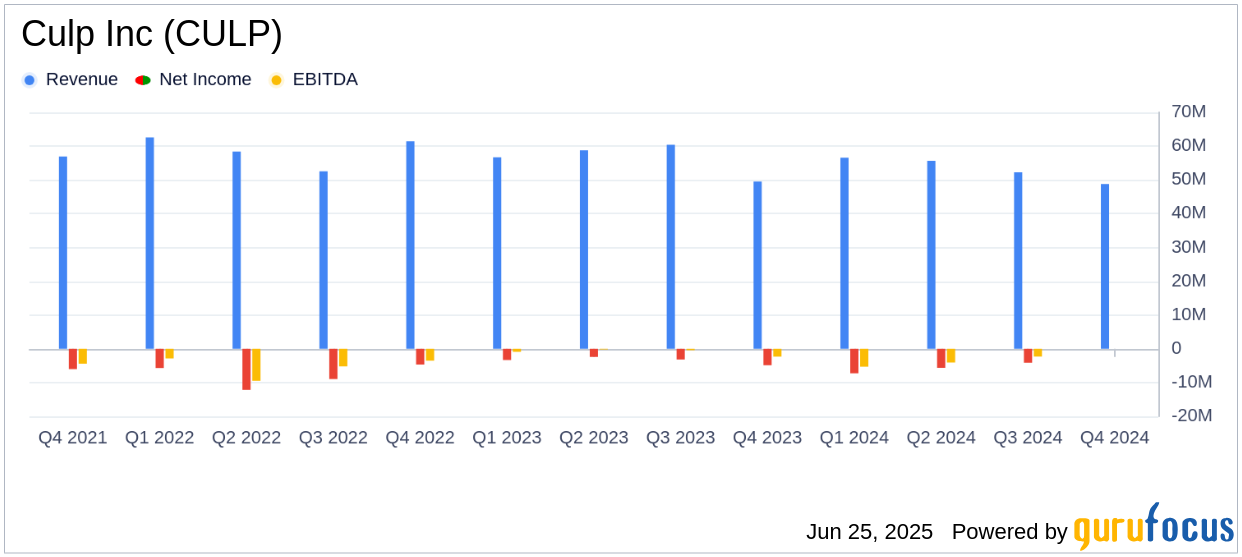

Culp Inc reported consolidated net sales of $48.8 million for the fourth quarter, slightly below the prior-year period's $49.5 million. The Mattress Fabrics segment saw a 5.3% increase in sales, while the Upholstery Fabrics segment experienced an 8.9% decline. The company's performance was impacted by industry-wide challenges, including low consumer demand and tariff-related uncertainties.

For the full fiscal year 2025, Culp Inc's consolidated net sales were $213.2 million, a 5.4% decrease from the previous year. The Mattress Fabrics segment's sales decreased by 2.1%, and the Upholstery Fabrics segment's sales fell by 8.8%. These declines reflect ongoing macroeconomic challenges and reduced consumer spending in the home furnishings market.

Financial Achievements and Strategic Initiatives

Despite the challenging environment, Culp Inc made significant strides in restructuring its operations. The company completed the sale of its manufacturing facility in Canada, marking the culmination of its restructuring plan. This plan is expected to generate $10.0-$11.0 million in annualized savings, with benefits already visible in the fourth quarter results.

The restructuring efforts have led to a reduction in fixed costs and improved efficiencies, particularly in the Mattress Fabrics division. The company also extended its credit facility with Wells Fargo, providing additional liquidity and flexibility for future growth initiatives.

Income Statement Highlights

For the fourth quarter, Culp Inc reported a GAAP consolidated loss from operations of $(2.2) million, an improvement from the $(4.2) million loss in the prior-year period. The net loss for the quarter was $(2.1) million, or $(0.17) per diluted share, compared to a net loss of $(4.9) million, or $(0.39) per diluted share, in the previous year.

For the full fiscal year, the GAAP consolidated loss from operations was $(18.4) million, compared to $(11.3) million in the prior year. The net loss for the year was $(19.1) million, or $(1.53) per diluted share, compared to a net loss of $(13.8) million, or $(1.11) per diluted share, in fiscal 2024.

Balance Sheet and Cash Flow Analysis

As of April 27, 2025, Culp Inc held $5.6 million in cash and $12.7 million in outstanding debt. The company's liquidity stood at approximately $27.0 million, including cash and borrowing availability under its credit facility. Cash flow from operations was negative $(17.7) million, primarily due to operating losses and restructuring charges.

Capital expenditures for fiscal 2025 were $2.9 million, down from $3.7 million in the previous year, as the company strategically managed capital to focus on efficiency and growth projects.

Analysis and Outlook

Culp Inc's restructuring efforts have laid a foundation for improved operational performance, despite the ongoing challenges in the macroeconomic environment. The company's focus on cost control and strategic initiatives positions it well for potential growth as market conditions stabilize. However, continued softness in consumer demand and tariff-related uncertainties remain key challenges that could impact future performance.

Overall, Culp Inc's strategic actions and financial discipline are crucial for navigating the current industry landscape and achieving long-term success in the competitive fabric manufacturing sector.

Explore the complete 8-K earnings release (here) from Culp Inc for further details.